TMW #063 | The SuperApp race, Adtech is alive and well, and Microsoft’s CX platform

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

👋 Hello and welcome to new subscribers from Germany, Australia, The US, and Spain! Know someone who loves comparing CDPs? Send them this link.

Here’s the week in Martech:

- The SuperApp race: The gap between commerce and media is closing

- Adtech growth: Despite all odds, this market is very much alive and well

- Microsoft enters CX: No one is better positioned to offer a CX platform

- Everything else: Privacy first programmatic advertising, innovation theater, the great reimplementation, the Google SEA report, the explosion of AI, transitioning to the blockchain, does data make us cowards? And app icon art.

✍ Commentary

The race to the SuperApp. We are living through a period of history where the world’s largest companies don’t offer essential services like food, water, or energy but rather facilitate the interactions needed for people to buy them. This is unique to modern history. Apple, Microsoft, Meta and Google, and Amazon are all trillion-dollar companies and all companies that facilitate these interactions. But among them, there remains a significant gap that none have filled - the SuperApp.

The SuperApp is a concept to explain what has been happening in 2021 when it comes to a number of high-profile acquisitions and mergers facilitated between transactional, media, and social companies. The trend points to the closing gap between who owns the payment and who owns the attention of the consumer as more apps consolidate and bundle into single points of media consumption, shopping, and socializing.

In 2021, the Intuit acquisition of Mailchimp, Square’s purchase of Afterpay, the rumored Paypal and Pinterest acquisition (that spooked the market enough to end it), and Affirm’s partnership with Amazon, all suggest a merging of where you shop and how you pay. Yet it’s not only these acquisitions that are driving the race.

PayPal has recently announced its plans to create a SuperApp by integrating a shopping channel within the core payments experience. Alongside this, most BNPLs are building features to offer discovery and social elements in the payments app. There’s been a huge amount of activity this year, and it’s only going to intensify.

You might be asking what is causing all of this. It partially has to do with the deep unprofitability of the BNPL sector and the efforts of these companies to hedge against disruption from the larger tech platforms.

