TMW #045 | Algorithm-as-a-Service, the ubiquity of e-commerce and the time we spend online

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

There are two versions of TMW, the full version for subscribers and a 50% version that's for everyone. You are reading the 50% version. Sign up to get the full version delivered every Sunday for this and every TMW. Learn more here.

👋 Hello and welcome to new subscribers from The United Kingdom, Australia, The United States, Germany, and Singapore.

Algorithms are the new tech products, where the few get to build for the many, but what does this mean as the world’s largest AI company announces an out-of-the-box AI you can purchase and use with your company?

I tackle algorithms-as-a-service today in TMW #045, along with examining the ubiquity of shopping, how much time we spend online, and 15+ links of everything that mattered this week including an open letter about targeted advertising in people’s dreams. 💭

✍ Commentary

👨💻 Algorithm-as-a-Service. I don’t think I’ve seen the concept of algorithm-as-a-service anywhere on the web, so I’m claiming it. My only downside is the unfortunate acronym (AaaS). Despite the silly-looking acronym, the concept of algorithm-as-a-service is that many of the largest tech companies are doing what they do best, taking their existing infrastructure, packaging it up, and selling it to other companies to use, and nowhere does this make the most sense than algorithms. From Amazon (SageMaker) to Google (Vertex AI), and most cloud suites like Salesforce (Einstein), Adobe (Sensei), and Tealium (Predict) the commoditization of algorithm-based capabilities are becoming commonplace. This week a new entrant has entered this game, ByteDance. The Chinese company behind the wildly successful TikTok has announced the Volcano Engine. It’s the recommendations engine that flipped the script on almost every other major social algorithm by weighting music preferences, sounds into a model that optimizes for new content.

The Volcano Engine is one of the major factors of Tiktok’s success and a major breakthrough in algorithmic content suggestions. What’s interesting is that although Tiktok is a social media app for consumers, ByteDance is classified as an artificial intelligence company, and in a way, TikTok was the first real global beta of what Bytedance has been working on. And now they’ve validated that their algorithms can power huge commercial upside (Tiktok has been the #1 app in the Apple App store for almost 18 months running), this technology is now being packaged up and sold to other companies for things like product predictions, content recommendations, and gamification.

