TMW #087 | Martech in a recession

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

✍ Commentary

Martech in a recession.

There are really two stories to explain the current market conditions.

The first is the impact the threat of a global recession has on the technology industry and the second is the continued spending growth from the marketing department. Is Martech sliding, like the rest of the technology industry, into a down market? Or will the pandemic-fueled growth we’ve seen over the past few years continue unabated?

For most people, the somewhat sudden vibe shift in the marketing technology industry has a jarring effect. This is because the industry is influenced by the confidence we have in the broader technology market and consumer spending behaviors which directs how marketers go about their job. Both are happening at the same time.

Signs of the times

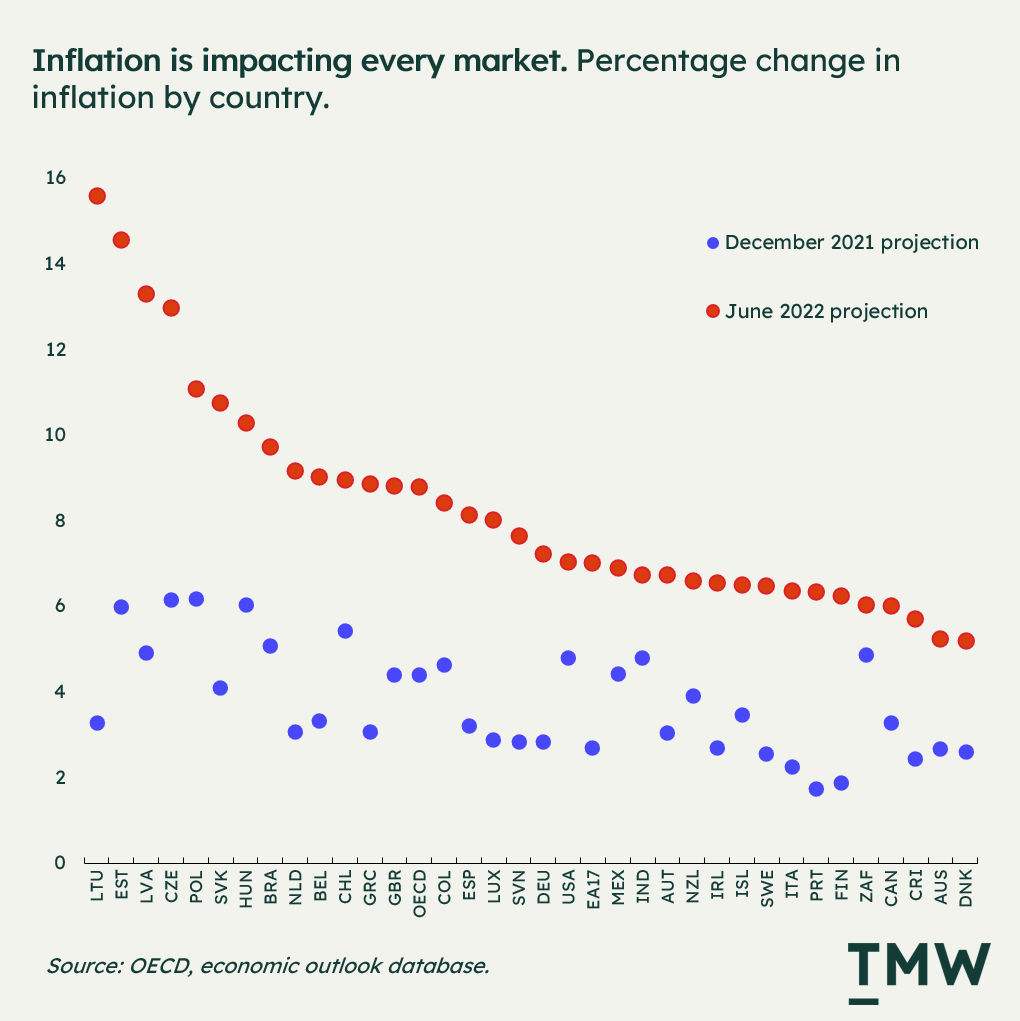

If we survey the market right now, a recession is very real possibility. Inflation in the US in May reached the highest rate since 1981, and GDP growth is at a standstill. The OECD has recently announced that the recovery out of COVID-19 has been significantly slowed by Russia’s war in Ukraine and China’s zero covid policy. If you’re anything like the average consumer, you’re feeling the effects.

