TMW #164 | Gartner and the authority economy

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get TMW newsletters, along with a once-a-month complimentary Sunday Deep Dive. Learn more here.

This essay is our once-a-month feature that is fully available to the general public and TMW subscribers. Join us at TMW PRO to gain access to every Sunday Deep Dive essay. It’s a lot of fun! You’ll learn a lot!

Gartner and the Authority Economy

Analyzing the Martech industry’s reaction to the newly released CDP Magic Quadrant.

There is no company that comes close to Gartner’s reach, influence, and ability to turn charts into revenue. Gartner is a 44-year-old, $35 billion global technology advisory, research. and consulting business that even goes by the stock symbol “IT.” It is an undisputed behemoth of intellectual might, and one of the most authoritative firms in the world for technology insight and research.

That all sounds great, but there’s good reason to believe that the company is getting closer to joining the ranks of McKinsey and Deloitte as businesses that are losing their leadership position in the technology domain.

Last week Gartner released the first ever highly anticipated Magic Quadrant for Customer Data Platforms. It’s been six months in the making, dominating months of CDP vendors’ time, energy, and marketing budgets.

Even a few CDPs rejected our invitation to join our international innovation program, TMW 100, because they were too busy applying for the Gartner Magic Quadrant CDP. From what I can see, it was a lot of effort.

Apparently, according to the rabble of LinkedIn, it cost a lot of money, too.

Last week I posted briefly about it on LinkedIn, and oh boy, are the comments a case study into the eroding public perception of massive global research firms. You can sense the seething distrust and jeering from here.

The release of the Magic Quadrant spawned a few hot takes from rival analyst firms, like this one from Real Story Group’s Tony Byrne who likens Gartner acolytes to Donald Trump followers and shares his view that the industry’s worst platforms take pride of place in Gartner’s analysis.

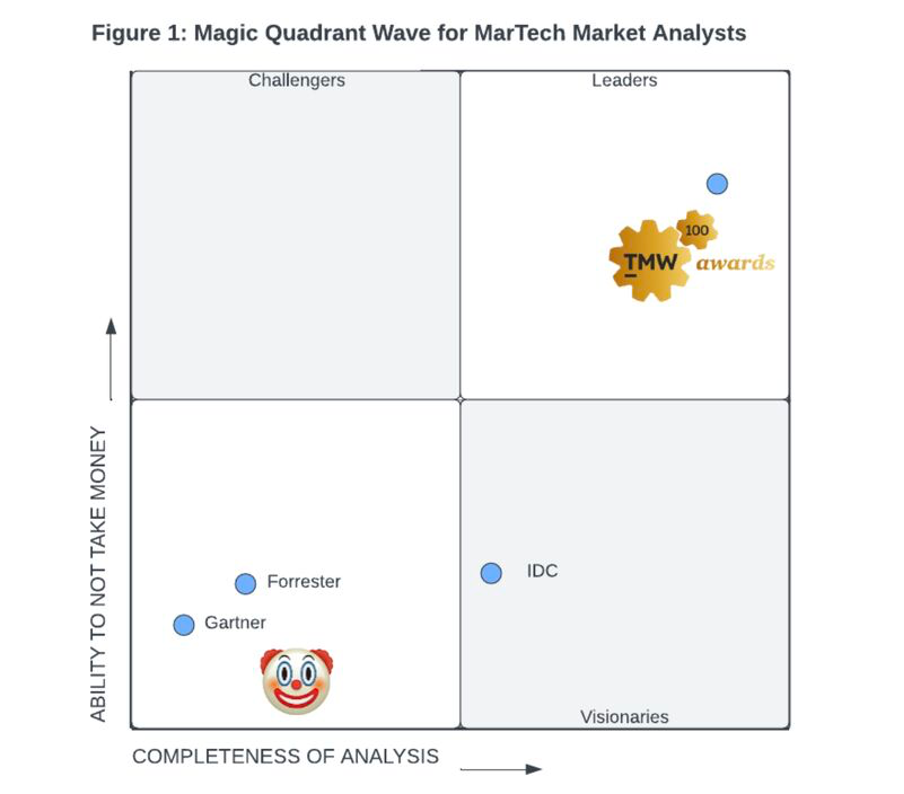

Someone even sent me this chart that conveys the sentiment in the industry of the role the Magic Quadrant or the Forrester Wave has to play in technology analysis. While funny, I’m afraid it’s not charitable or even intellectually humble at all.