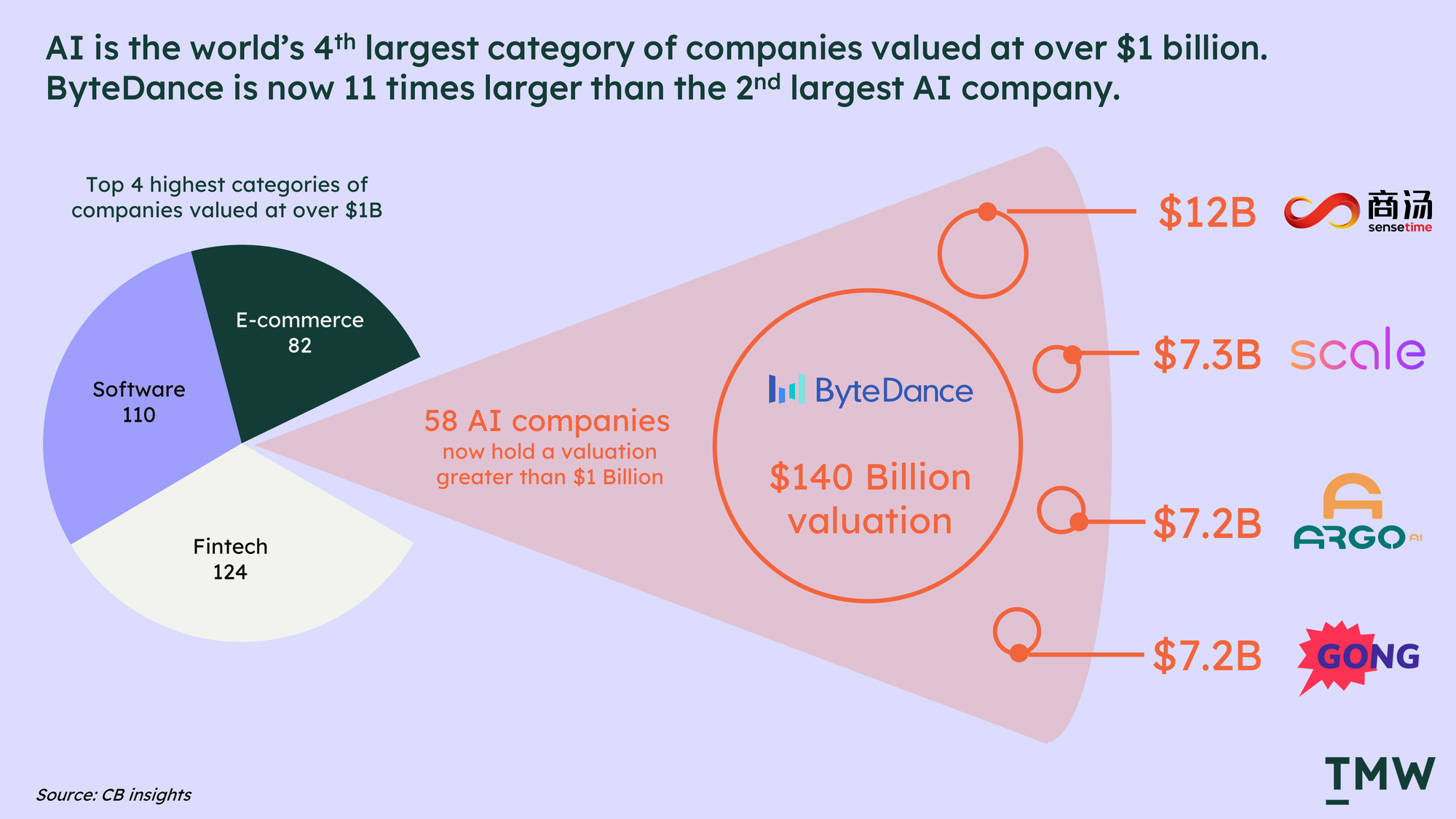

When you look at the largest AI companies in the world, nothing even comes close to Bytedance on valuations. Research from CB Insights looks at industry categories and the number of companies that reach “unicorn status” which means that they’ve reached a $1 Billion valuation. AI is now the fourth-largest category of company unicorns, of which ByteDance has a staggering $140 billion valuation, about 11 times larger than the next largest AI company, and about half of all valuations for this category. If anyone is in a position to package and sell their algorithms, it’s ByteDance. And the other top three industries - software, e-commerce, and fintech will eventually become reliant on the capabilities AI companies will create and sell. And that’s a problem.

By now, you can probably tell why this is important. When the world’s largest AI company decides to sell the algorithm that has powered the world’s most popular social media app it does give you enough reason to pause and think about where all of this is going. The problem is that, as I mentioned in TMW #026, when platforms get really good at something that requires a significant amount of capital and time, like training a recommendations engine on real-world data sets, then this gives these platforms the ability to do it for everyone else, and create significant dependencies. When you approach these algorithm products, whether or not it has been provided by Amazon, or Google or your favorite marketing cloud platform, the first thing you’ll notice is how much you don’t know about how the infrastructure will use the data you feed it and more importantly the end experience these algorithms will serve up for customers. They are literally black boxes most of the time, wait worse than that, at least you can get data out of an airplane black box. Perhaps they are more like black holes - in goes data, something magical happens, and out comes something valuable for your customers and your business, but it's impossible to peer in and see this magic.

