TMW #010 | The data issue - Oracle, Tiktok, Snowflake, 1st party cookies and analytics use during the pandemic

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

Here's everything you've missed in marketing and technology this week 👇

👌Top #3

🤳 Oracle and Tiktok. In a strange twist of events, Oracle has moved in on the Tiktok sale with something a little more than a partnership and a little less than an outright acquisition, beating out Microsoft to the purchase of the US version of the social media app. This is the data equivalent of a mid-life crisis for Oracle, celebrating 43 years old this year. It's worthwhile to point out here that the deal involves mostly the storage and housing of Tiktok user data in Oracle systems, which is a shift away from Tiktok using Alphabet's servers. So in effect, Oracle really just scored another cloud computing contract at the end of the day. There will be no US access to Tiktok's algorithm, yet some codebase access will likely go through in the deal. It's all a bit of a mess, it really looks like a series of under-the-table handshakes to secure US data from a rapidly growing Chinese social app. Where the deal doesn't safeguard US consumer data is in the algorithm, as it trains and improves this will still be Chinese IP. Although it's not a total acquisition it could be the right step in the protection of nation-state data.

So what does this mean for Oracle's line up of products? Can we really call Tiktok an Oracle company in the same way we could call Responsys? Ray Wang, principal analyst for Constellation Research says that Tiktok could be a contributor to Oracle's growing data marketplace which deals mostly in programmatic trading to expand on Tiktok's advertising targeting but also the creation and profiling of users who use the Tiktok app. The social app's feature set around targeting and advertising is in its infancy, but there is rapid development. It is yet to be seen if the Oracle - Tiktok partnership will boost those capabilities. At this point, Tiktok will continue it's US growth trajectory while Oracle tries to figure out what to do with its a shiny new toy. Link

❄ Snowflake, the cloud poster boy. This week snowflake went public, astonishingly becoming the largest Saas company to launch an IPO, doubling its share price on the release. This makes snowflake almost twice as expensive as Zoom video, a $40 billion-dollar company. Snowflake has been successful in taking the concept of a data warehouse and migrating it into the cloud. This has taken investors by surprise for sure, however since 2012 snowflake has consistently been in the right place and at the right time as cloud computing has taken off with the success of companies like AWS. Snowflake is now estimated at a $70 billion dollar valuation, five times that of it's 12 billion valuations in February. This is interesting as the company has posted revenues around $400 million in the last four quarters with a steady growth trajectory. So what makes this company, and cloud computing generally such a hot ticket? Well for one Snowflake has been doubling revenue in a 12 month period over the past two years. This is because cloud storage is near infinitely extendable with the almost limitless market need for the cloud, but this is not without high losses - the company is burning on average $300 million per year, and so in a way the company had to go public to get further traction and get to a break-even point.

The metric that investors are watching are the decreasing net losses over time as the company grows. On this account, the trajectory of the company is looking solid both in growth and diminishing losses. As more companies move onto the cloud from legacy systems and shifting into actively using data to power marketing strategies companies like snowflakes are the greater beneficiaries. AWS and snowflake offer a highly valuable product for digital teams - the ability to easily create scalable data solutions that are hyper-flexible, query-able, and at rock bottom prices. The value proposition pitches it yourself - if you've ever had to get data out of an old IBM system it can quickly become a frustrating and expensive exercise just to get your data into an email marketing platform. The cloud is just getting started and companies like Snowflake are putting their front foot forward. Link

🍪 First-party data is now non-negotiable. While we're talking about data, an interesting piece came out of Deloitte around the future of advertising targeting. There's a prediction floating around that third party cookies will be useless by 2022, which seems sensible enough. One of the very last dominant browsers, Chrome, is set to switch off third-party tracking within the next twelve months. The shift to first-party cookies will be a forced experiment for millions of advertisers who rely on products like DMPs and do programmatic trading as the widespread use of third party data will mean more companies having to take user privacy more seriously.

