TMW #097 | Figma’s windfall and Canva’s transformation

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

Here’s the week in Martech:

- Figma's windfall and Canva's transformation: Changing times in the design industry

- Is eCommerce slowing down? No.

- A big week for Web3: Ethereum Merge, NFT fundraising, and Starbucks’ loyalty experiment.

- Everything else: Salesforce and Snowflake partnership, AI unbundling, underreported TikTok stats, the genuine web, and a very fun portfolio website.

✍ Commentary

Figma’s windfall and Canva’s transformation

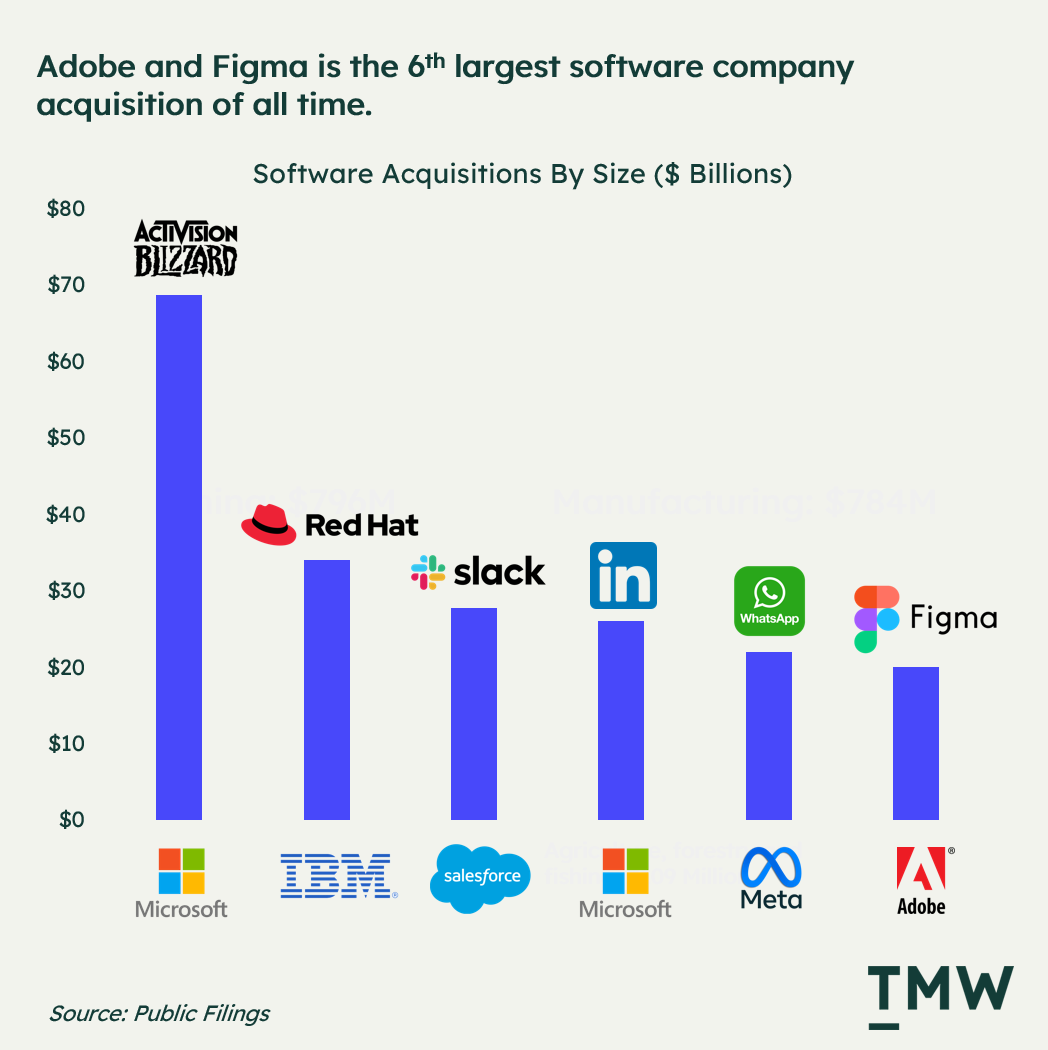

There are two stories this week that took over mainstream technology news – Figma and Canva. To the dismay of designers everywhere, Adobe acquired Figma for $20 billion (about 50x its current ARR). This is the 6th largest software company acquisition ever, and a significant turning point in how company valuations are calculated in the design industry – a space with historically little consumer choice and controlled by a handful of companies.