The growing warnings have already come for the technology economy in the form of the spectacular collapse of the crypto markets, with the $40 billion crash of Terra UST and the tanking of Bitcoin and Etherium prices.

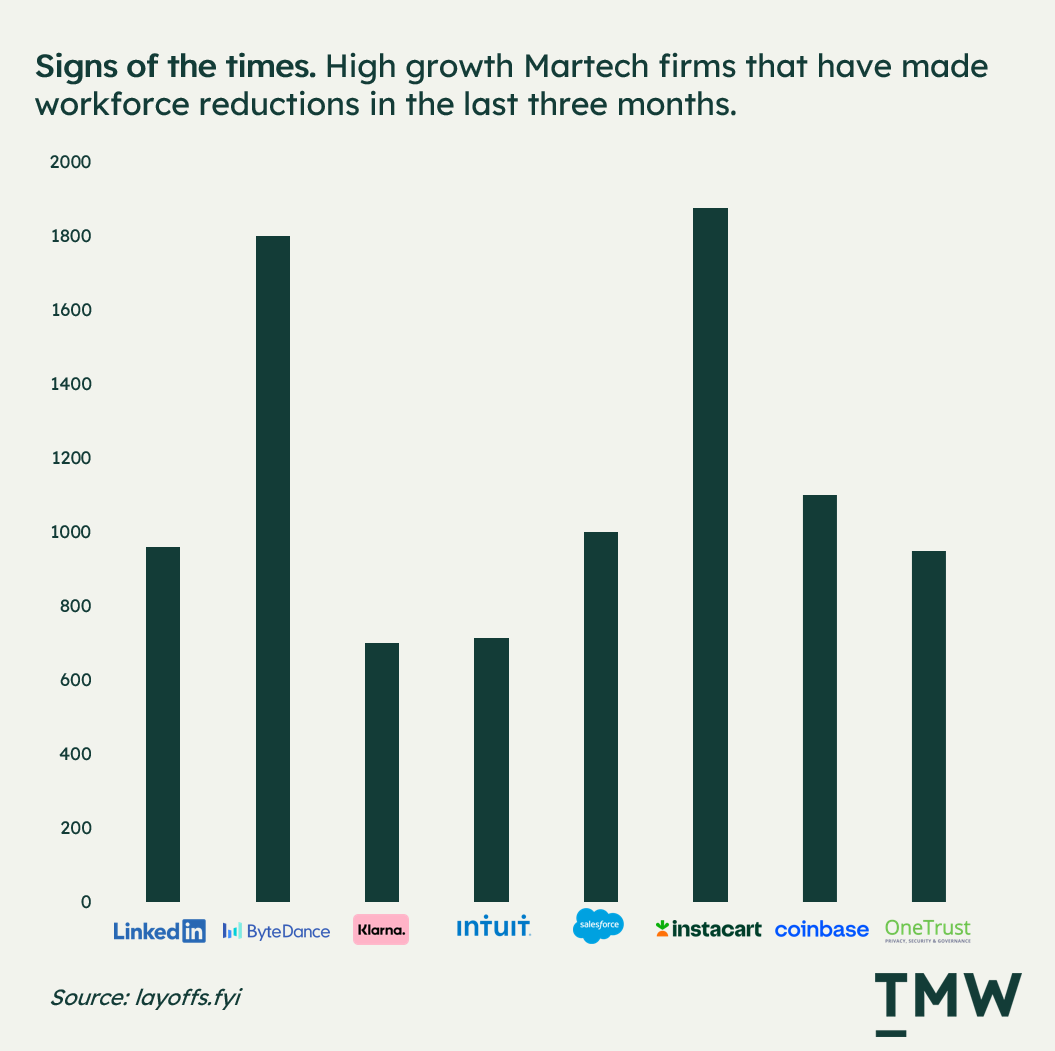

In the public markets, more than $1 trillion has been wiped out of the SaaS market since November, and high growth companies during the pandemic era like Bytedance, Salesforce and LinkedIn have laid off thousands of staff in the past few weeks. It’s a sobering reality check as we step out of the techno-utopian haze that was COVID-19.

The consumer is changing

One of the more interesting aspects of this down market is how the consumer is changing. If you change the consumer, you change what the marketer is doing and what technologies they use.

