TMW #099 | Martech in India

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

Here’s the week in Martech:

- Martech in India: The next center of marketing tech innovation

- 10 years of Martech: Company valuations have finally regressed

- Elon and Twitter: Plus some embarrassing text messages

- Everything else: More privacy fines, positioning technology, TikTok is deeply unprofitable, using Martech capabilities, many more AI use cases and a good marketing automation joke!

✍ Commentary

Martech in India.

From time to time I receive startup pitches from companies building products in the Martech industry. And almost every startup founder who is working on interesting ideas either comes from or is actively building in India.

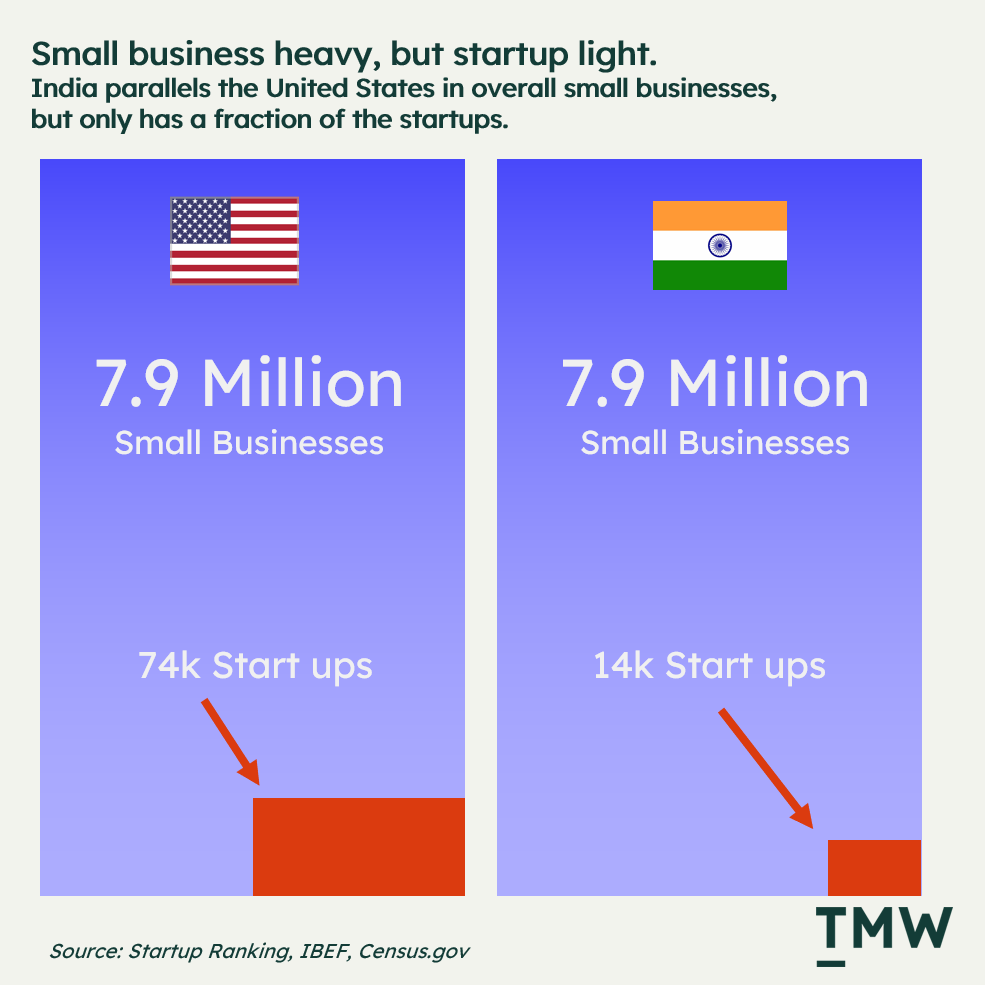

I don’t know much about India, but I really should. It’s a technology industry with a consumer market of over 1.4 billion people, millions of small businesses, and around 14 thousand startups - the second-largest population in the world. India rivals the US in total small businesses, but within that, India’s startup economy is still small with plenty of room for growth.