The other, less reported story was the launch of the Canva Visual Worksuite a “wild dream of building a full suite of visual communication products to empower anyone to design and communicate their ideas.” The concept includes a word processor, a presentation creator, video production, and a website builder - It’s big

Canva’s strategy is something between what Adobe did with Creative Cloud and Google with Workplace more than a decade ago – an ecosystem of creative and productivity software built on the cloud and designed for digital consumption on the browser.

Both stories are about the changing landscape for online communications. But first, let’s talk about the design community’s reaction to the Figma acquisition - one of the most bizarre reactions I’ve ever seen to what’s normally just another breaking story in the business world. If I could sum up the general vibe of the industry right now this would be it:

Figma’s journey to the dark side

If you don’t know what this meme is referring to, it’s one of the last scenes in Star Wars Episode III - Revenge of the Sith, where Anakin Skywalker becomes Darth Vader, defying expectations that he would be the one to bring “balance to the force.”

Somehow, along the way, designers, investors, and the tech community saw Figma as the underdog disruptor to Adobe’s design and creativity monopoly. Built for the browser, cheap, accessible, and fully featured – Figma was supposed to bring balance back to the force!

In the vacuum of innovation that Adobe created with years of market dominance, Figma’s value was everything the company lacked. Because of this, every app on your phone is probably designed by people using Figma. And despite the company’s focus on a new way of thinking about digital design, their own customers assigned it the status of the underdog, champion of accessibility, and killer of Adobe.

Figma’s value proposition is really just everything that’s wrong with Adobe’s approach to the Creative Cloud. Adobe is expensive, relies on downloadable software, and it’s harder to use. Across Photoshop, XD, and Illustrator Adobe’s product strategy is seemingly to extract more rent from creatives while giving less and less in terms of software innovation. Figma designed a product that didn't need downloadable software, is orders of magnitude cheaper, runs in the cloud natively, and offers unlimited storage.

Figma is also far more collaborative – you don’t need your own license to review someone’s work or collaborate on an upcoming project. Because of this, Figma created its own network effect through accessible sharing features and a universal interface (the browser).

The innovation is understanding that designers want real-time collaboration, and in a way that everyone could see the same thing in the same experience at the same time. Adobe missed this opportunity. In the still live Adobe vs Figma landing page, they put it this way:

“Collaborating in Adobe XD is different than collaborating in Figma. In Adobe XD, you design in one place but share in another. Comments are in a separate experience, and changes from different co-editors need to be merged manually.

Because Figma is Web-based, your design file is a Web link, a single source of truth, and a collaborative space for your entire team.”

