TMW #064 | Braze and next-gen marketing automation, the SaaS mountain and Nike enters the metaverse.

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

👋 Hello and welcome to new subscribers from Australia, Indonesia, Canada, the US, France, and the UK! Know someone who spends too much time in the Metaverse? Send them this link.

Welcome to another massive week for marketing tech. I saved over 150 pieces of research, articles, reports, and news. Only the very best 12 - 15 links made it in today's edition.

This week I sent a survey to a group of people who put their hand up to help shape what the TMW Plus premium subscription is going to look like. The results so far are super interesting, especially the last question. Interested in joining? Go here.

Here’s the week:

- Braze IPO: Braze went public and is now worth $8 billion. What did they do right?

- The SaaS mountain: Since 2017 companies have doubled the number of apps they use.

- NikeLand: This is a metaverse play, and it involves Roblox.

- Everything else: Passwordless unicorns, vendor marketplace fragmentation, consumer privacy by the numbers, the future of AI regulation, DesignOps, Shopify for NFTs, and reverse engineering recipes.

✍ Commentary

The Braze IPO and next-gen marketing automation. Email is boring, but also very effective marketing. So effective that there are now countless marketing automation platforms raising hundreds of millions of dollars to help marketers send more emails. Email is also ancient when it comes to internet standards, and needs to evolve.

Braze launched their IPO on Wednesday, raising more than $520 million and seeing the initial offering jump by 40% to $65 a share. The company is now worth $8 billion, making it one of the most valuable next-generation platforms in this space. Braze is a company that is trying to change the narrative around what an MA platform can do by introducing new channels while doubling down on the old, boring ones, like email.

What’s interesting about the company is the way they see themselves. The company was originally founded as Appboy in 2011 and then later rebranded. The founders had deep roots in app marketing, significantly influencing their product roadmap when Braze was born. Back in 2011 apps were still emerging and most platforms back then catered for desktop users. Braze's bet on mobile paid off and here’s why.

Bill Magnuson, the CEO of Braze said during the IPO launch that their outlook on marketing automation was built on a significant wave of changing consumer behavior towards mobile-first. If you look at their customer list this reflects the value proposition - their customers include Canva and LinkTree or companies that have heavily leveraged apps historically like HBO and Dominos.

