TMW #049 | Unbundling advertising, the platform problem, and the state of spam.

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

There are two versions of TMW, the full version for subscribers and a 50% version that's for everyone. You are reading the 50% version. Sign up to get the full version delivered every Sunday for this and every TMW. Learn more here.

👋 Hello and welcome to new subscribers from Canada, Romania, and The United States!

Last week I mentioned that today I’ll be sharing The Martech Quarterly review, however, due to a couple of scheduling changes (and a fresh lockdown in Australia), I’ll send that one out next week.

For now, here’s TMW #049. It’s a big one. So get ready.

This week I look at:

- Unbundling online advertising. Half of all global online ad revenue is controlled by five companies. Can alternatives compete?

- The platform problem. There’s a myth in Martech that the larger vendors offer more stable solutions and support. That’s not always the case.

- The state of spam. Email as a channel is so massive, there are hundreds of billions of spam emails generated each month.

- 15 + links including autonomous fried chicken wagons, an AI for design feedback, real-time advertising for doctors, and the value of privacy.

✍ Commentary

📦 Unbundling online advertising. In 2020, the pandemic forced one of the largest shifts in advertising history. That shift was from physical to digital. And now as most countries are regaining a sense of normalcy, online advertising has not only grown but continues to literally eat every other category. This week Group M delivered a comprehensive report on the growth of digital advertising, which is set to increase by 15% or about $95 Billion in 2021. Compare this with outlooks for other channels such as TVC ($7B), Audio ($4B), and outdoor ($5B) and you’ll quickly see what I mean - digital advertising is significant, and will continue long after COVID-19. While this huge market is only increasing, are there opportunities to unbundle how it’s done and who it's done with to create more economic opportunities and level the playing field? Well, the answer is complicated based on which market you're in and how large you already are.