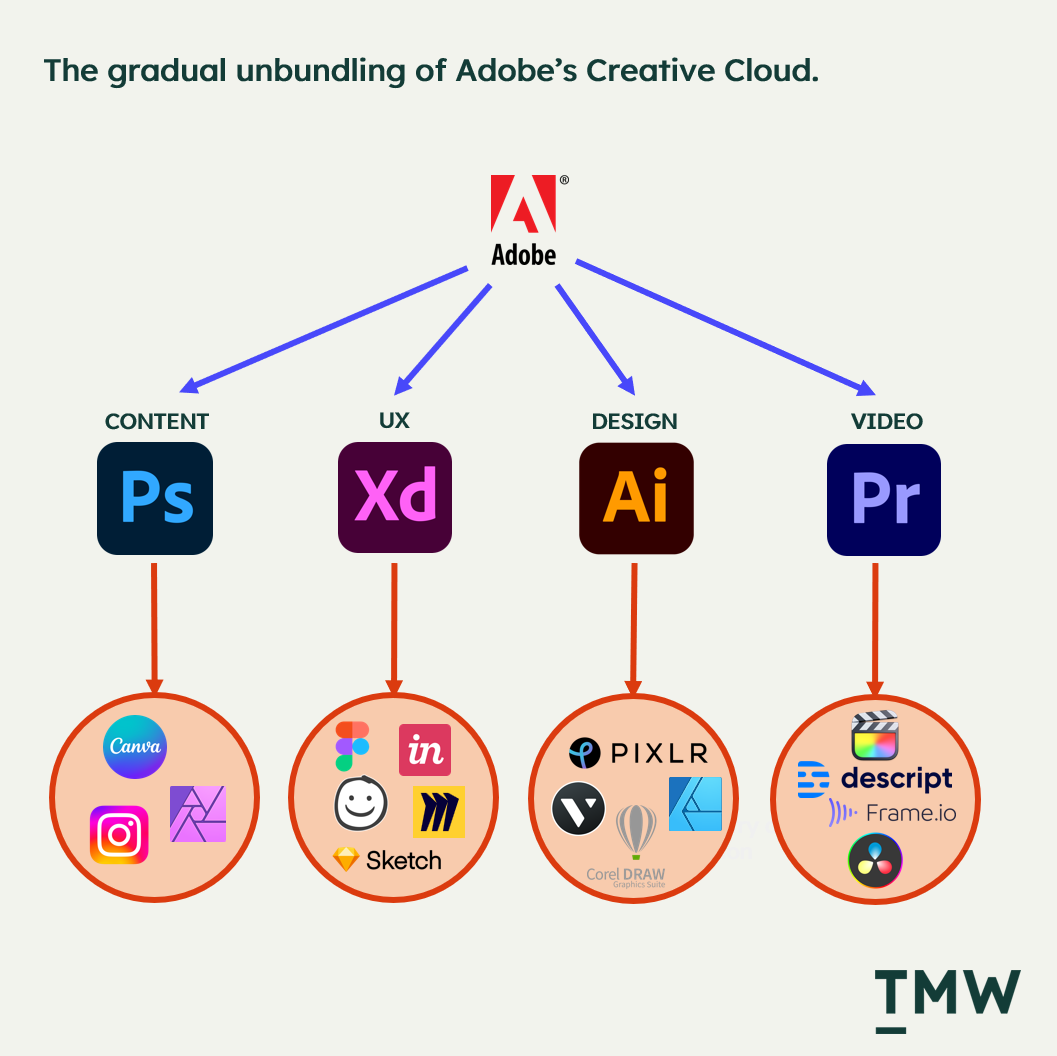

Adobe's gradual unbundling

It’s not only Figma that was slowly dismantling Adobe’s grip on the creative department. For years startups have been working to take market share away from Adobe’s disaffected users. In the early days, Canva realized that social media managers and marketers didn’t need a full-blown creative suite to design email banners and Instagram posts.

Figma focused on digital UX tooling and prototyping. Sketch’s integration with development tools solves the handoff problem from design to build. Products like Affinity (I’m a customer) built photoshop and illustrator products with the old school value proposition of buy once and own forever (the way that nature intended). Descript changed the interface of video production, Invision enabled a new way to do digital prototyping and even Instagram helped us rethink how photo editing could work on mobile. For years small chunks of Adobe's business have gone to competitors, new categories, and accidents that wound up with apps replacing features in the Creative Cloud.

Despite Adobe’s reputation as an early innovator on par with Apple, inventing several fundamental design and printing technologies, somehow, they missed one of the most important movements over the last ten years – the shift to the browser.

It was only a few months ago that Adobe announced a move to put Photoshop in the browser a decision that made most creatives say “Duh”. And while there is still a significant and important market for professional creatives to use dedicated software, Figma broke the rules to serve a specific niche better – UX design.

This is one of the more significant mistakes that Adobe didn’t realize quickly enough that 1) browsers would be sophisticated enough to do design work, 2) people would enjoy using them, and 3) browsers are universally accessible software, which enables sharing and collaboration (and product exposure). For Adobe, dedicated software was moat against products that couldn’t convince people to do creative things in the browser. $20 billion says that dedicated software wasn’t enough for Adobe to stay relevant in design.

Flying below the antitrust radar

This is the partial reason why Adobe’s paid so much for Figma. But there are other moves that the company has made recently that suggest a shift in focus. Adobe is a mammoth company that touches many areas of the enterprise. Email marketing (Adobe’s 2nd largest acquisition is Marketo), AB testing (Target) process and workflow management (Workfront) customer data management and personalization (AEM), and analytics are all under Adobe’s umbrella of products and services. It’s a broad church.