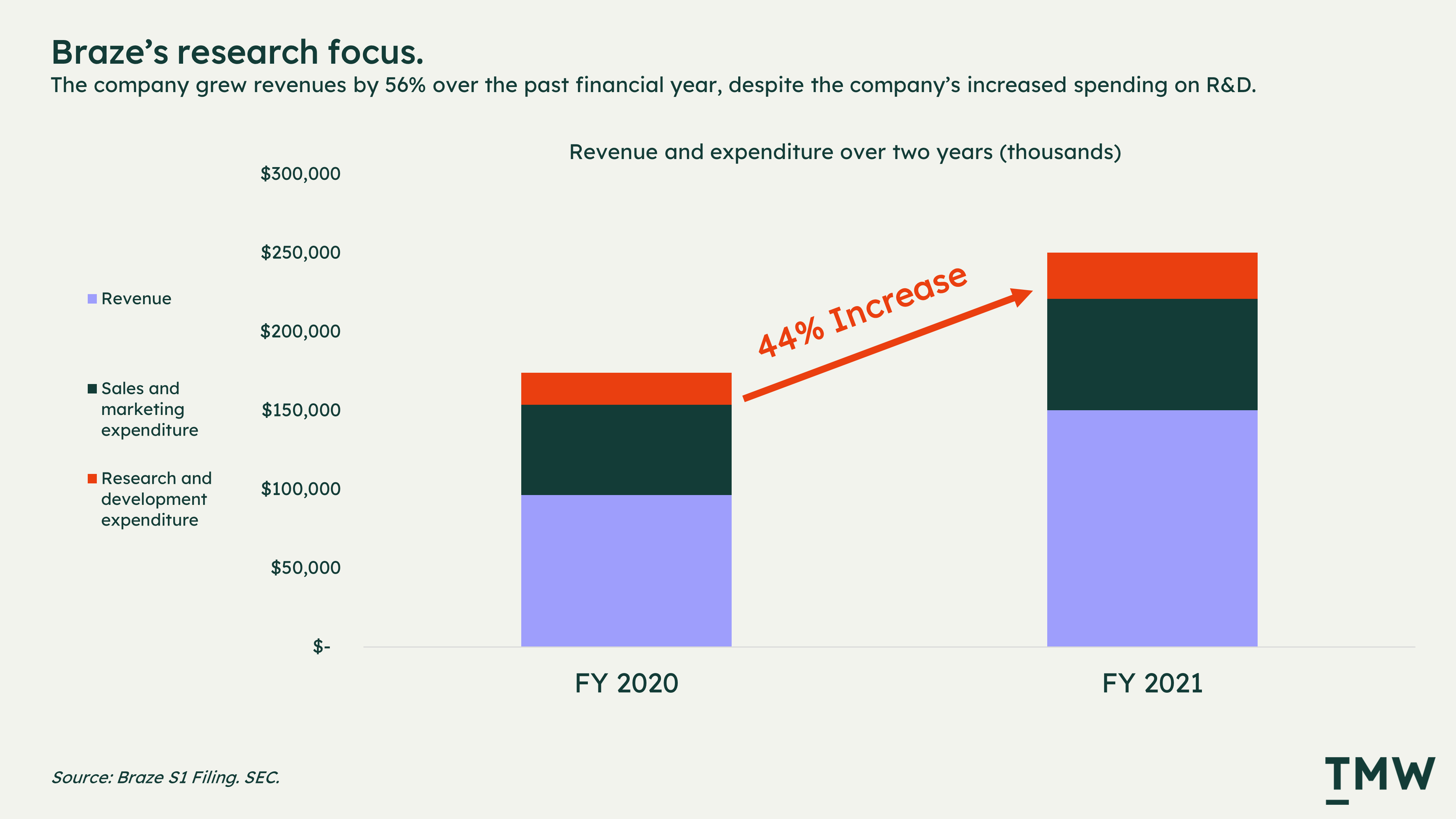

Braze has also been investing in research and development significantly. While revenues over the past financial year have grown by more than 50%, research spending has grown far more than sales and marketing activity. This tells me that there’s still plenty to do in the marketing automation space, purely because there are new channels being invented all over the place.

The shift from desktop → mobile browser → mobile apps has taken more than a decade, and the ways marketers have followed suit has taken even longer. When you go beyond web and email to dynamic in-app content, push notifications, and SMS the rules of engagement change. What also changes is how a brand can measure success and execute a content strategy. Being able to make content congruent across these channels is also a massive challenge (and headache).

That’s why platforms like Braze exist, it’s not really an email marketing system, nor is it an app experience platform like Swrve and it’s definitely not an SMS marketing tool. It’s…. Something else, what Forrester calls a cross-channel campaign management platform which really is just a way to indicate that these companies do more than just email.

In many ways offering channel execution across a variety of options in one platform is a key trait of the generational shift from the predecessors to the new kids on the block in the marketing automation space. When you see tools like this forming around a core idea instead of a key function, it’s usually a signal that there’s a problem in the marketplace that needs to be solved.

The core idea that changes a software company from a marketing automation suite to a cross-channel experience platform is inverting the primary value proposition of the tools. Braze suggests that marketers need to move away from channel-centric strategies to consumer-centric, but literally everyone already says things like that, especially in pitches. But there’s an interesting element to the idea that makes companies like Braze successful - they are saying that customers don't really care all that much about how marketers communicate to them but are more receptive to the when and why.

Should it matter that I get an email or a push notification when something I’ve been watching is on sale? Braze argues in the S1 filing that what’s most important is being able to trigger a message in real-time with the right message. So it’s more about how these channels deliver a message in concert across various channels.

I’ve yet to see a platform decide for a marketer that a push notification is better at a certain type of day, or with a certain type of message than email, and can do it at scale. But what would determine that kind of logic? Revenue? Customer Experience? That’s the interesting path that next-gen platforms could go especially as more channels are always being launched into the market. Personalization doesn't have to always mean content - it can also mean channel.