Inflation is driving a need for marketers to chase demand in a market where discretionary consumer spending is evaporating. As inflation increases, consumer spending decreases. In some sectors, this means that some areas of the market are making more money, for example Deloitte reports that real retail spending in Australia is 6.2% more than what was expected in the first quarter of the year. But this is not because of demand, it’s because of the effects of inflation on prices.

If people are less optimistic about the state of the economy because prices at the grocery store and the gas pump are higher, then companies tend to react by investing in marketing and the technologies that make it possible in order to continue to grow.

The demand for demand

This is why, during a down market marketing spending on advertising has grown to its highest point in the history of AdTech. In the UK, ad spending is the highest they’ve ever been, increasing to 24.8% this year to reach a total of £29.3bn, in the US, digital ad spending is set to increase by $29 billion this year and Trade Desk, one of the largest players in the AdTech ecosystem, enjoyed a 43% increase in revenues in Q1.

There is a high demand for demand in an inflationary economy, and the vendors that enable, produce, or facilitate customer growth will come out of this period stronger.

But there are warning signs for marketing technologies that don’t directly correlate to customer spending. Customers in a recession care more about price than convenience or experience. To quote a friend recently who went to a trade show for retailers, almost all the content in the trade show was about discounts and promotions. The previous year, everything was about CX and personalisation.

Back in March 2020, with lockdowns looming during a public health crisis, the mainstream narrative for the enterprise was about catching up in a digital economy that was exponentially accelerating. Today, this story now centres on doing whatever it takes to close a sale, whether it be online, offline, or both.

SaaS companies promising technology that enables things like personalization and customer journey orchestration may have trouble in the markets if they cannot prove their value in revenue, profitability, or conversion. CX is dead, welcome to the age of the discount.

