TMW #050 | Martech’s money market, the anti-identity movement, and our reliance on AI

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

There are two versions of TMW, the full version for subscribers and a 50% version that's for everyone. You are reading the 50% version. Sign up to get the full version delivered every Sunday for this and every TMW. Learn more here.

👋 Hello and welcome to new subscribers from Australia, The United States, and The United Kingdom!

It’s good to be back after last week’s quarterly edition. I do hope you enjoyed it.

Before we jump into this week, I’ve released a new podcast episode. It’s called “the enterprise problem.” Anita Brearton and Sheryl Schultz, cofounders of CabinetM share on the enterprise technology landscape. This interview pairs nicely with today’s commentary. Listen

This week in #050:

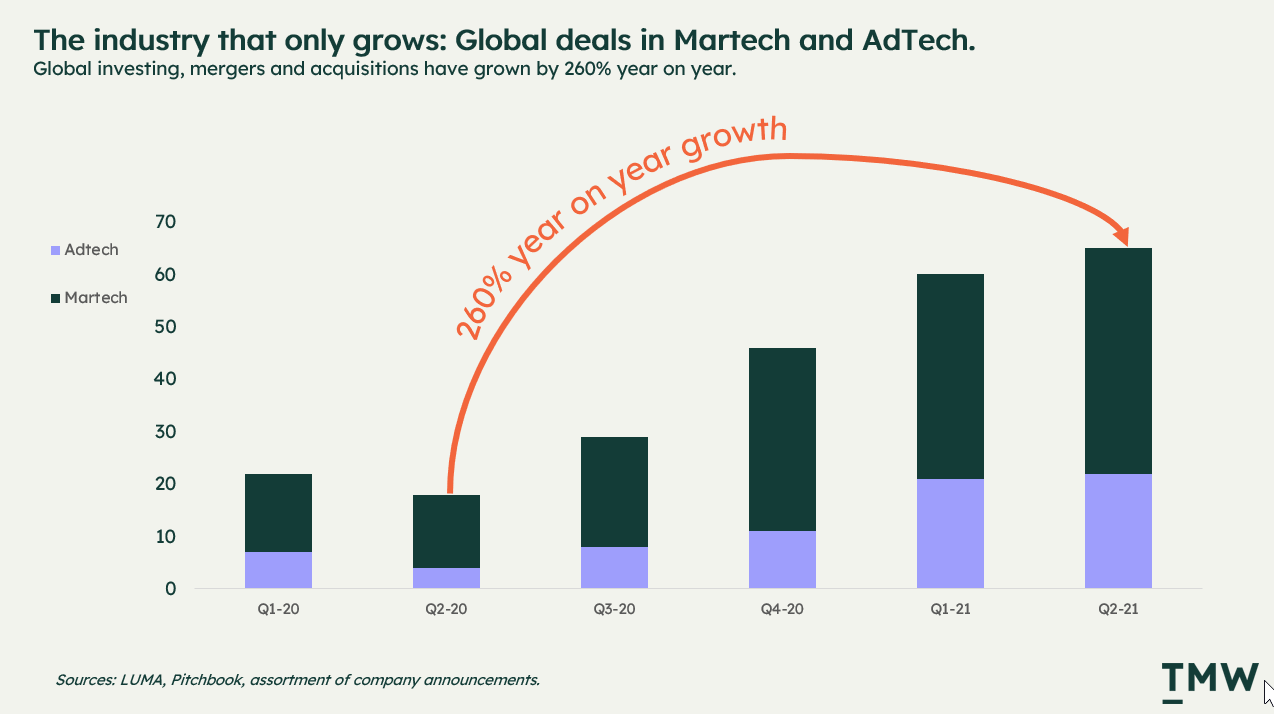

- Martech’s money market: Year on year, investment into the industry has grown by 260%. I thought Martech was supposed to slow down? Quite the opposite.

- The anti-identity movement: The way we collect customer data is changing. Maybe there’s a place that goes beyond privacy, and offers customer anonymity instead?

- Our reliance on AI: Is AI in analytics going to be a significant value creator for business intelligence or just another money pit?

- 15+ links including Shopify for data, tech salaries, Bubble’s $100m raise, an argument against growth teams, and why China is smashing its own tech industry.