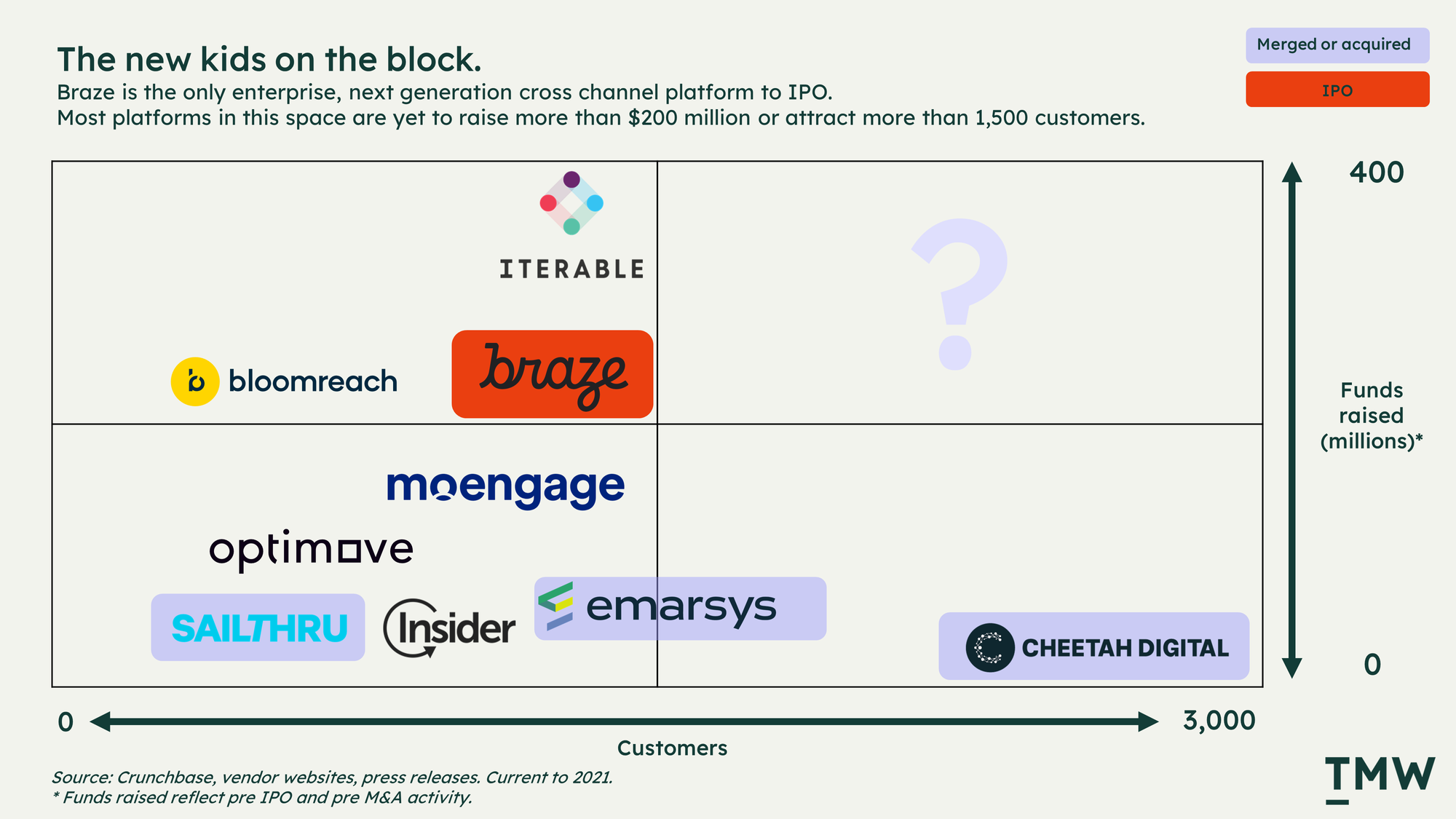

While the category is growing fast, the majority of these next-gen platforms have less than 1,500 customers and are raising less than $200 million. It’s likely that we’re not seeing many unicorns in this space because of the significant diversity of niche and industry. Insider and Emarsys focus on retail customers, while Sailthru is concentrating on publishers.

These next-generation platforms double down on a niche and solve the problems in these categories, a smart strategy for early growth but limiting later down the track. Braze, on the other hand, is one of the only companies in the category to go public, and at an $8 billion valuation, it speaks to the value of doubling down on an ascendant tech trend (mobile adoption) over a market vertical.