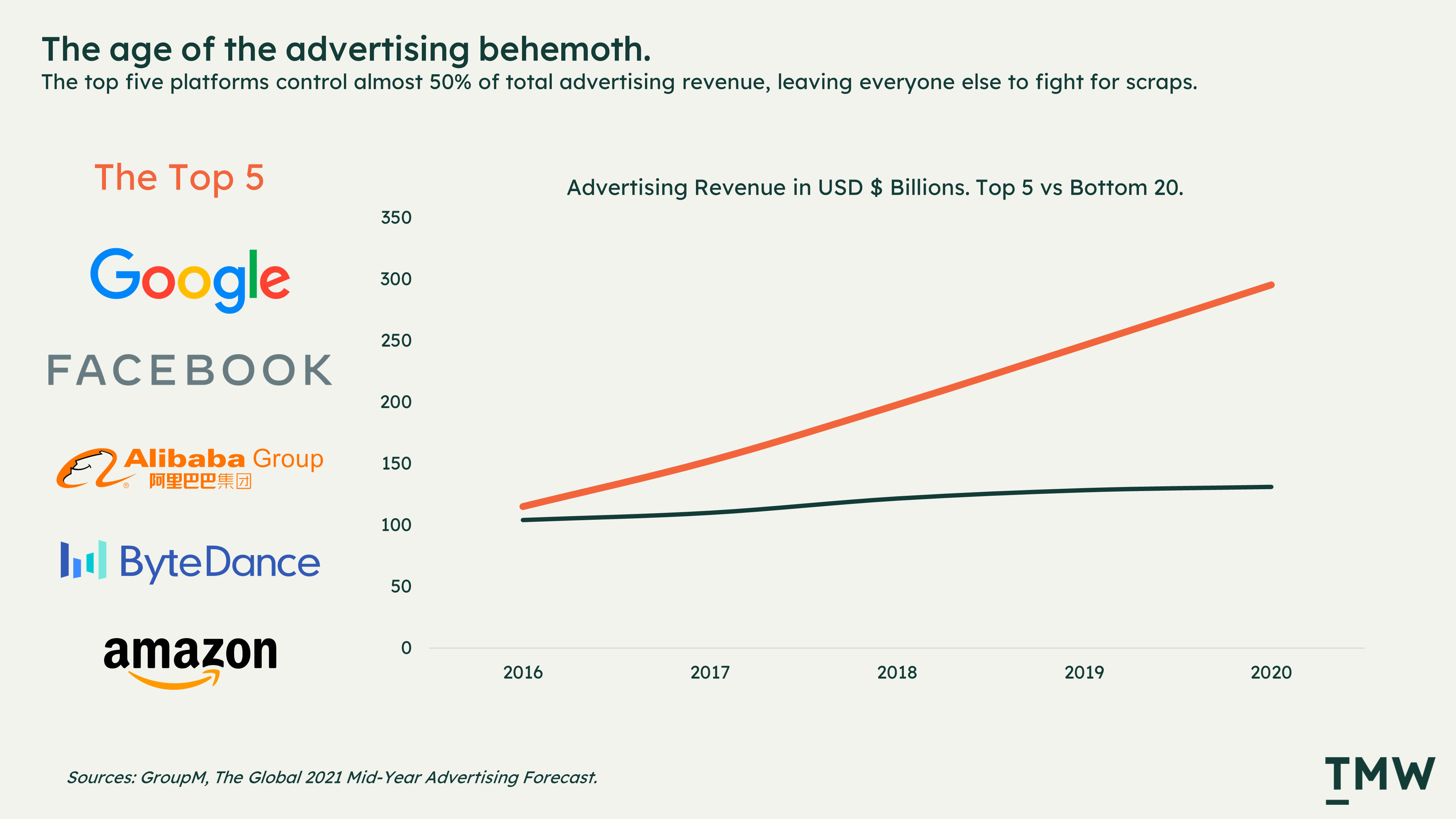

Let’s look at some stats. In 2020, of the 25 largest digital advertisers, the top 5 control about 46% of the total advertising revenue, about $296 Billion, or the entire GDP of Colombia. Every. Single. Year. You can probably guess who’s in the top five: Google, Facebook, Alibaba, Bytedance, and Amazon, five companies that have collectively grown by about $180 Billion since 2016. This is the great bundling of advertising. The bottom 20? They’ve only grown by $25 Billion over this same period of time. Now, this is obviously a problem as, in some of the areas of business, like social media and search, a lack of competition leads to a bad deal for media buyers in the long run and more importantly increasing anticompetitive behavior.

The size of the market should increase the number of new entrants to take some of that share away. However, when multiple advertising avenues are bundled under one company, as when Google offers video, search, display advertising, they effectively own a massive share of eyeballs on their essential services, which makes it very hard for new companies to compete in this way. These large companies are so large because they have significantly augmented how people use the internet, and in some parts of the world companies like Facebook are seen as the internet. But the future of advertising requires us to unbundle.