The accusation here is that Gartner and Forester are paid for their analysis by CDP vendors, and therefore their work is untrustworthy. At this point, it’s like a folk story that continues to be shrouded in mystery. I’ve yet to see hard proof of a pay-to-play attitude to these vendor rankings.

But many people seem to believe that Gartner’s analysts are heavily biased towards the vendors with the cash. Take some of the most revealing comments under my initial post:

“That's what everyone pushes, and since Gartner is surveying what everyone says they are going to invest in, this is what we get. We get what everyone else is saying, not what you should be doing. If you want to lead, I wouldn't be looking at Gartner research here, or in any other quadrant.”

“I never take Gartner and Forrester seriously. Whenever some vendor shows me their slide, I am like can we skip to the good part 😂”

“I'm very surprised that Microsoft isn't in there and doesn't get a mention! Especially with Customer Insights - Journeys (formerly Marketing, the Marketing Automation Platform/journey orchestration platform) and Customer Insights - Data (the CDP) being brought together for clients ... Which makes so much sense 🤷🏻♀️”

“You can drop Salesforce and Adobe quite a lot in ability to execute. I guess Gartner only spoke to sales managers and not customers that are using the platforms.”

“I have experience with a number of these CDPs, and this is nothing like my quadrant would be right now. Money talks...!”

“I thought it was all fine until I saw the leader”

“This just comes to show that Gartner has pretty much devolved [into a] pay to play platform.”

“Sure, these Quadrants are totally easy. You pay for consulting and you are in. So if you spend then you are in, and mostly this is because these Quadrants are not very useful. It's the same regardless of Forrester or Gartner.”

“Wow. No words except “pay to play.”

“My question is what Salesforce CDP? Haven’t they rolled out like 3 of them in the past 5 years.”

And last but not least, from TMW 100 Judge and VP of research and advisory at Real Story Group, Apoorv Durga:

“April 1st already?”

On the other side of town, the top right winners of the quadrant celebrate what appears to be a great victory and irrefutable proof of their excellence. It’s a mixed reaction.

But instead of denigrating the work of Gartner, I want to talk about something more important: the stranglehold Gartner and (and to a lesser extent Forrester) has over the public analysis and perception of enterprise tech.