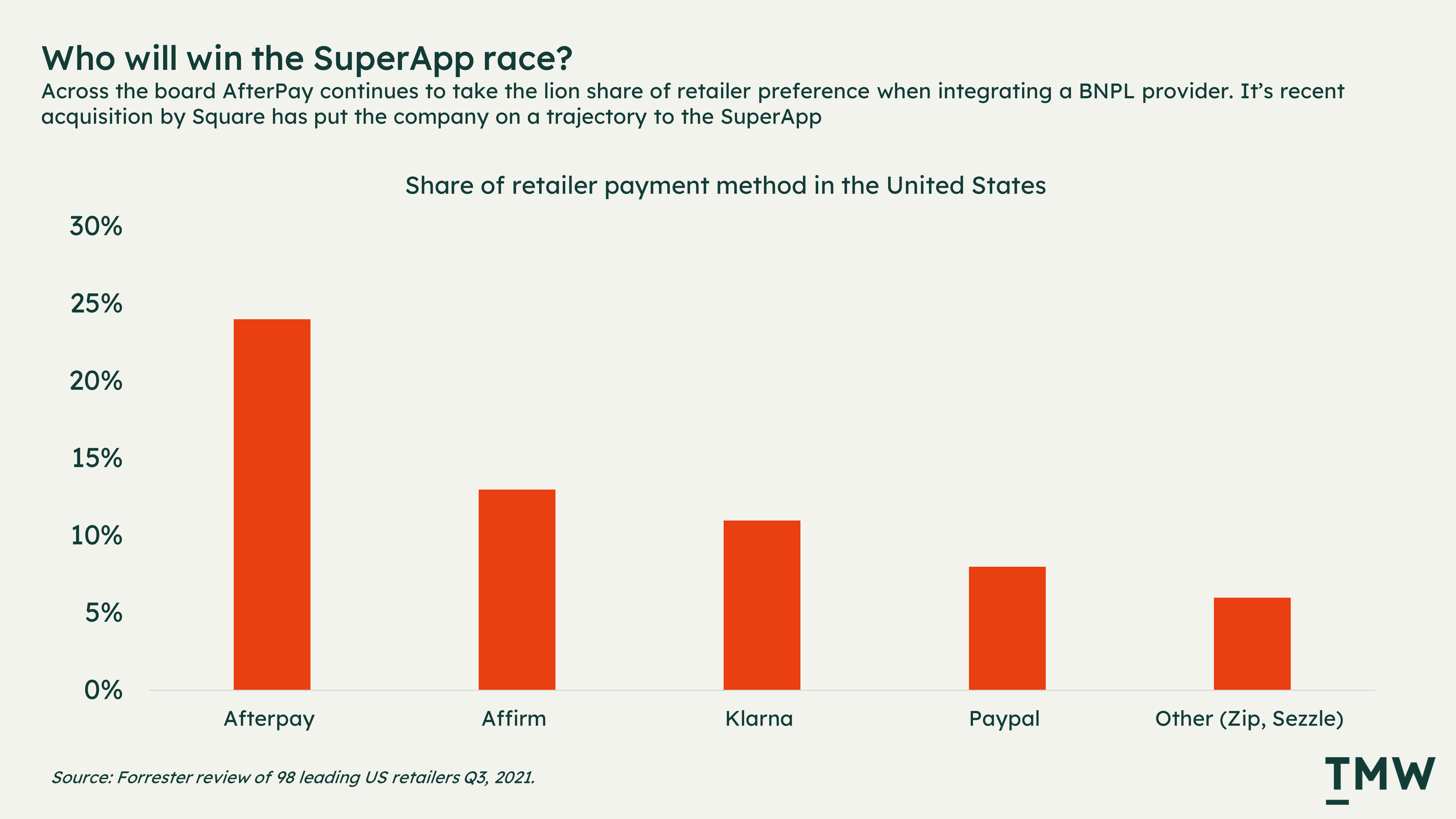

BNPLs need to be continually finding new customers to use their services, and what better way to do this than to offer a shopping channel? While in the US only 3% of eCommerce consumers actually use BNPL products, most in this category have seen significant growth over the past two years, with AfterPay taking the share of retailer sign-ups. The app that started the BNPL revolution.

It’s for this reason that a SuperApp strategy makes the most sense, if you can control demand and discovery and offer this as a value driver for retailers to partner then it makes distribution a whole lot easier.

It also diversifies marketing and advertising efforts. Instead of relying on Facebook or Google to generate traffic, a splintering of ad spend into a Paypal, Afterpay, or Klarna marketplace could help minimize the risk of relying on one big platform.

I was speaking to an eCommerce exec a few weeks ago on this topic. They described to me a situation where one of their colleagues recently went through the headache of having their Facebook ads account hacked in the lead up to BFCM. Facebook wasn’t helpful and it took weeks to reinstate their ad account, hemorrhaging revenue and negatively impacting investor relations. That’s what you call bad risk management and platform lock-in. Something no retailer wants but has to live with.

This is why the SuperApp proposition makes sense for consumers and enough sense for companies like PayPal to build towards it. Aggregating demand and supply are what gave us the world’s largest tech companies, and the ability to offer advertisers a way to target users based on their previous purchase history on Afterpay or PayPal creates a virtuous cycle of value for everyone.

The other side of the equation is the increasing acquisitions of media companies. SuperApps don’t have to only be the integration of social and eCommerce. I think about the recent acquisitions of The Hustle to Hubspot or The Infatuation to JP Morgan or MarketSnacks to Robinhood, a financial news company. Banking, B2B SaaS, and investing are three starkly different verticals, yet some of the largest players are all doing the same thing - acquiring media companies. All three examples are adjacent opportunities to control more eyeballs and mitigate platform lock-in from the larger tech monopolies.

The way I see it is there are three paths to the SuperApp; social media (Paypal + Pinterest), shopping (Afterpay + Square), or traditional media (Hubspot + The Hustle). All three have the same objective: Capture attention and generate demand.

No matter which way these companies go, the shift to SuperApp suggests that creating a business strategy that focuses on creating an engagement ecosystem where people can enter and don’t want to leave is imperative for companies planning their technology investments into the future. In other words, create your own demand, or live on someone else's.

In the end, not every retailer can become a media brand, and not every payments app can become a social network yet companies large and small are acquiring and building to these ends. You can call it a SuperApp, or you can just say you’re investing into the “experience economy” but whatever it is, the winners in the SuperApp race are the ones who figure out how to control both demand and supply on their turf and on their terms. Links: Scott Galloway on SuperApps, Paypal launches SuperApp, the BNPL market map, the rules of platform businesses, how apps will take over the shopping mall.