If you use a comparable technology that was highly disruptedive and had huge second-order effects, like the invention of the car, you can start to see why this is a problem. Vehicle technology, like the combustion engine, from the very early days, was understandable, creating the entire mechanic and automotive repair industry. How an engine works is taught in schools, and most people get the basics. Algorithms are not like this at all, in fact, they are the opposite, it’s a technology that only a very small group of people know technically how it works, the rest of us get a high-level understanding, and most companies buying pre-trained algorithms are sold business outcomes instead of an understanding of what the underlying tech is doing. This is because the technology itself is beyond our own human capacities to understand the logic and micro-decisions powering the models at scale. Most companies won’t have the ability to compete in the algorithm economy, and the few that can get to direct how the majority go about it. Links: Volcano Engine. TikTok growth. Algorithm overview for TikTok and Instagram. CB Insights: Unicorn company dataset. Cornel University on model extraction.

🛒 E-commerce is becoming ubiquitous. Have you ever heard of Shein? You probably should, it is one of the most mysterious e-commerce companies out there, but by far is the largest fashion retailer on the planet. Dubbed as the “Tiktok of e-commerce” this is another Chinese entrant in the market which has tripled Its valuation from 2019 to 2020 and is valued at about 15 billion. The brilliance of this company is the speed at which it has adapted to a new environment of selling on the internet, one of ubiquity, ephemerality, and frictionless spending, or what Shein calls “real-time fashion.” The pandemic shut down brick-and-mortar stores, which pushed the majority of consumers online, which then accelerated e-commerce innovation and one of these impacts is the integration of shopping into every single platform, from Facebook to YouTube and even search.

This is due to what I call Moore’s law for consumer behaviors, it’s never been easier to buy something online (back in the early 00’s I used to have to dial a phone number and hand over credit card details to buy software), but as technology closes the friction gap to buy, people also increase their expectations, and will take issue that they have to click out to an external website to buy something. Social media companies like Facebook have recognized this, as a big chunk of their advertising business is comprised of e-commerce retailers. And after collecting data for more than a decade, Facebook is realizing that people would prefer to buy where they already are, taking people to an eCommerce website reduces time-on-site metrics, and the majority of the buying decisions are increasingly made before even hitting a webpage. This is why companies like Shein are so successful, e-commerce competitiveness is moving away from what you can do on your websites and email, to how you can integrate shopping everywhere your customer already is. Links: Big tech and e-commerce. The mystery of Shein

📈Chart Of The Week

🌍 How much time are we spending online? Since the pandemic forced many of us to interact with people primarily online, our browsing behaviors have also changed. Since 2017, we’ve added an hour on average per day to our digital lives, and in some nations like the United States, it’s almost 5 hours per day, more than half of an average workday. This puts perspective into how marketing is done online, knowing that about 3 - 4 hours per day is the real attention opportunity. Link

📰 Latest Developments

Amazon is blocking Google FLoC. The company has made the decision to remove all cohort-based tracking on Google browsers into the future, including all of Amazon’s sprawling web properties and acquired companies. In a lot of ways, the third-party cookie was an open-source way to track people. As it goes away, the platform tech companies will silo their own properties and online tracking will mostly become a power play with the few. That’s why Amazon is saying no to FLoC, without cookies the company will become one of the most important places to do digital advertising. Link

Iterable raises $200 million. The company is now valued at $2 Billion, after their series E round. Iterable is an interesting contender in the marketing platform space, offering all of the garden variety tools like cross channel targeting and ML-powered personalization. Their strategy is to take the features of last decade’s MA platforms and make them really useful and stable. In our fractured marketing platform economy right now, it’s not a bad idea. Link

Big tech and voice. This week two things were announced. This first is Spotify’s Greenroom, which is basically a Clubhouse clone, but more focused on events and artist interviews instead of individual creators. Spotify’s use case for voice chat is the one that makes the most sense so far. Facebook also announced a Podcast product that links RSS feeds with their newsfeed to distribute your content. Clubhouse has become a template for big tech to copy, and podcasts are increasingly becoming a platform-dependent format. Everything feeds into DAUs. Spotify. Facebook.