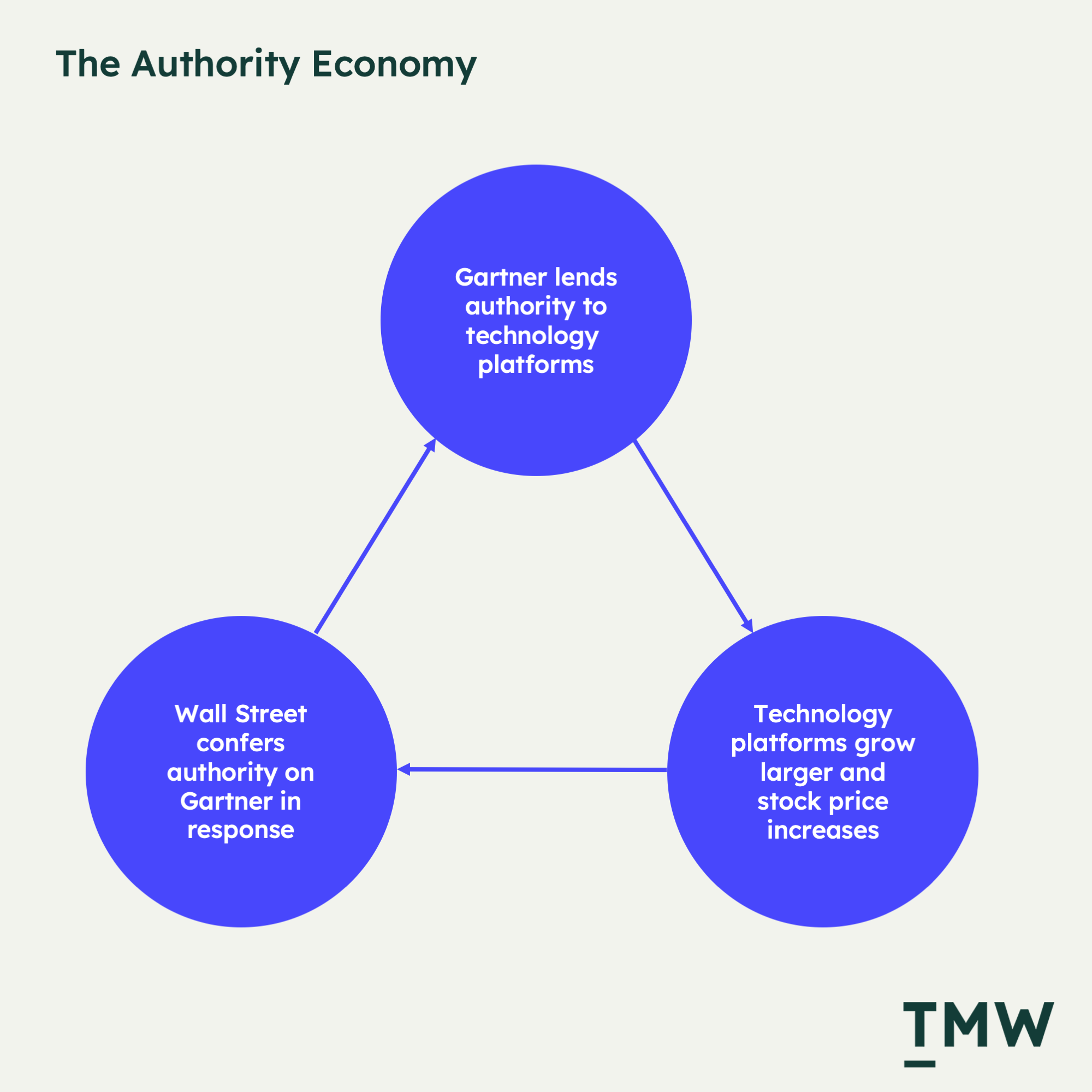

I call it the “authority economy” because that’s exactly what Gartner is selling here, or rather leasing to other companies – their long and storied authority to proclaim which tech is hot or not.

This essay will reveal why, on the one hand, tech vendors invest heavily to get their dot on these 2x2 grids, while on the other, the growing distrust of what these analyst firms have to say is becoming more pronounced.

It’s easy to jeer with the crowd; it’s harder to give the likes of Gartner and Forrester a fair shake and understand their place in the Martech landscape. So let’s start with the report itself and how it frames various CDPs.

The CDP Magic Quadrant

The majority of the criticism I’ve seen has been levelled at two things: the leader quadrant companies and the lack of proper representation. But there are other areas where the analysis can be very misdirected and very puzzling. Like the lack of rigor for how these companies are framed in the analysis, especially in their “caution” section.

Gartner cautions that ActionIQ has “too much of an enterprise focus,” but my question in response to this is: Exactly how is that a caution? That tells me that they are very focused on delivering value to customers doing more than $1 billion in revenue. That’s a strength.

Another Caution is that Amperity doesn’t play well with B2B use cases, but it’s very strong with B2C. Again, I ask. what’s the problem here?

Gartner also cites BlueConic’s lack of composability strategy; a fairly new take on customer data infrastructure as something to be worried about, while also saying that BlueConic is doing exactly what a CDP should do.

Gartner goes on to say that mParticle’s new pricing model is a weakness as it’s relatively new without explaining that the reason they did that was to enable greater flexibility and control over cost management. That’s a plus for any CDP buyer not wanting to pay for things they don’t need.

Gartner praises the technology for Adobe’s Real-Time CDP, but doesn’t talk at all about the definition of that, nor that according to Adobe’s own official product documentation, the company only cites this capability in one instance and says that most batch segmentation jobs can still take hours.

mParticle is praised for its acquisition of Cortex and Indicative, saying that these investments “make its CDP a more holistic option” without actually explaining how the integration of these two companies was achieved or even if customers are using them as an integrated whole. You’ll have to ask mParticle directly about that one.

Tealium’s modularity in its product offering is perceived as a weakness, as Gartner says it “creates a complex buying scenario,” but the flip side of this is that customers are more in in charge of the features they actually need for their use cases instead of buying it all and using half of it. Having used Tealium directly myself, I can say that the modularity really helps a company understand the entire supply chain and its processes as a CDP, as it gives you the ability to tweak and change those processes with a lot of transparency.