One of the more interesting questions about innovation is not when, but where. Culture sets the necessary context for where the next wave of marketing technologies will come from, and increasingly the center of tech seems to be shifting from West to East. According to FDI Intelligence, in India alone, 44 unicorns were created in 2021, achieving more than $72bn in exits which is 38 times greater than in 2020.

India has all the right conditions, cultural influence, and capital to turn the country into an innovation powerhouse in the marketing technology industry.

Rising young

One of the most interesting things about the cultural context of Indian startups is how normal it is to start a business. In the western world, deciding to start a technology company or a digital business tends to come after you build a career. The normal path for young people is to exit university and spend a decent chunk of time working in one or a few companies.

In India, it’s the opposite. Startups are how people enter the workforce. The World Economic Forum’s research suggests that Indian startup founders are among the youngest in the world, with more than 72% of them under the age of 35.

This creates an interesting cultural backdrop where people are building technology as the main onramp to participate in the economy – using technology skills and access to a large acceleration market to create economic security. India is fertile soil for an entire generation of new innovators and thinkers in marketing technology where starting up is a normalized part of life.

India’s affluence is also rising. The UN projects that India’s urbanisation will rise to more than 640 million people by 2035, creating an aspirational consumer cohort that’s more than twice the size of the United States market. What do you get when you have a rising middle class, a cultural normalization of starting businesses among young people, and an all-time high demand for software engineering? A lot. Of. Tech.

But the difference between starting a tech company and starting a business is that first-generation technology founders have to break traditions, navigate cultural systems that prevent upward mobility, and, the most daunting of them all - explain themselves to their parents.

All not easy tasks. Unlike the UK or the US, places that are now bringing a second and third generation into the tech sector, India’s investment into technology came later which brings fresh thinking about the role of technology in our lives, but less support and a smaller network.

Are Indians building Martech?

