TMW #104 | The rise of Retail Media

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

Sergey Brin and Larry Page talked about ads in their 1998 introductory paper describing what would become Google Search:

“The goals of the advertising business model do not always correspond to providing quality search to users…we expect that advertising funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers…Furthermore, advertising income often provides an incentive to provide poor quality search results.”

Although Brin and Page are talking about search, the same can be said about Retail Media. Retail Media is shorthand to describe a movement of eCommerce platforms, marketplaces, and retailers implementing Adtech tools to create new revenue streams on their platforms through targeted advertising.

Over the past three years, new advertising offerings are growing rapidly across digitally native platforms like Amazon, but also with traditional retailers from the likes of Walmart, Home Depot, and Target.

It’s an attractive proposition for the entire industry: Marketers are finding better reach and revenue-generating opportunities outside of high-cost search and social. It connects shopping to discovery and retail chains get to create a whole new, high-margin revenue stream.

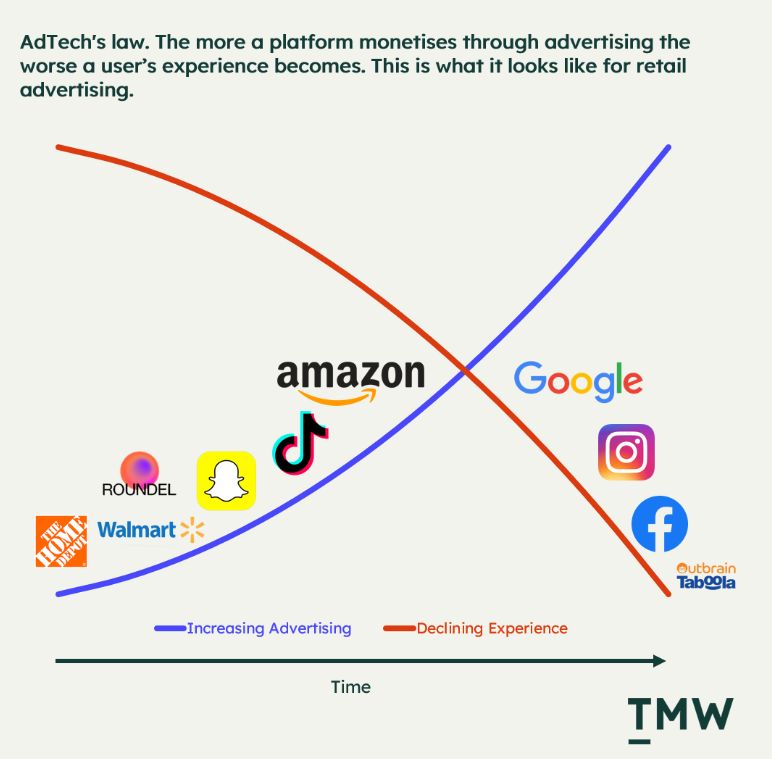

The question here with any new channel for advertising is what are the tradeoffs for marketers and users? Like every platform that monetizes with ads, Retail Media is likely to degrade the experience for shoppers over time.

But first, let’s look at how this category is growing.

Retail Media has arrived

The growth of Retail Media and its increasing relevance to marketers and advertisers is incredible. eMarketer reports that ad spending on Retail Media has more than doubled from 2019 to 2021 to $31 billion and that by 2023 it will encompass more than 20% of digital ad spend.

It’s been a little while since marketers had a scalable channel to grow their brands outside of search and social. And I’m here to report that if you’re looking for a new platform for programmatic, targeted advertising, it’s here. Retail Media has arrived.

But not all growth looks the same. One of the main drivers of Retail Media is Amazon, the company that is taking advantage of its own retail dynamic, lion's share of eCommerce traffic, and AWS cloud infrastructure.

In some shape or form, Amazon has been running ads in its online store for a long time, but only recently with the launch of Amazon Marketing Cloud did the eCommerce giant start scaling its ads to a point where the company is generating more revenue from ads than Prime, Kindle and Audible subscriptions combined.

And there’s no slowing down. Amazon’s ad business has grown roughly 30% year on year, taking up half of all ad spend in the Retail Media sector in 2021. Amazon entering ads is similar to the company entering cloud infrastructure with AWS. And we all know how that ended up.