Then there’s the praise. Oracle named as a visionary is just incredible despite Gartner saying that the company struggles to onboard customers and that there’s low utilization from marketers – the market segment CDPs are built for.

Gartner introduces Salesforce (the highest ranked in the quadrant) like this: “Its Salesforce Data Cloud, a hyperscale data platform built on Hyperforce and integrated into the Salesforce platform, activates data across (and beyond) the Salesforce ecosystem.” Tell me you’ve drunk the Kool-Aid without telling me. It’s like Benioff himself was dictating Salesforce’s positioning to the analysts from his beachside mansion in Hawaii.

But Gartner somehow misses that Salesforce is currently in litigation with the former CEO of Evergag and Salesforce CDP executive after blundering its real-time CDP launch back in 2022; a serious misstep that borders on false advertising.

Gartner even called out that to integrate the Salesforce CDP with anything outside of its internal ecosystem you will need to buy MuleSoft or an app from the AppExchange is also puzzling. The industry is well aware of Salesforce’s lack of external integrations. Tejas Manohar explains this problem well:

“Just like Salesforce Data Cloud for Marketing only “plays nice” when ingesting data from Salesforce sources, it similarly fails to activate data outside the Salesforce ecosystem. Salesforce can only sync data out to a few advertising and marketing destinations, far short of the hundreds that other traditional and Composable CDPs support. Take a look at the platforms your team is using today to reach customers. If any of them live outside of Salesforce’s ecosystem, chances are they don’t natively integrate with Salesforce’s CDP, and you’ll have to build your own pipelines or upload CSV files manually.”

How is it that a leading company in the CDP category does not offer more integration with other apps without the user having to pay for them?

And then there are the excluded. The omission of Bloomreach, Sitecore, GrowthLoop, ReBid, Meiro, Lexer, Insider, Netcore, Orrto, DreamData, Microsoft, Acquia, and others because of its arbitrary rule that a CDP must have brought in at least $75 million in a calendar year, or failing that, a sliding scale that goes down to $25 million with new a set amount of new business, makes the definition of the category extremely challenging to enter.

Another exclusionary feature is that 60% of revenue must come from EMEA or the United States, shutting our other major global players that operate out of Asia, and then there’s an outright exclusion tactic determined by Gartner for the top 25 companies that show a “strong degree of customer interest.” This is not independently vetted and it’s determined entirely by Gartner analysts.

It is funny, though, that they call out Simon Data as an honorable mention, and explain that they were not included because they are not growing fast enough. Ouch. Enjoy that participation trophy.

But there’s more. The TMW 100’s most innovative company for 2023 was an India-based CDP called CustomerLabs, bringing the complex technology of the CDP to small and medium businesses. They are doing well too, adding 800 new customers in the last 12 months, with the vast majority of these companies starting their first projects using first-party data. It’s a real shame these fast-growing innovators are totally excluded from Gartner’s analysis.

But Gartner’s criteria also excludes some of the fastest growing startups in the CDP space because they are not doing $25 million yet. This does the industry a huge disservice by only reflecting the larger players, giving a very limiting view of the entire industry.

There’s plenty that Gartner actually gets a lot right too. Their overall definition of the CDP fits well and is very comprehensive and they did manage to identify a lot of the key players in the marketplace. They also did a good job defining what makes each CDP unique which is a huge effort in and of itself.

But ultimately you have to ask yourself the question here: How much of this can be a realistic view of the CDP industry? Well, the answer is it doesn’t matter.

How to create an authority

Gartner is important because it’s very old. More than 40 years old. And their alignment and early roots with Wall Street gives the company greater credence than most other analyst firms in its ability to drive investor insights and by doing so, capital interest for the technology companies they cover.

If you’re in the tech industry or investing into it, Gartner is simply just part of the furniture. But get this: it looks like the company’s best days are still ahead of it. In the past decade, the business added more than $4 billion in revenue each year. Since the pandemic, the company’s stock price has surged more than 138%. Gartner is far from a senior citizen on its way out.

Gartner’s Magic Quadrant and the Hype Cycle were concepts developed in the 90s that served as mental models defining how we thought about technological progress and how companies are leading it. You have to give Gartner credit where credit is due; there is no other firm in the technology industry that has shaped how we think about tech.