Confidence correction

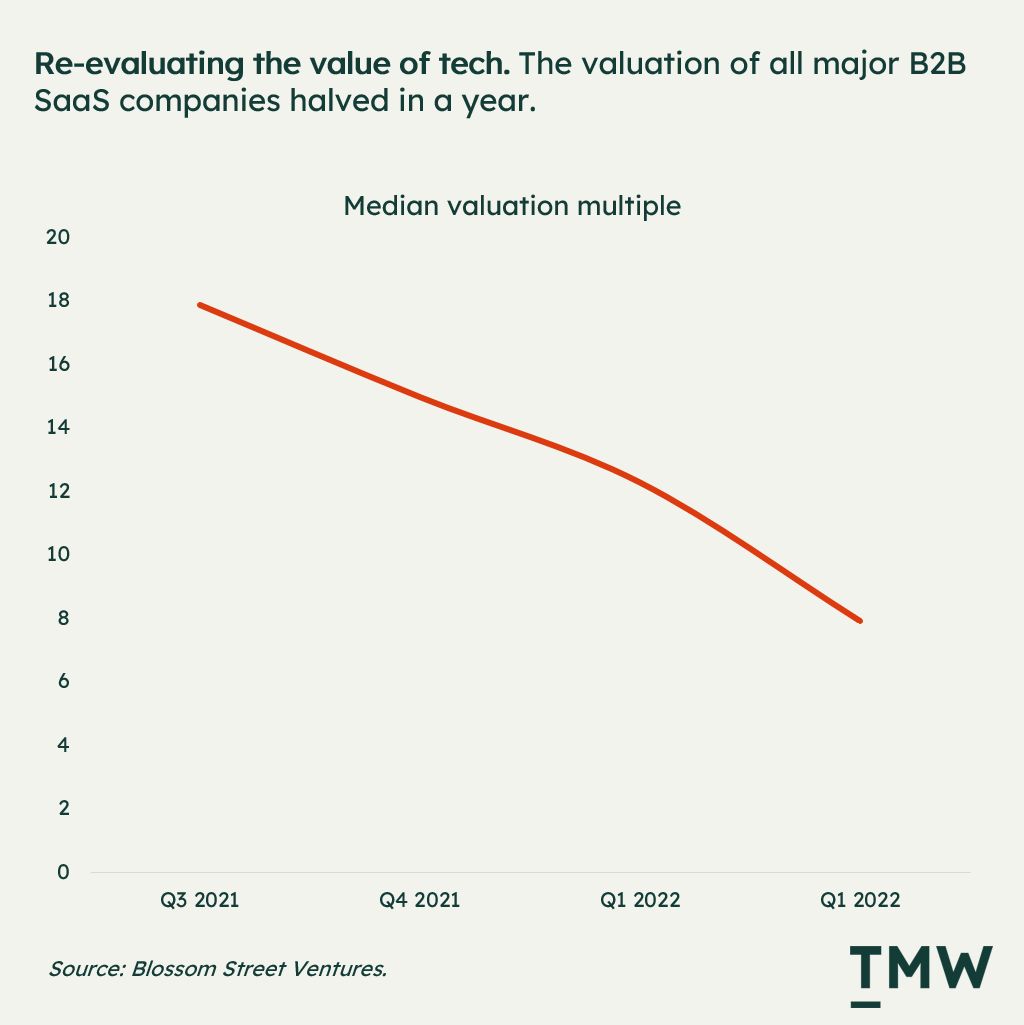

Despite the increased need for marketers to create demand, most of the publicly traded Martech company's stock prices are down significantly year on year. Since June 2021 Meta is down 52%, Salesforce 24%, and Amazon 33%.

In another sign of diminished confidence in marketing tech, investment multiples in SaaS halved in just a year.

What’s happening in the technology markets is a confidence correction.

COVID-19 brought about a new way of thinking about the role of technology in our everyday lives. When restrictions were placed on meeting face to face or going to the store, those things were replaced with digital equivalents.

Covid woke us up from the reality that most enterprise brands were not really addressing the growing consumer change brought about by the internet. At the beginning of COVID-19 McKinsey proudly announced that eCommerce spending gained 10 years’ worth of growth in 3 months. The fear of a respiratory virus without a cure led to inflated confidence that the internet can replace most societal functions.

One of the more extreme examples of this was Hopin, the online events conferencing platform that launched right at the start of the pandemic. This company reached a $1 billion valuation in only 5 months, and over the course of 2021 acquired 5 companies. However, Hopin recently had to lay off 12% of staff as demand for online events slowed.

The desire to live in that world is diminishing as people are spending more on travel and shopping since lockdowns lifted and the pandemic threat abated. This is one of the major reasons for the collapse of technology stocks and the crypto market as a whole, it’s not just about the looming recession, people not staring at screens as often as they used to.

While the line only went up in the tech world during COVID-19 the vibe is shifting because the irrationality of the past two years has hit a brick wall of reason.

While the situation looks grim, there’s always counterfactuals in every recession. Facebook and Twitter came into market during the 2008 global financial crisis and Amazon launched during the dotcom bust of 1995. Then as now, there will be new technology paradigms as the world grapples with a post-covid reality.

This is why Martech is recession proof - companies need to sell, consumers need to buy and even if confidence is low in the broader tech ecosystem, companies are needing to continually evolve with how consumers do things online. Links: RECESSION ANALYSIS. GLOBAL GDP (OECD). INFLATION.MARKETING IN A RECESSION.LAYOFF TRACKER. DELOITTE . HBR.GLOBAL AD SPENDING. SAAS MULTIPLES.SAAS MARKET STATS