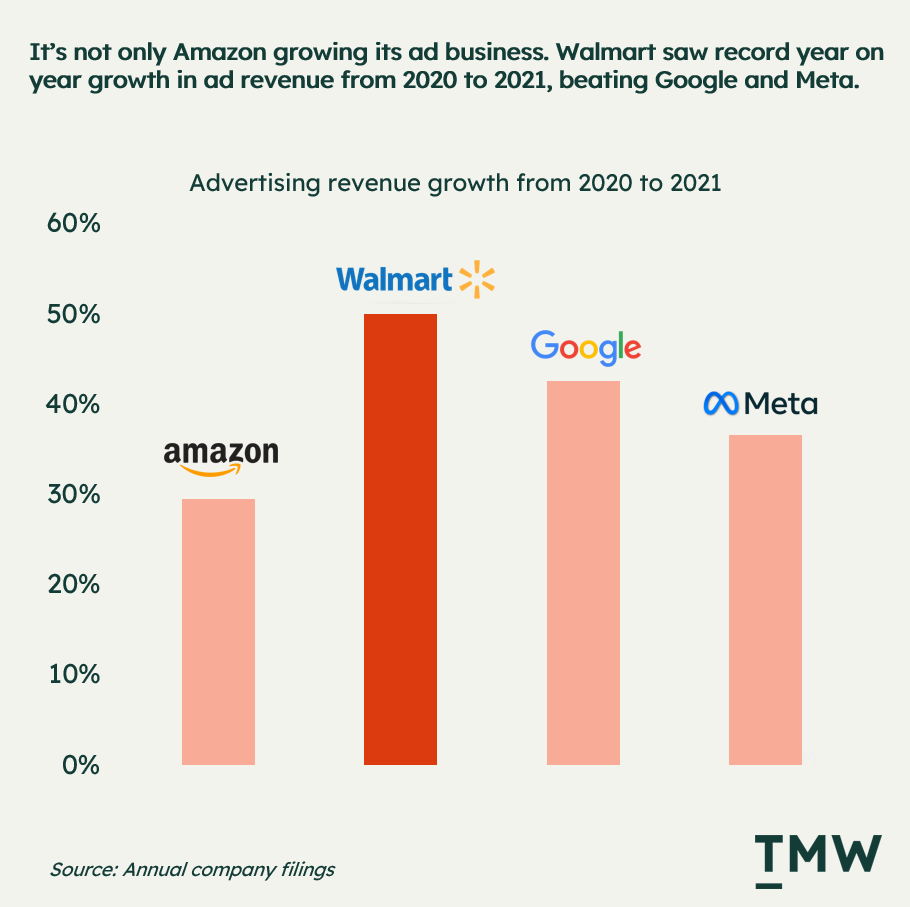

Surprisingly, Amazon is not the only retailer that’s on a big growth curve. Walmart has been building its own ad network as the company transforms from a legacy retailer to an online platform. From 2020 to 2021, Walmart has the highest year-on-year growth in ad revenue of all Retail Media platforms and even beating out Google and Meta.

And although Walmart’s ad revenue last year was only $1.5 billion, a fraction of Amazon’s, the company's growth is impressive for a legacy retailer pivoting into sophisticated advertising technology that requires algorithms, programmatic bidding, segmentation, user tracking, and of course marketers willing to spend their precious ad budgets with them.

Why is Retail Media growing?

What could motivate a retailer like Walmart or a department store chain like Target or a Grocer like Tesco to invest the significant capital needed to build an entire Adtech platform on top of their online stores?

There are two sides to answering this question. On one hand, monetizing an eCommerce audience with ads is a very high-margin business compared to selling and shipping physical products. On the other, marketers are searching for new channels as pressure is put on the industry from privacy regulations and platform change, increasing the cost to advertise. If I could summarize why Retail Media is so attractive right now, it would probably be this:

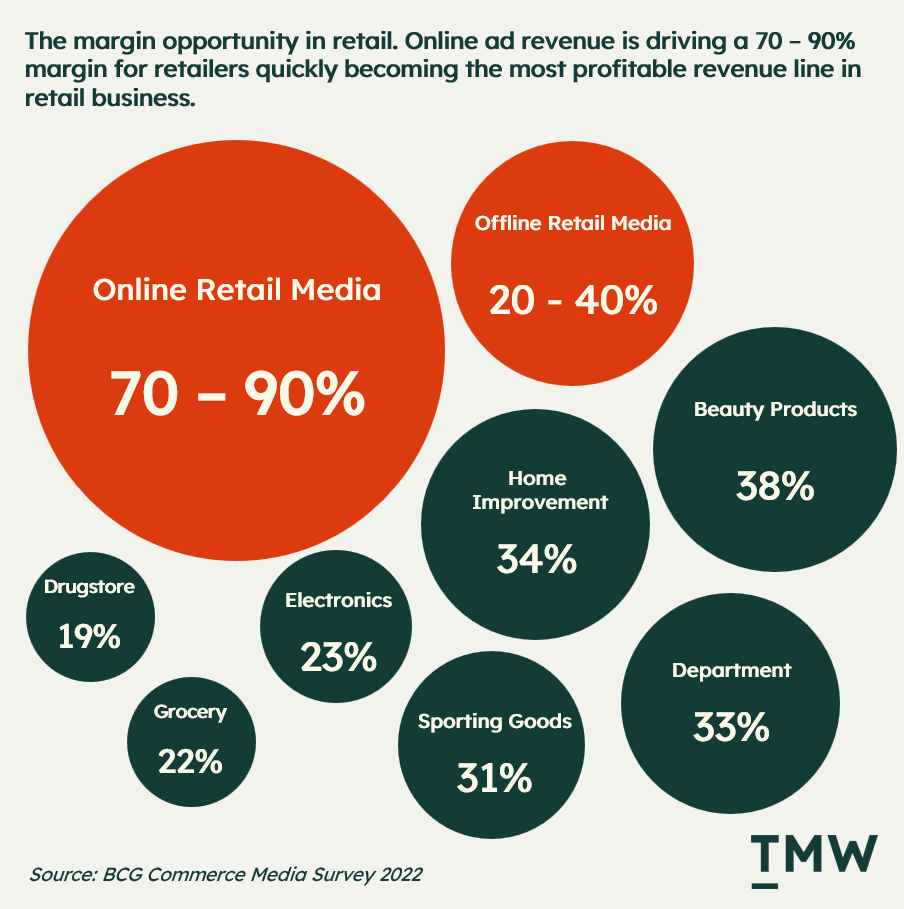

For retailers, margins are always thin. Between packing and shipping products, and sharing revenue with producers eCommerce has always been low profit, high throughput, and high-revenue business.

The COVID-19 pandemic made us all familiar with online shopping and as a consequence, retailers went from seeing the online store as just another shopfront to a central platform for running their business.

Driven by the commodification of AdTech which was once a space only technology native companies could play in, and the demand to diversify revenue streams, these companies are increasingly investing in ads as the next big platform play to monetize their users. Advertising monetization is not new – producers have been haggling with retailers for decades over store placement fees. The only thing that has changed is the digital aspect.

Now there are SaaS companies that offer retailers and eCommerce store owners the ability to plug and play retail media without having to hire an entire Adtech engineering team. Companies like Moloco are doing just this for the marketplace-saturated Asian market. Like every other marketing technology, being able to build an ad network on an eCommerce site will become table stakes with time.

According to BCG, retail executives cite ad monetization as the highest margin revenue stream in their business. Far greater than anything they can sell physically. Our attention is scalable and our eyeballs are valuable.

For marketers, these past two years have been a challenging torrent of change in advertising. From cookie deprecation on major browsers to App Tracking Transparency and the limitation of IDFA on mobile by Apple to consumer sentiment changing around privacy and online tracking, those good old days of running highly targeted Facebook or search ads to drive in-store and online conversion are quickly becoming a thing of the past.

This has impacted marketers in two ways; the ability to efficiently segment and target customers with ads and the ability to report on the outcomes. Privacy change is driving costs higher across all major social media and search platforms, while the traditional ways of measuring ad effectiveness are less reliable. In short – marketers are flying blind with less petrol in the tank.