Their models today have become catch-all fallbacks for explaining how technology evolves and changes. Now, according to the Gartner official index, the Magic Quadrant evaluates 358 technology categories. Who even knew there were that many to begin with!

But there’s more to it. Over the years, the Magic Quadrant has faced criticism. Either that the company skews the market with its research, or this 2009 complaint from a software vendor that challenged the legitimacy of their place in the Magic Quadrant, which resulted in Gartner filing a motion to dismiss the case by claiming that the report is made of “pure opinion” suggesting that the Magic Quadrant is not based in facts.

There’s a lesson about authority here. If you consistently create frameworks and report into them over a long enough timespan, they become a cultural institution and a shortcut to truth. The Martech industry’s very own Scott Brinker demonstrates this with the Martech landscape supergraphic.

So the ingredients to build authority that we can take from Gartner are the following:

- 1 framework that’s flexible for any tech category

- Make it so that brand, media and investor value can be created for featured firms

- Put in the oven for 20 - 40 years

Et voilà! You have a source of truth!

But the mistake people make with a Magic Quadrant or a hype cycle is the intended audience. Gartner analyses the business performance of technology, not just its usefulness, innovation, suitability for practitioners or really anything else.

In the ability to execute criteria, Gartner clearly states that they are assessing not just the value of the technology to the end user. They measure revenue and financial health, sales execution, pricing power, marketing performance, business model, industry strategy, and regional market presence. It’s an assessment of the overall business.

The question Gartner comes to is, “is this a good business.” Not “does this tech actually work for practitioners.” Usefulness and application are important considerations, but we have to remind ourselves here that Gartner is creating these quadrants for investors and analysts, not the everyday practitioners on the receiving end of the technology.

It’s this connection to investors, and the public stock markets which is the superglue that binds the authority economy together. Something that is key to our authority recipe.

Termites in the frame

I’ve often called the Magic Quadrant a “Myer Briggs personality test for tech companies”, mostly because these quadrants struggle to convey winners or losers. A leader vs a niche player vs a challenger are weak, loose terms to describe tech.

And there’s a reason for that: Gartner’s business model does not allow for overt criticism, because it damages the bottom line. Imagine a quadrant that went like this:

Would that be more helpful? Yes! It would! But in Gartner’s world, it’s impossible, because it’s much harder to do that. And in reality, you would need to do something like Real Story Group’s “Real Quadrant” that assesses the technology fit based on your actual business needs.

That’s why these frameworks are eroding; there are termites taking little bites of the Quadrant’s authority because of the folk law of “Gartner is pay for play” and its distance from the ground truth of what’s actually happening in the industry.

How else can you explain Salesforce’s CDP on the top right?

There’s been a long-time understanding that the analysis reports from Gartner and Forrester do not reflect the real-world experience of implementing and using these technologies. But the C suite of a lot of enterprize companies still care a lot because they grew up reading these reports, and we’re all ultimately selling into or reporting for the C suite. aren’t we?