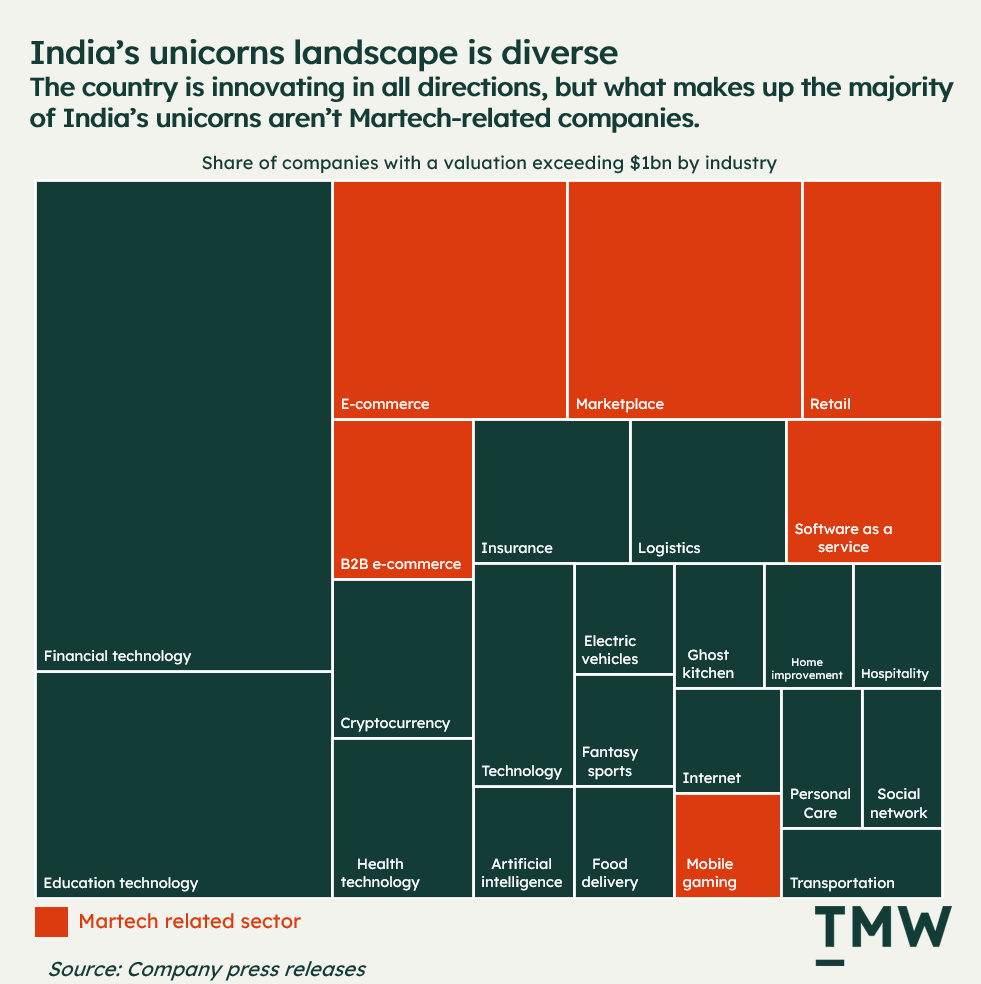

Overall, the answer is yes. But when it comes to India’s most powerful companies, those that have obtained a valuation greater than $1 billion, there is another story. The biggest startups in India are focused on finance and education. Compare this with the United States, where the top 10 list of companies are dominated by marketing and advertising technologies like Google, Amazon, and Meta and you start to form a picture of an Indian technology landscape that is building infrastructure companies to service a large population.

Most of the valuable companies in India aren’t Martech. But it’s growing. One area that’s growing fast is eCommerce. Currently, eCommerce is only 2% penetration in the Indian market, and with a forecast for that rapidly growing, companies like India’s eCommerce giant Flipkart become enablers for the next wave of marketing technologies.

Flipkart was recently acquired by Walmart at a 77% stake at $16 billion. This means that overseas investment into India at this scale will drive increased innovation. Flipkart already has India’s largest ecosystem of apps and services, providing a platform for entrepreneurs to build marketing technologies across all phases of the shopping journey. India is at the early stages of an eCommerce growth curve, which will unlock investment into all kinds of marketing technologies just in the retail and eCommerce verticals alone.

From the service desk to the cap table

One of the main questions about India is the country's ability to influence the technologies that other countries are using. Does India have a form of cultural power to attract global talent and build products that reach a global scale? We’re only just seeing China do this with products like TikTok and Alibaba. Can India follow?

One of the aspects that are important to the technology scene is the culture that surrounds the tech. An interesting signal is that India has its own tech celebrities. Just as startup founders look up to people like Marc Benioff, or Steve Jobs, India has a growing roster of technology thought leaders that are investing in major global brands. Like Hollywood actors invest in tech, Bollywood celebrities are doing the same. The flow of talent and capital around technology companies in India is growing and people are noticing.

India has also exported more than 90 CEOs that make up the US fortune 500 list of companies, making India the top country for non-US-born founders. In years past India was arbitrarily perceived as the IT helpdesk of the world. But with the country’s growing influence in the technology industry and the rise of the VC and investor class, there’s a decent chance that India can start to control the technology narrative on a global stage.

One of the longer-term effects of hiring abroad, particularly with offshoring practices gaining significant takeup during COVID-19 is that Indian tech employees get to learn and build key skills, contacts, and knowledge. This creates another vector for Martech startup growth – more people with more hands-on experience. This is happening so much that increasingly, Indian founders are forgoing the US greencards to build software in their own country.

India’s democratic government and integration with the wider political and economic landscape give the country one of the largest advantages in all of South East Asia. Unlike China, India offers the ability for companies to go global. That’s why India has such strong ties with the rest of the world – the country is a global economy, and its tech can be exported to influence other nations.

Bangalore vs Palo Alto

Don’t get me wrong, the cultural divide between India and the West is still large. Customs, traditions, and values differ greatly, but where there are differences, similarities abound. Both technology cultures value hard work and building solutions to solve problems for people. Both have innovation aspirations and big addressable markets.

