TMW #065 | Do CDPs have a future? B2B SaaS after the IPO, EU digital regulation intensifies.

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

👋 Hello and welcome to new subscribers from the US, Australia, Denmark, India, South Africa, the UK, France, Italy, Croatia, the Netherlands, and Canada! Know someone who loves last-click attribution? Send them this link.

Happy Thanksgiving/Black Friday/Cyber Monday! Yet again, it has been another massive week in the marketing technology industry.

Before we get into the week, another episode of MSoM went live today. I got two digital optimization veterans on a call and we spent an hour trying to answer this question - what does ROI have to do with experimentation? Link

Here's the week in Martech:

- Do CDPs have a future? In just five years the category has grown by 700%, is this a signal of the technology’s staying power?

- B2B SaaS: What happens after the IPO?

- Today in regulation: The EU is changing everything again

- Everything else: Niantic (Pokemon Go) raises $300 million, the inevitability of Super Apps, advertising on Web3, the post-privacy report card, the state of marketing automation, quitting social media, the Black Friday retaliation, and fake agile theater!

✍ Commentary

Do CDPs have a future? If you had to name one category in Martech that has the potential to create the most value, has the best staying power as brands evolve, and will be used to its fullest potential. Which one would it be?

Many would say CDPs (Customer Data Platforms) fit this category well, and I’d agree. There’s only one real category that promises to integrate everything else that your company has bought, and that’s important.