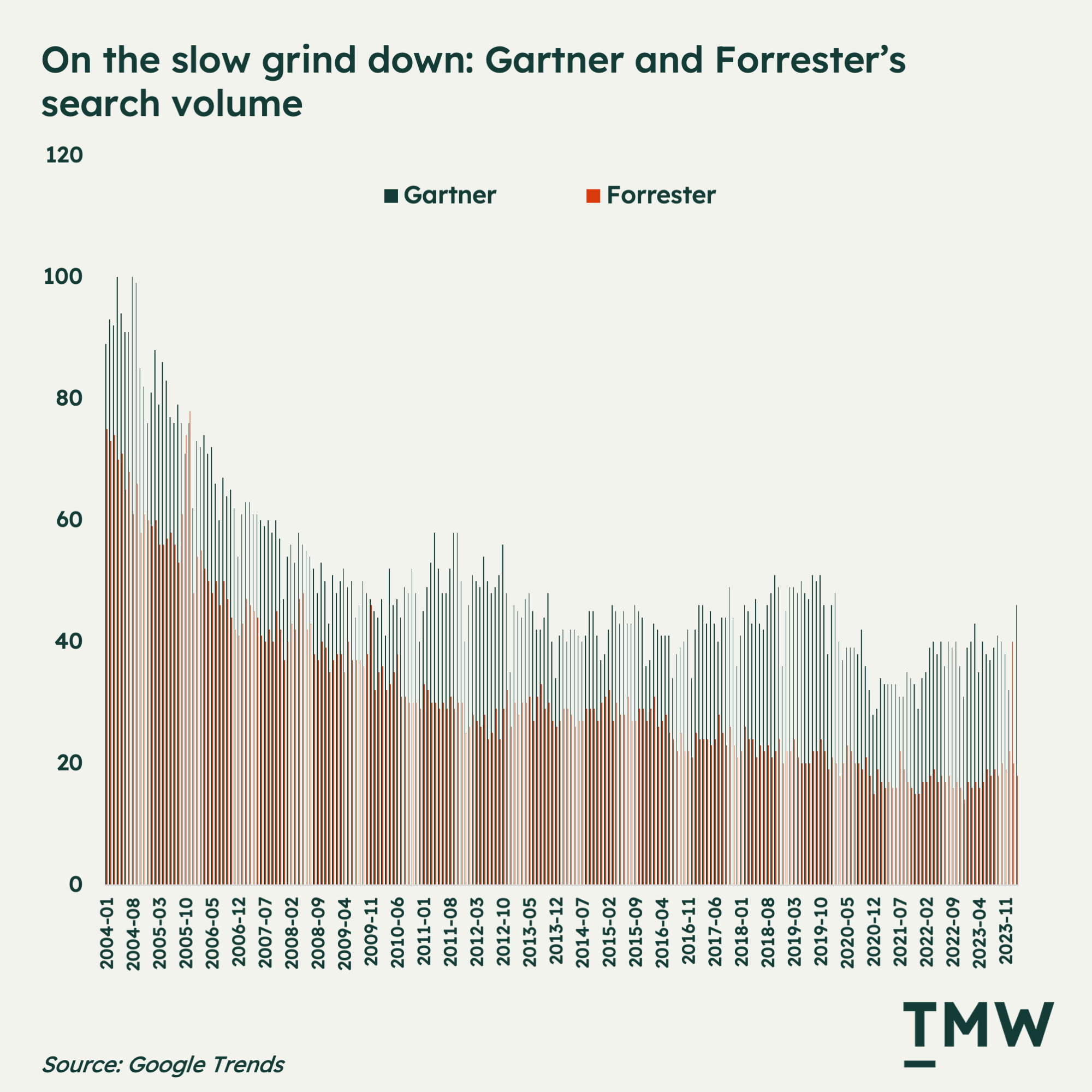

But while the company’s market dominance is growing, its popularity on search – just one data point – continues to decline along with the likes of rival Forrester. The next generation of technologists are not deferring to this abstract authority and its starting to show.

So how does Gartner make money from all this effort and time spent analyzing over 300 categories with the Magic Quadrant? The co-founder of CB insights and now CEO of new analyst firm Alium, Johnathan Sherry, gives a good summary of how a lot of technology firms approach Gartner:

“The supposed value prop for vendors to pay firms like Gartner and Forrester is market / competitive intel. The reality, however, is that very few of the vendors I speak with gain any real value from the intel provided by these analyst firms. Rather they view paying as a bounty to speak with the analyst, in the hopes that they’ll find themselves favorably included in Magic Quadrant or Wave reports.

I’ll stop here for a moment. I have no hard evidence that Gartner and Forrester are pay-to-play. But in my private conversations, that’s certainly how vendors feel. And it’s clear that if the prominence of these analyst-led opinion pieces were to fall from grace, so would vendor interest in paying the so-called "bounty" (their words, not mine).”

Despite the rumors, you can see that the incentives are aligned to favor some companies more than others, even without this conspiracy theory that they are “pay to play.”

Gartner gives authority to certain platforms, but they have to be big enough to be on the public markets or close enough to it; the companies use the authority bestowed onto Gartner to grow their market share, Wall Street sees this growth and gives greater credence to Gartner. The Magic Quadrant is just this cycle repeated each year.

This, my friends, is why Gartner wins: a combination of generational trust from people in C suites in their 50s, their tight flywheel leveraging the promotional incentives of the companies they cover, membership fees and content marketing, and the company’s uncanny ability to create and reinforce frameworks over a long time span.