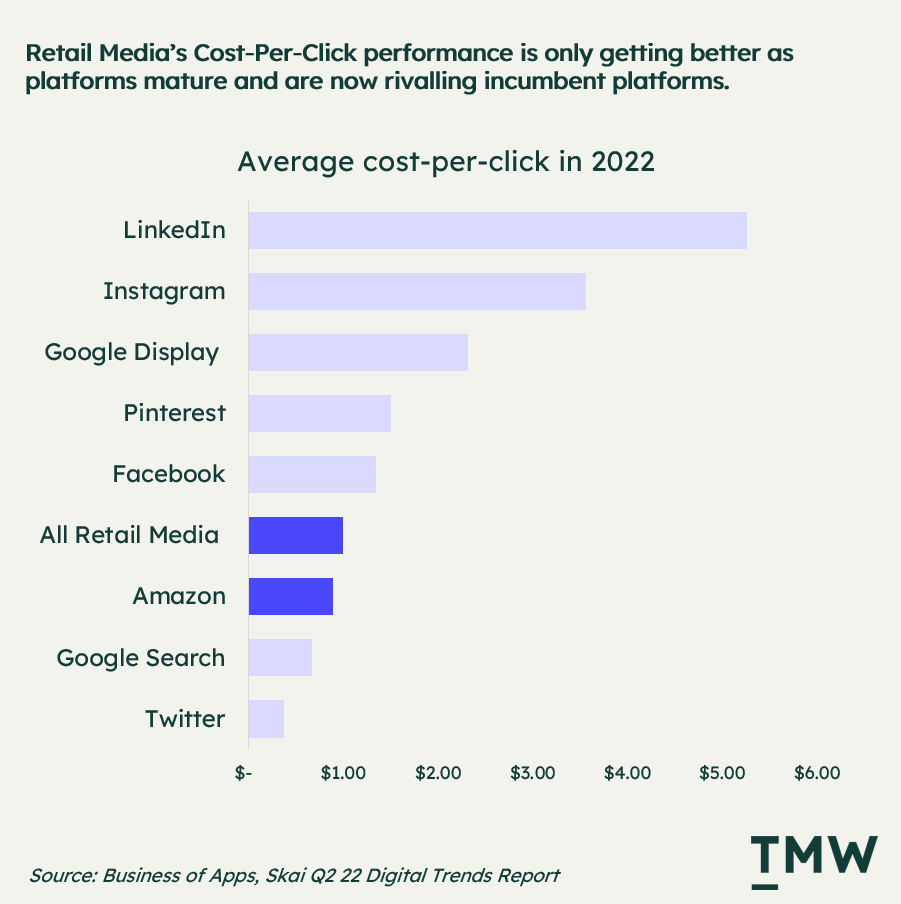

That’s why Retail Media offers several advantages for marketers. Research from Business of Apps indicates that retail media networks are offering a much lower cost-per-click for marketers. This is partly because the primary ad placement on retail media is within search.

Being able to leverage a customer’s explicit intent with a query means greater targeting precision than even Google search because people are searching in a marketplace, not a search engine - a domain for purchasing, not researching. For brands selling consumer goods and physical products, this is a big advantage.

Wunderman Thompson suggests that last year only 8% of ad inventory on Amazon’s DSP was affected by App Tracking transparency changes by Apple. A significantly good outcome given how these changes are impacting Meta and Google. A walled garden like Amazon or Walmart of highly targeted users who are there to buy is about as close as you can get to a literal goldmine for advertisers.

Add into this mix greater precision for measurement and analytics in a closed retail ecosystem means effectiveness is easier to track. As long as you take into consideration that incrementality is always a challenge and especially in an experience where customers are likely to purchase your product already, there’s a lot of value in the closed ecosystem from an analytics perspective.

If you zoom out and look at the factors that have driven $2.5 billion for Walmart and more than $25 billion for Amazon in ad revenue over the past two years, it’s a curious cocktail of privacy regulation pressures, increased advertising sophistication at legacy retailers, margin opportunity and platform advantage.

Shopping will probably get worse

My main contention with Retail Media, to put it in Jason Del Ray’s words is this - “basically everything on Amazon has become an ad.” In a recent post from Del Ray, he investigates the growing preference for advertisers on Amazon.com and comes to the conclusion that internal teams at the company are overall happy with the compromise of ads over customers – knowing full well that over time a preference for advertisers will degrade the user experience.