📚 Reading

Email is now a platform strategy. Sometimes the TMW newsletter lands in Gmail’s promotions tab, most of the time it lands in the updates tab. The open rate difference is about 10%. The decision of where my email lands are in the hands of Google (mostly), and the data I get back on who’s opening my emails will soon be in Apple’s hands. An interesting perspective on email marketing, and why it mostly belongs to big tech now, and how it changes the ways in which you approach it. Link

Digital experience: orchestrated, not managed. When you take a step back and think about the digital industry, almost everything we design and create content for is based on the browser. This piece from Preston So, challenges this notion, by suggesting that content frameworks need to change and adapt for the increasing ubiquity of voice-first devices and the increasingly diverse ways in which we experience things online. That’s why digital strategies need to move towards orchestration across these various experiences, rather than simply management. One is propagating the status-quo, the other is leadership. Link

Curation as a cure. There are three main ways content hits our eyeballs on the internet. The algorithm (social media), the search (Google), and the curation (a friend sends you something, like a TMW newsletter 😜). This thought piece talks about your intellectual life as a collection of knowledge assets, that are inundated with irrelevant, or bad information, like the 150k emails that are sent every minute on the web. The article’s case is that curation from trusted leaders is the highest quality way to access important information to guide your decisions, investments, and ultimately your career. Link

🔢 Data & Insights

The state of the freelance economy. The first annual report from Contra is an interesting perspective on how the freelance digital economy is changing the future of work. About half of freelancers work less than 30 hours a week, with the majority of projects belonging to marketing and social media categories. This is probably the most well-design analysis piece I’ve ever seen. They must have some good freelancers. Link

Venture capital in 2020. A long but interesting report on where venture capital is being allocated over time in the US. Seed investing has been one of the biggest growth areas in attracting VCs, with the majority of capital being allocated to healthcare and software industries. Link

The long slide of the global population. There’s a statistic in this NYTs piece that talks about the decrease of new births: It’s likely that by 2050 we’ll see more deaths than births across all nations. We’re having fewer babies than any time in the past century, and this will drastically impact how marketing is done and how brands will be positioned for a population of people where the majority will be over 50. Link

💡 Ideas

What it takes to be a top 1% Podcaster. There are currently 2 million podcasts out there, 90% of these don’t make it past episode 3, and for those that do, 90% won’t make it past episode 20. To be in the top 1% or about 20,000 podcasts, you just need to get past episode 21. Link (Source: 54.32)

Choosing a north star metric. In almost every enterprise marketing or digital team, there’s this concept of a “north star” which is basically the end goal the team has agreed they are working on. It’s supposed to focus attention and effort on the things that matter. Here’s an interesting guide to choosing north star metrics for growth state companies. Link

The regulatory sandbox. This idea fascinates me. Governments have been disastrously slow to regulate tech companies, and about a decade too slow when you look at companies like Facebook and Google. This idea focuses on collaborating with innovative companies to co-create government regulation and improve the competitiveness of new-to-market entrants. This is interesting because 1. Government can get ahead of innovation to craft policy and 2. Tech companies get a chance to be involved in policy decisions from an early stage. Link

✨ Weird and Wonderful

VR Ads. Facebook is experimenting with including ads in VR experiences and games. It kinda makes sense, they’ve been on an acquisition spree over the past three months, acquiring and investing into VR tech and the gaming industry more than ever. Someone’s going to have to pay for all this “innovation” and Facebook wants it to be advertisers. TNW calls it a "fully immersive capitalist hellscape." Link

The very hungry millennial. I love reading the very hungry caterpillar to my daughter. Someone made a millennial version of it and replaced the food items with D2C brands. It’s a tongue-in-cheek foray into what the internet is doing to the FMCG category. Link

Dream targeting. Apparently, a global coalition of sleep researchers are very concerned with the potential of tech companies to invade people’s dreams with targeted ads. You cannot make this stuff up, in the open letter they are literally saying this - “Our dreams cannot become just another playground for corporate advertisers.” Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.