Figma is just one small piece in an otherwise extensive design, communications, and data management machinery. But with a purchase price so large, is the FTC even considering Adobe as big enough to be a Big Tech company, or is that only reserved for social networks like Meta and Google that fit into a specific ideology like privacy, or app store rules? Design is a smaller market, but with Figma joining Adobe, are there any opportunities for other companies to build new paradigms for digital design? This will make it harder.

Let’s compare this acquisition with two other examples. Meta has been blocked twice on two far less consequential deals. The first was GIPHY for $400 million (this made a lot of sense) and the VR studio Within for $400 million (this too made sense given Meta’s VR ambitions). It’s incredible that a company like Adobe with a $140 billion market cap can achieve a deal like this.

If a $20 billion acquisition of a major competitor in Adobe’s core business is not an antitrust issue, what is? The challenge of this acquisition, despite the potential to neuter Figma’s potential and absorb the brand into the already exclusionary pricing model, is to convince Figma users that nothing will change. But with less choice in the market, customers don’t have the same kind of voting power with their dollars (and pixels). The outstanding question that Adobe has to answer is how buying Figma will lead to greater value to users.

The interfaces for our interfaces

In an industry like digital design, there’s a second-order effect when Adobe acquires Figma. The digital economy runs on designers, creatives, and UXers to do their job well, and the interfaces they use inform how we experience the web every day. Whatever happens here will have an impact on we experience the web as well. Happy designers = more cool stuff online.

There’s no future I can see where Adobe doesn’t control the top of the market. Canva’s opportunity is to create a new paradigm for design, collaboration, and productive digital work by putting it all in the browser and making it all work together. That’s more than what we have today – even with the acquisition of Figma and the promise of a more collaborative future for web design.