✍ Commentary

💸 Martech’s money market. There’s often one question rolling around in my mind - is the marketing technology industry slowing down? Is it, as New Found Glory once put it - “all downhill from here?” The past two decades have seen significant growth, and there are now more than 15,000 Martech companies. Like any saturated market, surely things have to slow down at this point? Well, my answer for you is quite the opposite. There’s one data point that’s useful when it comes to tracking the growth of Martech and that’s the money market - the amount of capital pushed into the industry from VCs and private equity firms. And by this data point, marketing technology is still in a phase of rapid acceleration.

Here are some stats. If you compare the deals made in Q2 2021 to 2020s, Adtech and Martech have grown by over 260%. Of this, 75% of public Martech companies outperformed the S&P 500. Over $12.8B of identified capital has been deployed into the industry just this past quarter. That’s the equivalent of adding the value of two Hubspots to the market every three months. Three-quarters of raised funds went to just 41 companies, all of which raised more than $100 million each.

So, why is Martech’s money market only growing? I’d posit that there’s a couple of considerations at play globally that has triggered a whole new phase of sector growth.

The forced experiment -- This time last year was Martech’s first real slump in capital investment and now we’re bouncing back. The pandemic became a forced experiment in moving many legacy brands to seriously compete in the digital space, and as we all know marketing technology products are really primed for non-technology-focused businesses. Martech scratches the we-can’t-build-consumer-technology itch with offerings that are increasingly easy to implement and prove their value. As more people globally prefer to use a combination of digital and marketing channels when they interact with brands, the capabilities needed for this brave new world come from our corner of the universe - Martech.

Tectonic shifts in privacy and tracking -- The demise of cookies, Apple’s aggressive shutdown of tracking, and an increasing consumer wariness over privacy, Martech, and Adtech companies have received plenty of finger-pointing from the public, followed by quite the beating. But instead of letting these changes break existing companies, it has refined the value proposition and has become a catalyst for innovation - the refiner’s fire if you will. Facebook, essentially an Adtech company that happens to offer a social network hit a $1 Trillion market cap recently, they aren’t slowing down. And there are new ways to mitigate privacy concerns, like UID 2.0, and the awareness of the value of first-party data is hitting all-time highs. As they say, when life gives you lemons; make lemonade. The shifts in privacy are driving more innovation and value creation than less.

Emerging business models -- Martech is looking much more like consumer technology these days. Companies like Snowflake and many others are moving away from ARR-focused lock-in contracts for usage-based models, similar to AWS. I like to call this the “Uberification of B2B SaaS.” When I take an Uber trip, most of the time I don’t even look at how much it was charged to my credit card, and if you talk to any AWS system administrator, they would tell you that the company is insanely efficient in charging for services. These changing business models are catalyzing growth, squarely because the equation of usage = value seems to be working better for brands that demand that tech platforms play a significant role in their quarterly KPIs.

Martech is an increasingly stable market with an upward trajectory, in fact, I’d suggest we’ve really only just finished our entrées, the main course is yet to come. If you’re thinking about starting and funding a Martech company, it’s not a bad time to get in. VCs and privacy equity firms are embracing startups and scale-ups in ways we haven’t seen before, including plenty of hugs and high fives. Links: Luma Q2 market report, and analysis from Martech Alliance. Cabinet M Q2 Martech Innovation Report. Changes to the pricing models of B2B SaaS. Martech Podcast: Private equity and digital transformation.

❌ The anti-identity movement. What would the internet look like without the ability to track a person’s identity online, even to the most benign degree such as cookie or IP address? There are communities out there that are imagining a future where customer privacy will become a thing of the past. In fact, this future looks beyond privacy to something more interesting - customer anonymity. In the marketing and advertising world, the discussion around customer privacy has reached a fever pitch over 2021. This is caused by data restrictions coming into place and increasing regulation in consumer privacy that impacts big tech companies, but will also have second-order repercussions for average joe businesses that are collecting, processing, analyzing, and acting upon customer data. The status quo of free-for-all tracking is coming to an end.

Those who are altering this status quo are emerging mostly out of the blockchain and crypto community. This corner of the internet is offering solutions to anonymizing customer identity that may seem quite strange but with most things in tech, it only takes a few years for a nascent idea to become a commodity. In this case, the idea centers around “the billion user table” a way to change how people access services through decentralizing how people log in to apps. The concept centers on the public blockchain as a massive user table of the internet. By trading email addresses with a blockchain wallet address there are two problems that could be solved.