Braze and many other platforms in this space represent a significant change in how we understand owned channel marketing. From email marketing to cross channel and from desktop to mobile. And while the category is becoming very crowded the standout platforms focus on execution speed, congruency across channels, and embracing where the eyeballs are - mobile, but that might change in due course. Links: Braze announcement.Braze IPO analysis, Stock overview.Forrester Wave overview.

📈Chart Of The Week

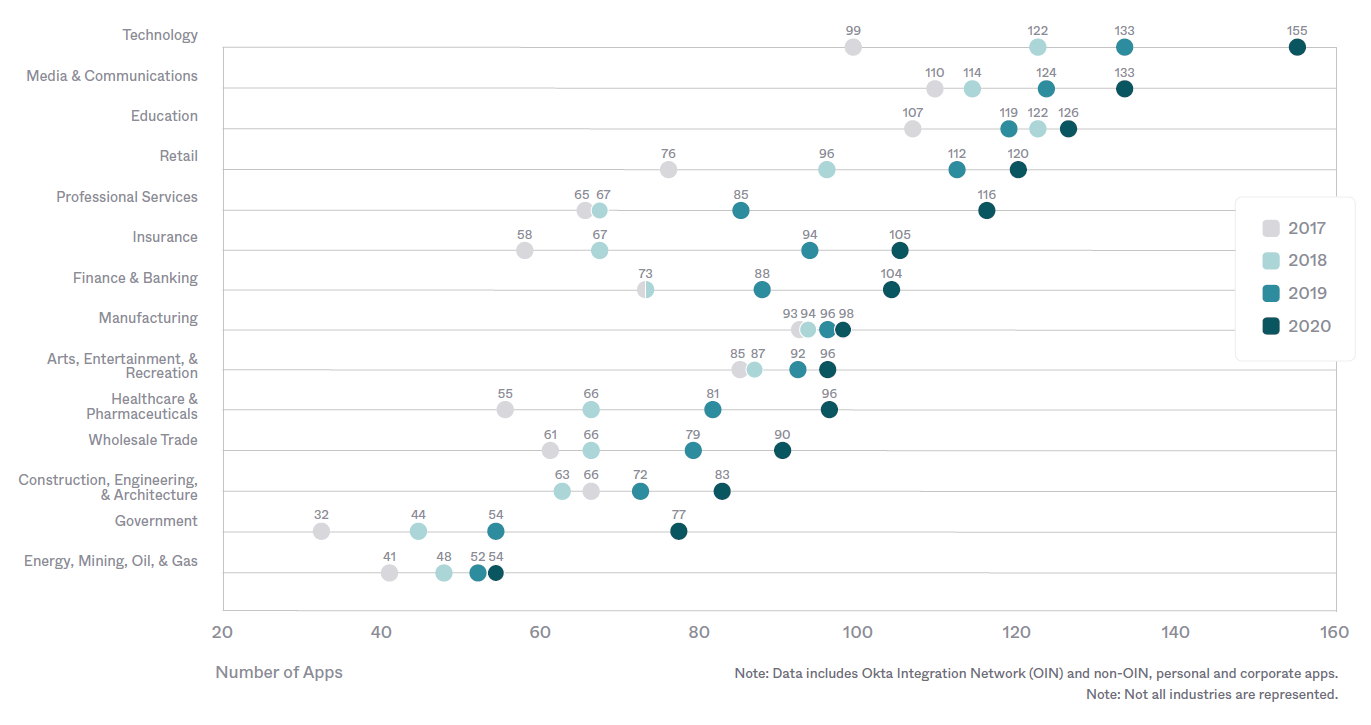

The SaaS mountain. The business at work report from Okta on the average number of apps per customer is significant in that in just three years most industries have seen a doubling of apps implemented. Retail is especially impacted moving from 76 to 120 apps over this period. Okta is the app you use to manage all the apps, but where is the app you use to integrate all the apps? Maybe BigOps is the answer. Link Big Ops.