📈Chart Of The Week

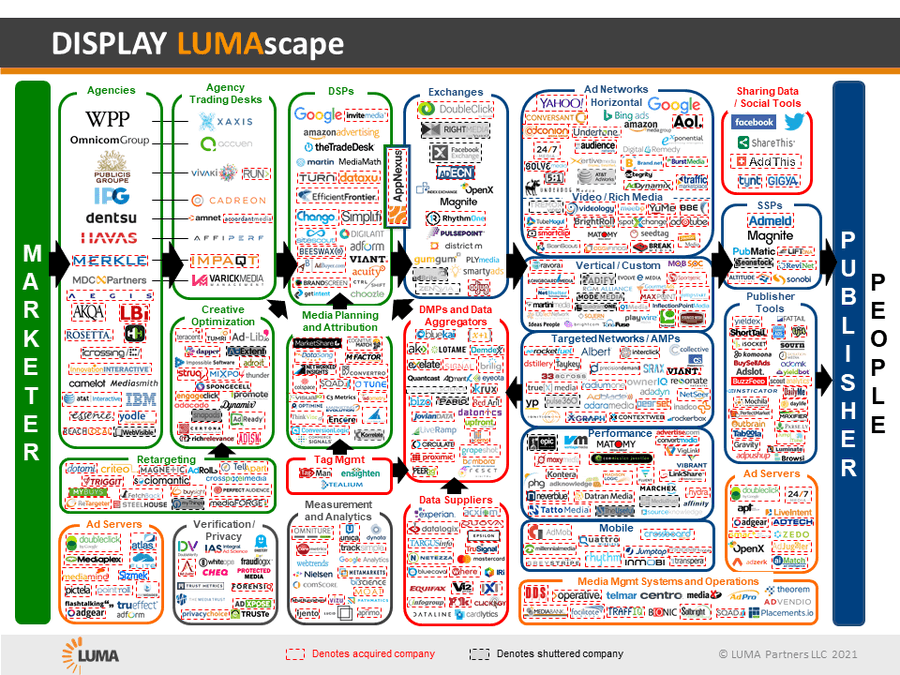

Adtech is alive and well. The 2021 Lumascape is one of the only charts tracking the deal flow progression of the marketer and publisher categories in the Adtech space. The sheer scale in which companies are attracting funding is impressive, and it’s only growing despite increased consumer aversion to online tracking. Every red box is a recent acquisition.

📰 Latest Developments

Microsoft’s CX platform. Earlier this year the company announced their marketing automation suite and now they’ve doubled down on cross channel marketing with the Customer Experience Platform. Microsoft has been sleeping on the Martech category, but they are very close to the enterprise. The brands already running on Azure would see choosing Microsoft over other CX platforms as a no-brainer. Don’t say I didn’t warn you. Link

IAB Europe has breached consumer privacy laws. The scale of this is phenomenal. The Belgian Data Authority has found the organization has breached the privacy rights of hundreds of millions of Europeans with its consent system originally implemented on the advent of GDPR. Under fire is the IAB-designed pattern for the majority of cookie pop-ups in use today. Link

Permutive: Privacy first programmatic? Offering a privacy-first pragmatic solution, this company announced a $75 million raise. The round was led by Softbank, which was also a major stakeholder in the Treasure Data CDP raise mentioned last week. I’m sure Permutive is built for privacy but how many ad networks are going to say they aren’t privacy first? Link

📚 Reading

Innovation theater. Legacy organizations are facing significant digital disruption across almost every vertical. Innovation is needed to compete with new, more nimble, and faster-to-market companies. Instead of competing, management consultants, hack-a-thons and team alignment efforts have created environments where most of the work is focused on talking about innovation instead of shipping it. Link

The great reimplementation. Adam Greco on the next wave of packaged analytics services like Google and Adobe and why most companies will be replatforming in the near future. Link

LinkedIn: The only good social network. Every single massive social network is under media and government scrutiny for all the bad things happening on their platforms. LinkedIn is completely different. At 800 million users, and with only one-third of revenue coming from ads, the company has created a platform where the incentives are aligned to the success of users. They even ship features to mitigate negative (and highly engaging) user patterns. Link

🔢 Data & Insights

Google’s South East Asia economic report. 40 million people have been brought online in the region this year, and 8 out of 10 are transacting online. Consumers are also purchasing from more services, increasing by 4 this year. For companies operating in the rest of the world, participating in the internet economy is not nice to have. Link

The explosion of AI. Companies that specialize in AI or ML apps continue to see surging growth over the last quarter. Unicorns minted in this space have increased by 59% year on year. Acquisitions are also on the rise, tripling compared to last year. AI is moving from an innovation state to a cost of doing business. Link

The new reality of social and search advertising. Common Thread has analyzed ad spend across 200 eCommerce brands or around $2 billion in online revenue. ROAS for Facebook advertising is down 10% year on year, and it’s only getting worse since Apple introduced IDFA and limited in-app tracking. Link

💡 Ideas

Transitioning the enterprise to the blockchain. Companies everywhere are starting crypto wallets, getting involved with NFTs, and accepting crypto payments. But what about legacy enterprise companies? What does it take to change entrenched financial infrastructure? Link

Does data make us cowards? The idea of being data-driven has a lot going for it. Validating ideas and decisions through data creates more certainty and confidence. But the contrary can also be true, leaders can easily dodge hard, and unclear business decisions by suggesting that they don’t have all the data. This breakdown of the dynamics between business leadership and analysts is a helpful read. Link

Grocery stores and the attention economy. Kroger, a large US-based grocery chain has announced a first party data powered ad network. Agency advertisers can plug in directly with their DSP network and run programmatic campaigns. The company serves 60 million US households. More retailers are going in this direction, to both diversify revenue and drive up more demand in-store and online. Link

✨ Weird and Wonderful

Everyone is a cyborg. A deep dive into how social technologies create fake intimacy and augment how people become friends. Link

The app icon book. Someone created a beautiful art book dedicated to iOS app icons. Link

The faces of open source. Who are the people that build and defend the open source technology movement? Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.