📈Chart Of The Week

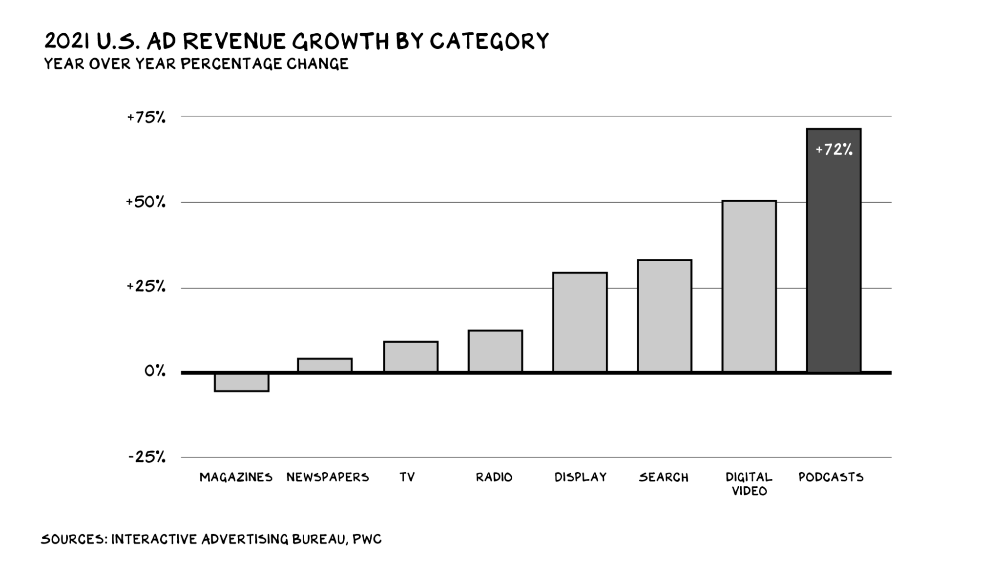

Podcasts are underrated. Podcasting took off during COVID-19 and advertising is quickly catching up. The interesting thing about the channel is the combination of open distribution (RSS), near zero cost to produce and distribute, and the emerging scalability of advertising placements. Compared to radio, TV, and print journalism, it’s one of the most accessible and revenue-viable channels for creators at the moment. Link

📰 Latest Developments

Amazon and UID 2.0. AWS and The Trade Desk have signed a deal to integrate UID 2.0 into the ad tech offering. Customers of AWS will be able to match first party data with UID identifiers to activate across various channels and ad placements within Amazon’s ecosystem. This is a very interesting move given Amazon’s growing advertising business which is based primarily in the control of first party data collected from Amazon’s consumers. Link

Saying it again: Everything is a CDP. Klavio, the rockstar marketing automation platform that found success in the mid-market ecommerce space announced Klavio One, a unified personalization platform. Give any marketing automation platform enough time and they’ll magically turn into a CDP. Link

Edging closer to US federal privacy regulation. Up until this point, most of the policy surrounding online privacy has been at the state level. The bipartisan American Data Privacy and Protection Act Discussion Draft is the first sweeping federal legislation that will give the FDA the ability to define what kinds of data need opt-in. Link

📚 Reading

Media theory and enterprise automation. Marshall McLuhan had an interesting theory on media back in the 60s when he introduced the now famous catchphrase “the medium is the message.” This piece unpacks that logic in the context of channel activation in enterprise businesses. A question worth asking is how much is channel selection part of what you’re trying to say? Link

How authentication works. The past, present and future of online identity and a review of how it should work when you're trying to prove who someone is. Link

Are there any good Web3 use cases? A lot of discussion recently on getting down to the specifics of whether the blockchain can offer a use case that is more valuable than what we already have. Even the A16z chief Marc Andreesen couldn’t clearly give an example, without recreating a lot of what we can use today. CARTOON AVATARS.TYLER COWAN JOSH LEDBETTER.

🔢 Data & Insights

The architecture of the Metaverse. CB Insights on the technology infrastructure built around the idea of the metaverse. Link

The state of personalization. A Segment Twilio report talking about the changes they are seeing from their customer base. Less than half of companies are personalizing using real time data, and even less are using first party data in their efforts. Link

Demand for CTV grows. An interesting report on the use of internet connected televisions in the US. Almost 90% of US households have at least one CTV device, and 46% of adults watch content via a device. Link

💡 Ideas

Apple and the end of CAPTCHAs. An interesting piece on how Apple plans to replace those annoying "I am not a robot" prompts on website with on device authentication using FaceID. It’s an interesting development considering Apple’s role in removing the password completely (covered in #082). Link

Alexa uses your dead loved one’s voices. Amazon demoed a tool that can train Alexa to convert tech to speech based on a short sampling of a person’s recording. Some of the rationale for this is to remember a loved one after they pass away, but not discussed is the huge potential for deep fake abuse and privacy. Link

The next social platform is in your home screen. When Apple introduced the iPhone widget, a small number of apps have been capitalizing on it to change the experience of social media. Apps are becoming less like true applications and more like features in the iOS ecosystem. Link

✨ Weird and Wonderful

Festival complaints. Two great pieces on Cannes and NFTNYC, both very polarizing events for the crypto and advertising worlds respectively. NFTs were featured heavily in both. CANNES. NFTNYC.

Death to Jira. Customers hate Atlassian so much that a few of them collaborated to create this website. Link

Internet Explorer and nostalgia. We all used this browser at some point in our internet journey. Now, it’s time to say goodbye. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.