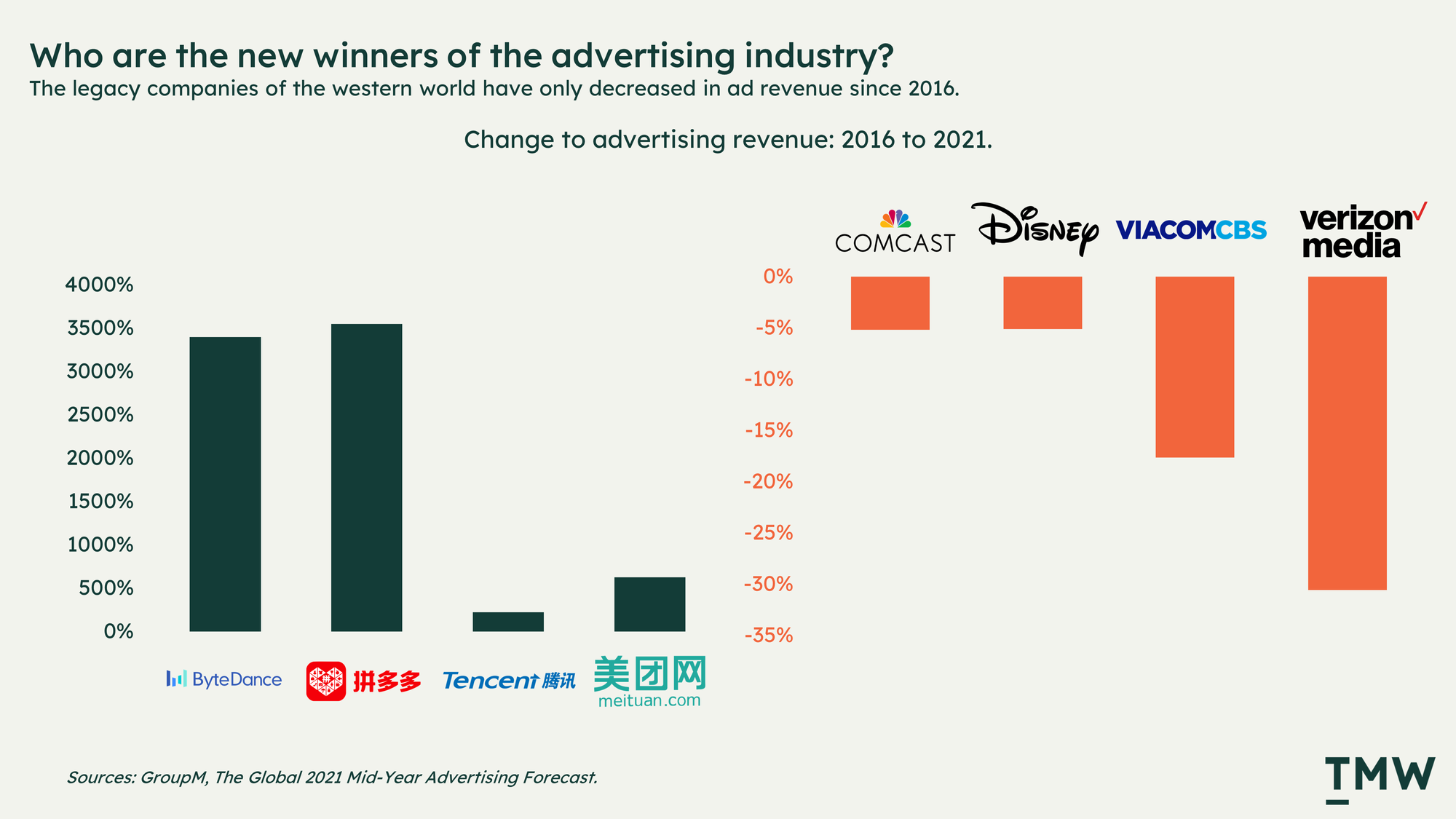

What’s interesting is that if you look at the companies that have grown in advertising revenue since 2016, one trend quickly emerges and that’s China. Bytedance, the company behind TikTok is in the top 5, yet has grown advertising revenues by 3,400% since 2016, and the other companies like Pinduoduo, an online marketplace also grown by 3,550 despite not recording any revenues since 2017. Looking at mainstream media companies like Viacom and Warner Media, the differences are stark, the story isn’t growth, the very very opposite.

Yet, while Chinese platforms are quickly growing in ad revenues, they are all either marketplaces, social networks, or gaming technology companies, which suggests that online advertising will continue to belong to those who aggregate content and products rather than those who create it. This is a form of unbundling. Over the three years, Bytedance’s TikTok has unbundled social video advertising away from Instagram and Youtube, while Amazon is taking search advertising revenue from Google. And although alot of the disruption is coming from the world’s largest platforms, this does mean there are more options for marketers and advertisers out there.

Outside of the major players in this space, there has been an emergence of advertising networks across unlikely verticals like delivery services such as Instacart launching their own advertising services and retailers like Walmart and Target building first-party advertising services and even services like PlayerWON are launching which are the first of its kind ad network dedicated to the gaming industry.