Maybe we might see the end of days for those annoying re-targeting google display ads (I hope so). It also means a major shift in how not only advertising tools should work, but onsite experience products such as Google Optimize and Hotjar in how they track users, meaning that brands are going to have to work harder to identify their users and attribute conversions in their analytics. First-party data is now the next hot thing, but it behaves very differently, it's more in line with identity resolution across owned channels than paid media, yet the larger vendors like Facebook and Google will be looking to integrate first-party data into their targeting solutions and some are already there. This will eventuate to far more controls over privacy both on the user and company end. Link.

📈Chart Of The Week

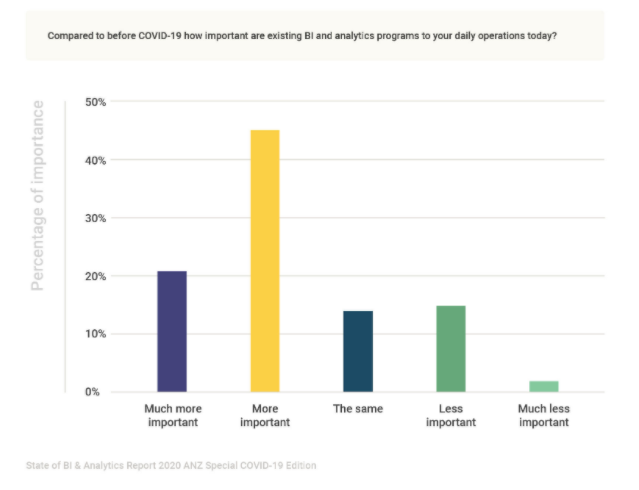

Some great research has come out this week out of Sisense, on the changes to Australian company's use of data and analytics during the COVID-19 pandemic. The top line is that 67% of survey respondents have said that their use of dashboard, reporting, and analytics instances has become significantly more important to the business. And when it comes to business departments, marketing teams are leading the charge in the use and reliance on data to make business-critical decisions. A lot of this stems from the economic conditions that have forced brands to make more critical decisions on things like ad spend, coupled with an increasing reliance on digital channels as they have replaced traditional retail.

Importantly 79% of respondents are actively looking to restructure their cloud data environments to better analyze and use their data, due solely to the changes in business throughout COVID-19. There have been tectonic shifts in how data is used by marketers during COVID-19 which is accelerating initiatives like machine learning application, cross channel rationalization, and decisioning. It's still early day, yet what I'm predicting is that the shove to digital is only accelerating maturity in the Australian marketing industry, which means more internal teams buying more best in class solutions and relying less on marketing cloud "all-in-one" solutions for their data and analytics needs. Link

📚 Everything Else

Apple released a couple of new watches, a new service bundling offering, newish iPads, and no iPhone (which must be a first for a September event). Apple, like many other companies, are branching out into new verticals like fitness to leverage the capabilities of their core products to create a closed ecosystem where it only makes sense to keep up that $15 / month subscription. Link

"I have blood on my hands" an honest letter from someone working at the heart of preventing Facebook political misuse. Link

A really great analysis on why almost every DTC brand just all look exactly the same. Link

Qantas is helping to open lines of credit for SMEs by putting business frequent flyer points to use. A very cool and helpful pivot during the pandemic. Link

Nine news media has launched their own digital media advertising product backed by Adobe, this is an attempt to compete with Facebook and Google. Link

How one person obtained a former prime minister's passport number with nothing more than an Instagram photo. Link

A great read on how Whispr is building a product which is the antithesis of most habit instilling tech companies. Link

Selling pet food and optimization - Petbarn is up 43% for new visitor purchases only three weeks into their personalization program. Easy money. Link

Gartner has come out with some great research focused on what Marketing teams will be focusing on in the next 5 years. The number one focus? Data management. Link

COVID-19 has demolished Ikea's e-commerce efforts, which is kind of a shame. So much potential for flatpack furniture during the pandemic. Link

In Colombia, the same data targeting consumers for furniture ads are being used to identify potential COVID-19 carriers. Link

A great approach to regulating news on Facebook and Google, looking at a use case from the EU. Link

Until next week!

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Friday plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.