📰 Latest Developments

NikeLand. Nike has announced a collaboration with Roblox as an early venture into the Metaverse. As Meta talks about the promises of the Metaverse, Roblox is simply shipping it. Nike is not really a surprising candidate for something like this. Their strategy is to enable customers to buy and wear digital versions of what they get in-store and leverage the overlaps with teen culture in the platform. What is surprising is that Dyson also announced a metaverse play this week (they sell vacuums), which is totally bizarre but also points to the mainstreaming of the concept. After all, marketers would probably not be doing their jobs if they didn’t experiment. Link. Analysis

Passwordless unicorns. Stytch, an API-first passwordless startup raised a series B this week and surpassed a billion-dollar valuation. The popularity of Passwordless login tech is driven by the increasing value of first-party data (which mostly needs people to log in for collection) and changing consumer attitudes to passwords. After all, saving passwords for 500 apps does get tedious. Link

Google’s digital futures initiative. Google is investing $1 billion dollars into the Australian tech sector focusing on research and enablement. The goal is to transition the country to a digital-first economy. In light of this year’s news media bargaining code, this is a clear step change in how Google wants to be perceived on the regulation front. The press release has no information on the digital advertising economy. Link

📚 Reading

The three-body problem of digital privacy. There are three gravitational centers of the privacy debates: Tech competition, government regulation, and public opinion. All three have the potential to significantly sway the future of how the internet works. This article looks at each and explains how there’s won’t be any clarity for the foreseeable future. Link

Vendor marketplace fragmentation. Is Martech consolidating or diversifying? It’s probably both depending on how you look at the landscape. Many of the technologies that you would consider “Martech” are being bought by the larger enterprise vendors, but for every acquisition, there are two more that are founded. Link

Forrester on the Metaverse. This is interesting because Forrester is not really in this business at all but has started to create content around it. This is most likely due to more brands looking into the concept (as opaque as it is right now) and are wanting to get involved. Link

🔢 Data & Insights

Consumer privacy by the numbers. Sequoia is saying that decentalisation and web3 are exploding right now due to the shifts in consumer privacy. 96% of iOS users chose not to be tracked when ATT was rolled out, in January tens of millions of people flocked to encrypted messaging platforms, DuckDuckGo the privacy-focused search engine recently surpassed 100 million queries a day. These data points are becoming a narrative around the end of online tracking. Link

The future of AI regulation. A comprehensive report done by YouGov and Clifford Chance has surveyed a thousand tech execs on how government and private bodies will react to the increasing capability of AI applications across all industries. Link

Creator platforms. Which platforms are facilitating the next wave of creativity online and more importantly monetization? Most creators don’t have the technical skills or couldn't be bothered building their own way to express themselves. Technology companies have historically played a role in enabling and extracting value from the creator and consumer of online content. Maybe this is about to change. Link ($)

💡 Ideas

DesignOps. MarketingOps, DevOps, DataOps…. This list keeps growing. What’s interesting about the emergence of an “ops” role for UX/UI design is that it reflects the increasingly technical nature of these roles and the separation of strategy and execution. Link

Shopify for NFTs. A startup is trying to get NFTs to the mass middle consumer. Integrating with Shopify and offering a no-code platform for creating, minting, and selling your own NFTs is an interesting value proposition if the technology had any real use case. Link

NPS needs an update. This legacy way of determining customer satisfaction signals is more than 20 years old. A lot has changed since then. An interesting alternative is called “Earned Growth” which looks at pulling a financial model from hard data over and above survey scores. Link

✨ Weird and Wonderful

ConstitutionDAO. A rare original copy of the US constitution was up for auction, so a small group of crypto enthusiasts set up a DAO (decentralized autonomous organization), which is basically just a chat group with a bank account. They raised $40 million from 17k participants in 72 hours, lost the auction, and burned through $5 million in gas fees. The lesson? Crypto will be nowhere near mass adoption if this silliness keeps up. Links: DAO Analysis

Netflix’s AI movie. This is perhaps the most unsettling thing I’ve seen in a while…. Netflix fed an ML program a bunch of horror movie scripts and asked it to produce its own animated film. AI content generation is in this wild, free-form phase of innovation, and I’m here for it. Link

Reverse engineering recipes. Meta is working on a tool that can take a photo of a meal and generate the recipe to make it. This will transform food blogging forever. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.