All of these new investments into ad networks are perhaps not unbundling the ad market that the top 5 own, but rather finding new opportunities to offer online advertising to brands who have relied mostly on the mega-platforms for their online advertising success over the past decade. This means that the work that goes into researching, validating, and building commercial partnerships with advertisers will only increase in complexity. One of the appeals of working with one of the top 5 is that most services are all under one roof, it’s operationally more straightforward, compared to say 20 smaller partners with various ways in which measurement and content are executed.

For this reason, most brands prefer to deal with the behemoths as they collectively own the majority of eyeballs, however, there will always be niches that make sense for companies that want to compete in ways that others aren’t. The unbundling may happen sometime in the future, but for now, the future belongs to five of the world’s largest internet platforms. Links: Group M report. Report analysis: PressGazette. The Attention Revolution. The ad market belongs to everyone now.

🤷♂️ The platform problem. One question that is constantly asked by digital and marketing teams is whether or not they should invest in all-in-one platforms like Salesforce or Adobe that bundle together a number of services and offers customers an “integrated cloud solution.” And what’s interesting about this question is that a major factor for deciding to go down the cloud path is the risk it carries compared to investing in individual point solutions. As the story normally goes, the larger platforms can better support the longevity of the technology, while also providing better support and better data security. And while all of this is true, an interesting perspective this week from Real Story Group highlights that this might not be the case. Large vendor tech companies are always sunsetting products, and due to their size and complexity, there are less incentives to support customers in the long term. There are a number of examples of this, such as platform companies sunsetting technology or ending customer support for it, or in some cases, these platforms will acquire and offer two CDPs to customers only to shut one of them down over a period of time. And so perhaps best-of-breed companies can better support customers and offer a kind of longevity that large platforms cannot?

One example of this is the eCommerce email marketing platform, Klavio. Positioned for mid-tier eCommerce businesses, the company has grown from a simple eCommerce solution (that didn’t even offer email initially) in 2011, to a giant in email marketing valued at $4.1 Billion. This company fits squarely into a best-of-breed point solution for a specific niche, yet has outlasted many products that the major platform providers have offered over the last decade, which goes to show that best-of-breed companies can be stable and offer long-lasting solutions, and support. The question of best of breed vs integrated cloud solutions in the enterprise conversation continues to be a challenging one. However, it’s clear that there are likely more product failures in the integrated cloud than best-of-breed companies going out of business and it’s important that for both, specialized staff training and dedicated processes are needed to make these technologies successful. Links: Big vendor risk. The story of Klavio. The frankenstacks.

📈Chart Of The Week

📩 The state of spam. Talos, an arm of Cisco’s research department tracks global cybersecurity issues and things like domain reputation and email spam. What’s significant from their research is that more than 84% of total emails sent are spam, which equates to 249 billion emails in the last month alone. The sheer scale of spam is one indicator for the popularity of email as a channel and is probably why Apple is limiting tracking to some degree. Link

📰 Latest Developments

Amplitude files IPO. Its last funding round lead by Sequoia valued the business at around $4 billion, and now the company is going public. Amplitude solves product analytics problems in ways that are tightly integrated into a bundle of services for experimentation, customer sentiment, and web analytics. It’s one of the few companies out there that have doubled down on a very focused analytics niche and have won. Link

Apple enters BNPL. In a not-so-surprising move, Apple is planning to offer interest-free installment payments along with Apple Pay and the Apple credit card. In one fell swoop, the company disrupts incumbents like Afterpay by offering something no other company can - seamless integration into the Apple ecosystem. Link

The week in regulation. Google has been fined 500 Euros by a French regulator as the company has fallen out with a trade negotiation on compensating news publishers in the country. This is similar to what we’ve seen in Australia with the news media bargaining code. The difference is France’s hard-line stance, enforcing a 900k fine for each and every day Google displays French news content on its platform. Outside of this, South Africa and the US state of Colorado have enacted their own privacy protection regulation taking similar approaches as the GDPR. Customer privacy is fast becoming a matter of legislation and law around the world. Links: Google. South Africa. Colorado.