The first is identity, a wallet address could easily replace an email address or a phone number with new applications that could securely and privately manage communications between a brand and a user. We’re already seeing some of this happen with companies like Metamask, which offers browser and app extensions that integrate with a website to enable login with one click but don’t give any further information to the brand outside of the wallet address. The second problem is anonymity, a customer would be able to buy something, have it shipped to their house, or manage a return without ever giving any personal information other than a cryptographic address. It also allows for interoperability between apps - a world where all of your social apps reference the same wallet ID, and your followers are synced between platforms effortlessly. Your Instagram followers are also your followers on Twitter or your discounts can be redeemed by dozens of separate eCommerce retailers.

In this new age of privacy, ideas like the billion user table are worth considering. As the incentives are stacking up for customer privacy in new markets, the next wave could be anti-identity and pro-anonymity. Links: Billion user table. The blockchain and Big Tech.

📈Chart Of The Week

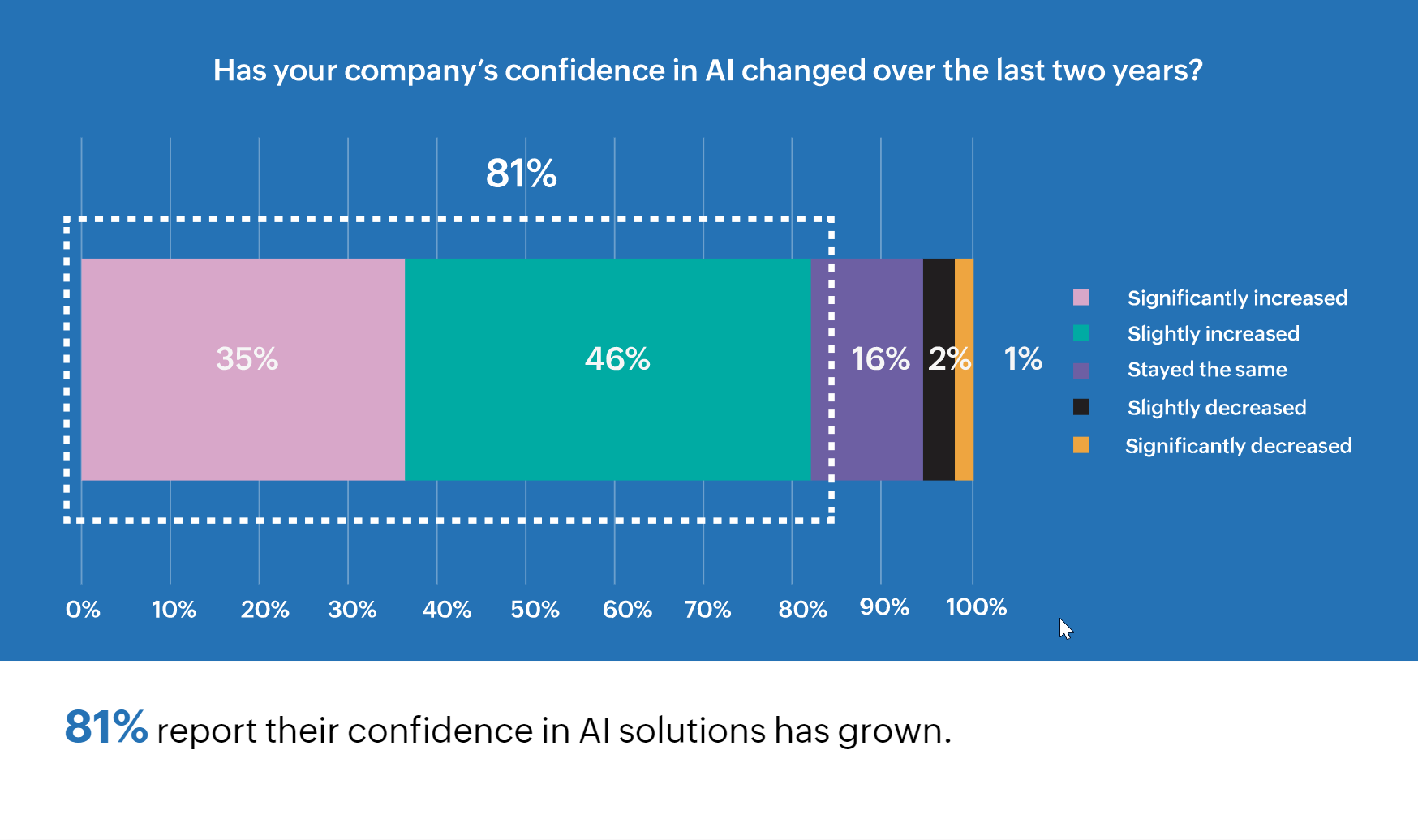

Our reliance on AI. New research from ManageEngine investigates changing attitudes to the use of artificial intelligence in the world of business analytics. In what they call “the double-edged sword” more than half of executive respondents from the US and Australia have said their AI-powered analytics initiatives will likely fail, yet 81% have also said their confidence in the technology has grown over the past two years. Report. Analysis.