So any company coming in (including TMW) realizes that to defeat Gartner the Goliath, you need more than a slingshot with some data and a cool logo. You need endurance to run the long race, to provide consistently higher quality, more useful and accurate technology analysis than any other company that’s come before it.

Status is the hardest thing to earn in this life. Making money is relatively easy, so is generating attention if you’re crazy enough, but what Gartner epitomizes is why Balenciaga charges $859 for a T-shirt. Domain authority is time x consistency x effort. The hardest is time. But once you’re there you’re impossible to topple.

You have to be salient over successive generations to really matter. But what we’re seeing here is a company that is over indexing on value extraction, simply because they earned their place over 40 years. Authority is Gartner’s product and they know how to sell it very well.

Escaping the authority economy

What I would suggest is that instead of relying on Gartner or Forrester for Martech vendor evaluations, look into the growing cottage industry of independent players that are coming out of the direct practice of making Martech work in their business.

Real Story Group is one great option. They have aligned themselves 100% with the practitioner and provide more useful evaluations of what Martechers care about. Grassroots efforts from ChiefMartec to define the categories and growth of Martech continue to be a free and unbiased service that gives a holistic view of the Martech universe. Martech Tribe has been data mining on how Martech Stacks are built and maintained, with a wealth of data from thousands of real practitioners around the world.

UofDigital has built an amazing educational program to give people insights into how various Adtech platforms work. Databeats is shedding enormous light on the work of the modern data stack and the players within it. MarketingOps.com has its own demonstration methodology to help Martechers really understand what these platforms are doing.

Alium is going after Gartner directly with their marketing technology buyers intelligence platform. More are coming out of the woodwork, but what we’re seeing here is mostly an exercise of curiosity and passion for what has become a fascinating industry to work in. One that is growing by more than 1,000 new applications every year.

Does Gartner do great analysis? Yes. I learned a lot about the CDP market from the Gartner Magic Quadrant. And we’ve featured a ton of great analysis over the years from both Gartner and Forrester.

If Gartner and Forrester are not careful, the industry will start to see them as the content marketing arm of some of the biggest and most influential marketing technology platforms in the world. In fact, from what I’ve seen the CDP Magic Quadrant responses, the response certainty points in this direction.

The way I see it, the problem we have on our hands is not about toppling Gartner or really even criticizing their CDP Magic Quadrant. It’s actually about integrity and authority. Authoritative publications should be held to a higher level of integrity.

Integrity means Gartner publishing how much influence technology platforms directly or indirectly pay in membership fees and access, the analysts that are making the decisions and any ties or connections those analysts have to the vendors being assessed.

My primary school motto was “honesty and integrity.” As a 10-year-old boy, I had no idea what these words meant. But I learned as I got into big trouble fibbing in class about something stupid.

What I learned then is that a lack of honesty impacts your integrity and creates all kinds of friction for others to work with you. A well-functioning society needs information that people can trust, and that is earned through building integrity through honesty. A well-functioning industry needs it just the same.

If a 10-year-old schoolboy can learn this lesson, a multi billion dollar research firm filled with intelligent adults should be able to learn it as well. Authority can only exist in an environment of trust and integrity. If an economy forms around it to extract value from the industry it serves, then it can only exist for so long.

Stay Curious,

🔓 Are you ready to join the PRO's?

Get the entire Wednesday Martech Briefing and all of our newsletters every week with TMW PRO. It's the easiest and fastest way to make sure you're fully informed on how the marketing technology industry is evolving.

Here’s what some of our existing TMW PRO members have to say;

“TWM is a finger on the pulse of what's happening, with the clarity of insight to see the important patterns underneath the noise” – Scott Brinker (VP, Hubspot).

“I recommend TMW to all leaders who are customer-focused and transforming companies via digital technologies” – Kazuki Ohta (CEO, Treasure Data).

“I've subscribed to many Marketing newsletters, but TMW is at the top of my list with the most valuable content for marketing professionals" – Lilly Lou (Marketing Director, Icertis).

TMW PRO is an invaluable resource that’ll help you to truly transform and future-proof your career in Martech.

Are you ready to join the PRO's?

If the answer is yes, CLICK HERE.

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.