📈Chart Of The Week

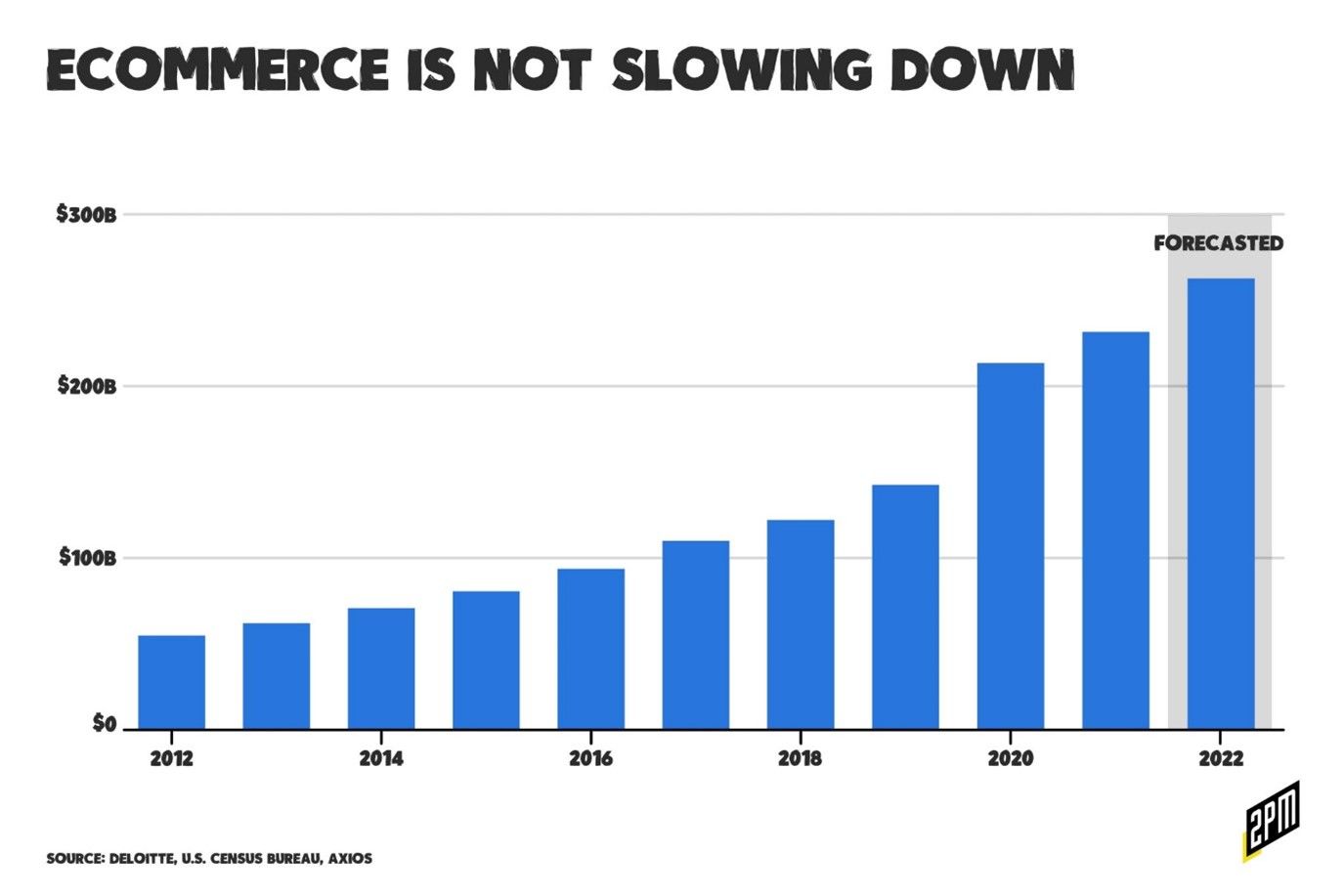

Is eCommerce slowing down? The answer is no. Link ($)

📰 Latest Developments

A big week for Web3. The Ethereum merge finally happened after many years (and many memes). This means that the way consensus happens to create a new block in the chain for contracts and transactions is no longer dependent on mining new blocks. In other news, Doodles, one of the more popular NFT projects just raised $54 million (leading many in the community to ask what this will return for them). Starbucks also announced its crypto foray with a loyalty program that offers rewards and collectibles. MERGE 1.MERGE 2.DOODLES. STARBUCKS.

Google fined €4b. EU courts have upheld the fine for Android antitrust breaches. The main contention here is that the mobile operating system has played a major role in diminishing the competitive opportunities on the platform and limiting consumer choice. The EU has fined Google more than $8 billion over the past 5 years, or about 0.9% of total revenue over this period. Antitrust fines are an OPEX rounding error. Link

Salesforce and Snowflake partner. This speaks to the growing need for marketing suits to integrate with data lakes and warehouses. The partnership seeks to solve the growing disconnect between customer data repositories and the apps that facilitate experiences or analytics. Link

📚 Reading

Market change and margin power. We’ve never seen as many large, differentiated technology companies without competitive peers. This analysis from Morgan Stanley on how market share dominance adds value to users and the economy, how it affects margins, and some of the risk factors. Warning: This is dense. Link

Friends don’t let friends buy a CDP? Another controversial piece from Hightouch Data on why CDPs are becoming obsolete and should be replaced with warehouse native orchestration apps. This piece goes well with a more nuanced exploration of warehouse native apps from my colleague Arpit Choudhury and TMW #095. Link

AI Unbundling. An analysis of the current state of AI apps and how to understand it against the context of the previous wave of media disruption. One novel concept is that AI tools won’t just accelerate human replacement, but also idea propagation and development. What happens when all the good ideas come from the robots? Link

🔢 Data & Insights

Apple’s ad workforce. There are 600 positions available at Apple under advertising in New York. Link

Underreported TikTok stats. TikTok is hard to copy: According to internal research at Meta, people are spending only a 10th of the time on Instagram Reels compared to TikTok. Also, how did TikTok make its way to mainstream adoption? The company spent $3m a day advertising on Snapchat. TIKTOK VS REELS. SNAP ADS.

Marketing vs IT. 66% of respondents to this Lytics survey suggest that marketing teams are wholly reliant on the IT department to facilitate data needs. Link

💡 Ideas

Mindworms. Link

Why Craigslist never changed. Maybe not all platforms need to go through endless iteration cycles. The founder of Craigslist has a unique perspective on value and innovation. Link

The Genuine Web. A space between an ad-supported and a private internet. Link

✨ Weird and Wonderful

A different kind of social media surveillance. Someone started fact-checking Instagram posts using AI and CCTV. Link

The full multiverse war. Whoever put this together has way too much skill and way too much time. Link

A very fun portfolio website. You will waste 30 minutes on this. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.