But can it really become a global superpower in the technology industry? Enough that we should all learn a little Hindi and where startups looking to join incubators will move there? In other words, will Bangalore become the next Palo Alto?

I think we’re a generation away from any meaningful influence shift in the technology market. But in Martech it’s already happening. Some of the most impressive startups I’ve had the good fortune to meet and learn about are Indian. Ecommerce is still early, there are more people than ever working on hard marketing problems and the economic connection with the global economy means there’s likely to be a ten-year onramp for India onto Martech.

📈Chart Of The Week

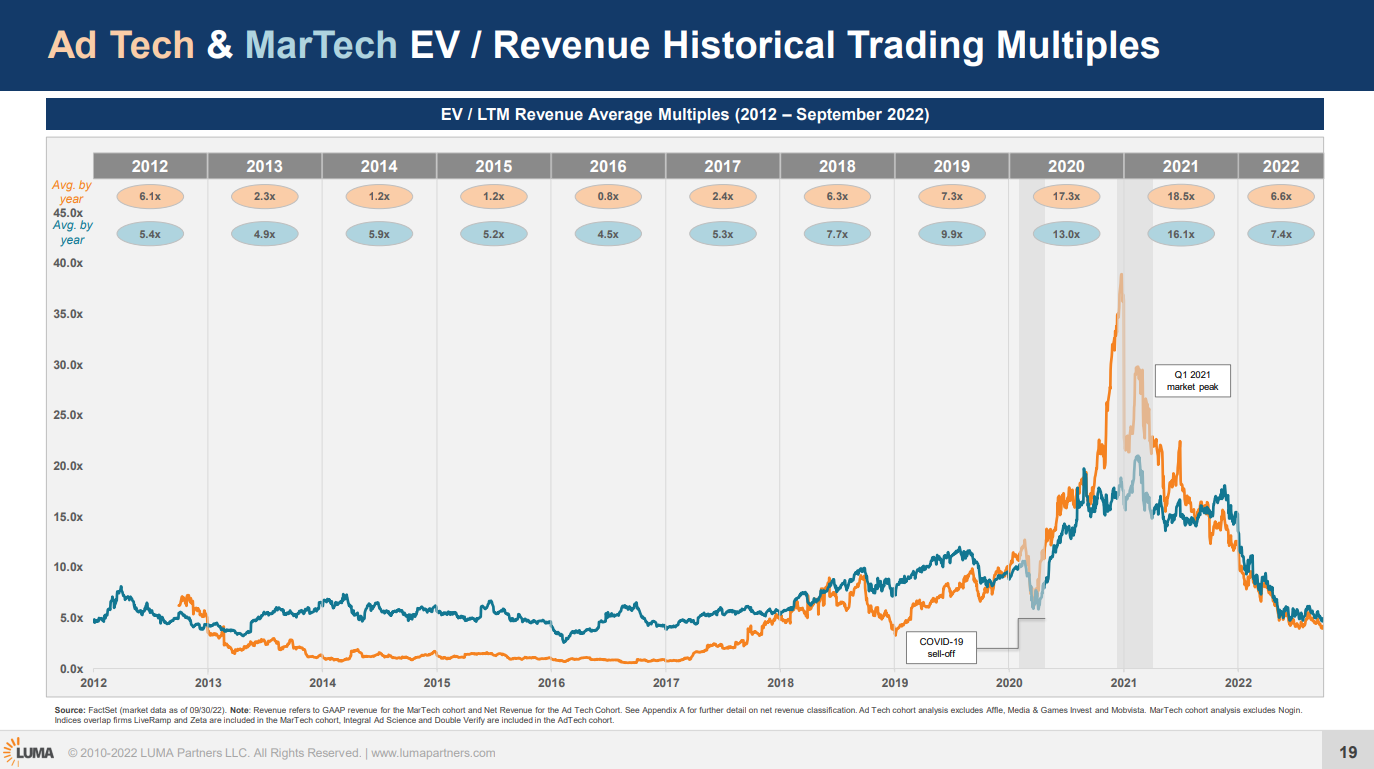

10 years of Martech and Adtech. Valuations are reverting back to the historical, pre-pandemic norms, but the interesting angle this is how Adtech valuations (in orange) saw a far greater surge during the pandemic, but now are trading in the same 4 – 6x multiple ranges as marketing technologies. Link