“And, of course, just the presence of an increasing number of ads on Amazon pages ruffled the feathers of some Amazon staff responsible for the overall customer shopping experience. The company’s retail division, which operates separately from the advertising division, “really believed the customer experience would be negatively impacted by ads,” a former Amazon vice president told Recode, while the ad division “figured there was a way it could be done in a smart and beneficial way.” Ads leaders would also stress how important the profits from the business were.”

Advertising creates an adversarial relationship with the consumer that is unavoidable – the more you motivate them with ads to purchase the less likely a consumer is to be satisfied with their purchasing decisions. With Retail Media, the difference is getting harder to spot. If you’re looking for something and are shown or recommended a product, is it because of the reviews, the relevancy to your query, or because a brand is paying for you to see it?

The real cost of introducing ads to an eCommerce marketplace is the experience. Ads divert attention and customers going to a marketplace are often wanting to find something specifically, rather than discover something new. Yes, there’s always the price comparison, window shopping, and educational aspects to eCommerce. But by and large, if a consumer is in a marketplace, they are there to buy and to do so as easily as possible.

This is why obfuscating the experience with advertising, diverting or complicating the fastest paths to the product will increasingly make the experience harder for consumers to navigate. Like any platform management philosophy, there comes a time to choose your real customer.

The value exchange between serving both – advertiser and consumer work only insofar as the incentives drive both equally. As we’ve seen with the degradation of social media, social networks increasingly prioritize advertiser needs over users, creating an arms race for attention-grabbing and holding mechanisms that trick us into spending our time more on platforms.

The outcome of ad-driven media is that the experience becomes more addictive but less enjoyable. I call this Adtech’s law. Give an ad platform enough time and the quality of content, products, and experience slowly degrades as advertisers have a greater say in what is shown to users.

Retail Media influencers other kinds of detrimental changes to how consumers can shop. One of the more recent ones was the ICCL, suing UK grocer Tesco for experimenting with refusing store access to customers that haven’t signed up for a Loyalty card.

Clearly, Tesco values data collection for their growing Retail Media network so much that they will let it overshadow the social contract of letting anyone walk into a store to buy something. Retailers really want to get to know you – you’re preferences, behaviors, likes, and dislikes for the sole purpose of selling that information to advertisers. You can feel the hostility rising.

In many ways, Retail Media is very similar to the normal product placement negotiations that happen with physical retail stores all the time. There’s a reason why Coca-Cola has a quarter of the shelf in most grocery stores. They pay for the real estate.

But there’s something unique about the online experience in that so much of the journey of buying something is guided only by what you can see, in a physical store you are exposed to much more than what you get on a screen.

Marketers are also at risk of platform lock-in by selling into retail media networks. Brands lose the most margin when selling on marketplaces like Amazon, Walmart, or Tesco which means less to spend. According to Vox’s analysis, successful Amazon sellers have to spend between 10 to 20 percent of their sales on Amazon Ads. This is just another tax you have to pay to get in front of customers.

However, there could be a lot of good that can come from the growth in Retail Media. Ad monetization could work in similar beneficial ways to how Netflix is making streaming more accessible with a low-cost, ad-funded tier. If retail media is a profit center, then theoretically this could mean a better deal for consumers by lowing prices and forcing advertisers to offer deeper discounts and offers in conjunction with ads. It’s unlikely but sometimes I like to think optimistically.

This is one of the great challenges of Retail Media – if advertisers become the priority over consumers then marketplaces like Amazon become less useful and more annoying over time. It forces an issue of where the experience is prioritized. So which one will it be - advertisers or customers? Retailers will eventually have to choose.

Stay Curious,

💼 The market review preview:

- Google class action: The largest privacy violation settlement in tech

- TikTok Shop: Expect a whole new vendor ecosystem for eCommerce

- More Reverse ETL: Amplitude announces a warehouse-native product

- Cloud growth: Revenue is growing, but growth is declining

- Everything else: Cookies and creativity, after NFTs, retail media's impact on CX, marketing automation buying, entity resolution, and a good agile Tweet

Get the Wednesday Market Review email with a TMW PRO Subscription. It's the easiest way to stay updated on the marketing technology industry. Try it for free for 30 days.

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.