📚 Reading

The eventual conclusion to the free internet. Noticed more brands offering a monthly subscription lately? How about more paywalls guarding content? About twenty years ago, companies like Napster and Google created a precedent that most things on the internet should be free. Now that more companies are expecting people to pay for content and media, how long will it take to reverse this expectation that’s as old as the internet itself? Link

When metrics are bad for business. I’ve never worked with a marketing or digital team that does not have a sense of the metrics informing their strategies and roadmaps. But what if things like quarterly targets are not a good thing to pursue? Marketers have an obsession with conversions and revenue, few think about COGS or profitability. But, as Goodhart's law suggests, “when a measure becomes a target, it ceases to be a good measure” how should marketing leaders think about how they measure performance? Link

The impact of Google’s cookie removal delay. An interesting piece this week came from Tealium on the impact the delay in shelving cookies will have on marketers. Delaying cookies, while Apple and firefox will only increase privacy constraints over the next year will force brands to have to plan by browser type in how they will collect and use data for advertising purposes. Google’s running slowly to consumer privacy online, and it wouldn’t be such a big deal if the company didn’t have such a large browser market share. Link

🔢 Data & Insights

The disinformation dozen. A new report tracking COVID-19 and vaccination disinformation in the United States has a few surprising insights. They’ve found a staggering 65% of all anti-vaccine content can be traced back to just twelve content creators on social media platforms. Social networks are still just a massive experiment, and when you enable anyone on the planet to achieve scale with their ideas, anything can happen. Link

How much is online privacy worth? Not much according to a new research study into online privacy attitudes by the Technology Policy Institute. When respondents were asked about the cost of their contact information if they could sell it to a company, it’s about $3.50. For more sensitive information like bank balances or fingerprints, it’s closer to $10. There’s a whole missing piece in the privacy debate here, and that is there are multiple generations of people who lack basic data and technology literacy skills to comprehend what happens to the information they give. Link

Apparently, there are still millions who don’t use the internet at all. Working in this industry for some time now, it’s easy to see that digital is the new normal. However, a new report from Australian telecom giant Telstra and Roy Morgan suggests there are more than 2 million people who remain offline in the country. This is important as more mass consumer brands have to balance the expectations from two very different generations, and leaving people behind is never a good look. Link

💡 Ideas

Take a long-term view on data collection. Alot of what’s happening to cookies and app tracking is causing a reactionary approach to collecting first-party. The problem is that most data collection takes years to accumulate, and even longer to prove that it is valuable using metrics like LTV and retention. Taking a long-term view on data collection is something that’s sorely missing in the industry. Link

3M’s visual design tool. The company known for its sticky tape has created what’s called VAS. It’s an AI-powered feedback system that analyses design and content based on the first 3 - 5 seconds of viewing it. It’s supposed to help design teams validate designs before “real” humans actually see them. Link

Shopify inbox. A new product released from Shopify is a messaging service that allows customers to get shipping updates and send customer service requests and handle sales enquiries. It’s a smart move for Shopify, owning the platform millions of retailers use, means they can also own more the customer experience. But what happens if a Shopify merchant wants to move on and many of their customers are using Shopify inbox? New features are great, platform lock-in isn't. Link

✨ Weird and Wonderful

Autonomous fried chicken wagons. The future was supposed to give us flying cars, but instead, it gave us KFC selling fried chicken out of 5G enabled autonomous vending machines in China. Link

Facebook’s failed brain interface. The company was working on hardware and software that would allow you to control a computer directly with your mind. They made some progress, but have shut down the commercial side of the project. The research will continue, and it’s kinda scary if Facebook actually succeeds with this type of technology. Link

Real-time targeted advertising. The audience? Doctors. This technology seems to be on an ethical boundary in the way it works. The software allows pharmaceutical businesses to target ads to doctors within medical software as they consult with patients. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.