📰 Latest Developments

Elon and Twitter (again). Looks like the deal is finally closing. This time a ton of Elon's text messages were made publicly available which gives you a small insight into how billionaires think about social networks. On the situation, this is the best paragraph I’ve read about it so far from Ryan Broderick: “So what do Musk fans actually see as the end game here? A shitty TruthSocial-esque hustle bro message board with just them and Musk, where they share his cringey top-of-r/all memes, tell him how smart he is, and try and scam each other with NFT phishing?” ANALYSIS. TEXTS.GARBAGE DAY

Trouble in podcaster land. Spotify is downsizing its podcasting team and has canceled 11 original shows on the platform. Podcasts are a big part of Spotify’s monetization strategy, which has kind of turned the music streamer into an audio production house similar to Netflix. It’s not immediately clear what metric Spotify is aiming for with podcasting - subscribers or ad monetization. Maybe trying to do both isn’t working? Link

Today in everyone gets a privacy fine! Former Uber CSO has been found guilty of concealing data breaches from 2016. Consumer brands are increasingly facing fines as exposure to data security gets more government attention (see last week’s newsletter). Link

📚 Reading

Positioning technology. An analysis of how Substack defied gravity to create an entirely new media category on a platform model. Positioning had a lot to do with it. Link

Privacy as a product. Sometimes I read an essay and wished I wrote it. This is one of those essays. Link

Adtech is watching Rome burn. A good inside view on the chaos that prolonged cookie deprecation is wreaking in the AdTech industry. Lots of confusion, some creativity, and a lot of worrying. Link

🔢 Data & Insights

TikTok is deeply unprofitable. And apparently, the company used to spend a major share of revenue on advertising with other social networks (about $3 million a day with Snap). Social media is in this interesting situation where the largest social networks are both competing and dependent on each other for audience growth in some kind of weird attention arbitrage. WSJ is saying that TikTok has $7 billion in losses, increasing 3 times since last year. Link. Snap spending.

No one home in the Metaverse. Coindesk reports that prominent metaverse companies Decentraland and The Sandbox have less than one thousand DAUs. In one estimation (which was contested by the company) suggests that Decentraland has only 38 DAU on some days. Somehow these companies have market caps of about $1.3 billion. The idea of a “decentralized metaverse” using 3D virtual environments and crypto tokens seems like a failed idea. Perhaps it’s trying to do too much? If there’s no speculation opportunity, and if there’s nothing interesting about these platforms, then there’s not much “there” there. Link

Gartner: Marketers only use 42% of Martech stacks to full capabilities. Are marketing technologies too feature-stuffed? These numbers suggest that differentiation through simplification could be a winning strategy. Link

💡 Ideas

An alternative to statistical significance. Experimentation teams have long relied on statistical significance to ensure results have accurate data. This exploration from LaunchDarkly looks at a variety of alternatives that are gaining traction in the market. Link

The AI use cases keep coming. Using AI to search, produce music and buy furniture are all just a few edge cases coming into the market right now with open-source generative AI products. There’s no killer app yet that can do it all, but the expressions of what people might want from these tools are interesting nonetheless. SEARCH. MUSIC.FURNITURE.

Feedback loops in data. This is an oldie but a goodie on feedback loops in data architecture from Tomasz Tunguz at Redpoint Ventures. This piece is even more relevant now with the growth of cloud-based modern data stacks and new concepts like reverse ETL. Link

✨ Weird and Wonderful

Christie's are not done with NFTs. After the hype cycle subsides there appears to still be demand for NFTs as experimental expressions of art. Christie’s, one of the world’s oldest auction houses for artwork, announced Christie’s 3.0, an NFT blockchain project this week. Link

Our complicated relationship with self-checkouts.Link

A good marketing automation joke.Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.