📰 Latest Developments

Google’s ad rates. Google has risen the rates for international advertising. This is due to a digital services tax that is rolling out across a number of countries as a way to indirectly tax big tech companies. The only problem is that Google is asking the advertiser to pick up the bill. Link

Bubble raises $100M. Bubble sits right in the middle of the #nocode movement. The company is a SaaS platform that enables creators to build apps, marketplaces, and platforms with little to no programming knowledge. The company has been around since 2012, and its moment has finally arrived. Link

The New York Times is launching a Substack competitor. This is a brilliant move, the Times already has the brand and distribution access to millions of subscribers who’ve already forked over their credit card numbers. It will be interesting to see how this plays out when it comes to the staff/entrepreneur equation on the newsroom floor. Link

📚 Reading

Pricing is the Achilles Heel of the cloud. Every company is moving to the cloud, and that usually means paying by the bit for data storage and processing. AWS has one of the most interesting pricing models in the cloud space. This is a teardown of how it works and a strong argument that the pricing methodologies are a step backward in making the cloud more accessible. The cloud is the equivalent of renting a house, and more companies want to be happy with who their landlord is. Link

An argument against growth teams. “Head of growth” or “Growth Product Manager” or “Growth marketing manager” are all roles that we’ve become familiar with. The titles are self-explanatory, people whose job is to grow users or revenue. According to this article, there are a bunch of negatives in building a growth team. growth marketing is really easy to screw up, is way too tactical to get the attention of executive leadership, is very expensive to maintain, and growth teams are not flexible enough to address new goals. Link

Why is China smashing its tech industry? One the best deep dives I’ve seen into why China is dismantling the country’s most prominent consumer tech companies and imprisoning their CEOs. It has a lot to do with aligning the purpose of tech with the national cause and that means constraining innovation and shutting down threats. Link

🔢 Data & Insights

The exponential tech salary. Lockdowns, closed borders, and a timezone that’s removed from the rest of the world means that technology talent is hard to come by in Australia. It also means that salaries have increased by 30% in only twelve months. This is bad news for recruiters: It’s a buyers market now. Link

50% of time spent on Facebook apps is on watching videos. The pivot to mobile in the early 2010s looks much like the pivot to video now. A lot of this is stemming from Instagram’s copycat TikTok feature: Reels. US consumer tech companies used to set the precedent for online behavior, now it’s China’s job. Link

DAO landscape. This is not really hard market data, but more of a landscape snapshot of the DAO, otherwise known as the decentralized organization. There are now dozens of these companies of all different shapes and sizes. They are a new kind of company that is owned by a community and is often associated with a token that gives everyone a stake. Link

💡 Ideas

Zeitgeist moments. The Economist CMO on how taking advantage of cultural shifts has been the largest contributor to paid subscription growth. Link ($).

Shopify for data. An online store for buying and selling customer data called Narrative wants to be a place where digital marketers could buy data as easily as you could buy a pair of shoes. Link

A Futures Triangle for marketing. Pull of the future, push of the present, and weight of the past. A novel framework to build strategies around three important market forces. Link

✨ Weird and Wonderful

Gary Vee buys $3m NFT. In other crazy news, Gary Vee, now a major proponent of NFTs, has just purchased a CryptoPunk NFT of a monkey for $3 million in Etherium. There’s also a video of Gary video defending NFTs and it is the most intense thing I’ve seen in a while. Link Video.

Facebook’s next target: The religious experience. Sheryl Sandberg said in this opinion piece that religion and Facebook share the same purpose - it’s about bringing together a community. This is a fascinating deep dive into the world of religions online and how they are being augmented by big tech. Link

AI programs can now be patented inventors. A new ruling by Australian courts will allow artificial intelligence programs to be named as inventors or contributors in patent contracts. This means that one day, a lawyer could represent an AI program and serve you a notice for violating a patent. Welcome to a world where machines have legal rights. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.