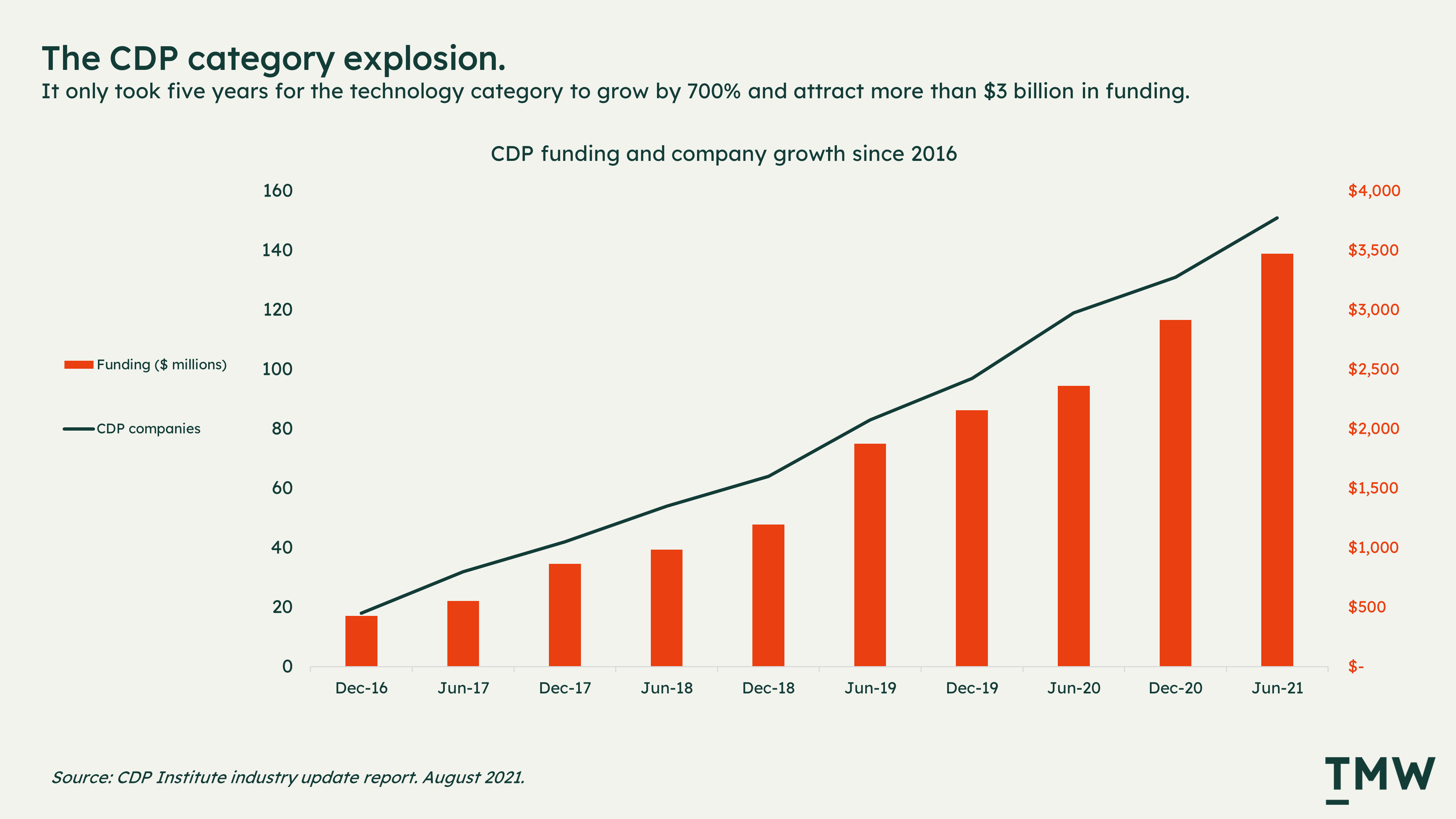

If the markets are anything to go by, CDPs are here to stay. The category has enjoyed explosive growth over the past five years, increasing the number of new companies by 700% and funding for those companies exceeding more than $3 billion. Recently Treasure Data announced the largest fundraise in CDP history, backed by Softbank. CDPs are having a moment in 2021.

The question I want to answer, despite this explosive growth, is if CDPs have a future. Will the category go down the path of the DMP, a much-hyped and now mostly shelved technology, or does the CDP offer something that can evolve as fast as the industry?

The answer to the question is complicated, but my working thesis is that for CDPs to survive the next evolution of business maturity in data and tech, much of what makes the category relevant today will need to change.

CDPs are what I call a class of “bridgeware” a way for non-technological companies to compete against more sophisticated companies in the digital marketplace. We’re still in an early and mostly exploratory phase of the internet where new technology startups are born every day, and existing technology firms are changing entire categories of the economy.

A shortlist of companies like real estate (Airbnb), hospitality (DoorDash), finance (Afterpay), travel (Uber) all point to one conclusion: Tech companies disrupt markets through leveraging data and experience on the internet.

But what’s interesting about the more obvious technology companies that are causing disruption is that the majority of them don’t think about CDPs in the same kinds of categories. For example, Uber built their CRM system from the ground up, precisely because their technology is an asset, and a core pillar in the business strategy. They are able to offer something unique to customers because they built the integrations, data models, and experience delivery mechanisms themselves.

To the Ubers of the world, the categories of customer data infrastructure are not built vs buy, they are leveraged vs non-leveraged assets. In other words, technology and data are the necessities to compete in the market and create business value, not merely things that enable it.

Non-tech-centered companies think about data and technology in vastly different ways. Traditionally the business strategy of these companies revolves around something like pricing or products, how they are promoted, or even geographical territory. Technology then becomes more of an enabler of the business strategy instead of a core pillar.

This is where CDPs come in. When non-technology-focused brands buy a CDP what they are getting is a database (usually run on AWS/Google/Azure) a user interface, a list of APIs, and a rule set to manipulate the database. If you’re lucky you’ll get a friendly CSM too.

These features can all be built and managed by internal teams, but for non-mature brands, they usually aren’t. The bridging phase of company maturity we find ourselves in highlights the point - companies either don’t want to invest in the technology capabilities to build and manage an internal system, because the costs and risks may be too great. CDPs are a viable alternative allowing you to pick up most of the capabilities you need.

This is fine for now. But if Moore’s law is anything to go by the level of maturity of most companies using CDPs today will look very different in 2030, and again in 2050. The use cases of today look awesome, innovative, and exciting, but soon enough they’ll just become the cost of doing business.

This is why I think the future of the CDP category is at risk of declining. CDPs make money because most companies in non-tech categories are not sophisticated enough (yet) to build their own data infrastructure to connect various apps. So the staying power of a CDP then relies on three things:

- Companies not progressing to technological and data management maturity (less likely)

- The high risk of switching or moving off a CDP (more likely)

- A CDP can do things that internal data and IT teams can’t do like maintaining security, offer a low/no-code GUI for marketing folks, and managing APIs (most likely)

The way we understand the place of CDPs is already changed significantly compared to just a few years ago. I remember back at the start of 2019, none of the major B2B vendors like Adobe, Salesforce, and Oracle had a CDP in market. Only a mere 24 months later and each of them has an offering, either built or acquired.

Because of this, there’s a widening gap between the independent platforms like Twilio, Treasure Data, and Tealium and the interdependent CDPs that are designed for marketing cloud suites like Adobe or Salesforce. The independent CDPs are more focused on building the APIs for every other tool, while the cloud vendors are more focused on integrating peripheral apps deeper into their ecosystem.

As an example, Tealium integrates natively with more than 1,300 different tools, and when an app is not supported there’s a flexible API that can be customized. This should tell you that Tealium and other independent CDPs are betting on a future that forks away from the “everything in a box” marketing suite.

From this perspective, you can see that there’s still a lot of potential for the CDP category, especially for independent platforms that are API first. Companies will continue to buy apps well into the future, and in this way, CDPs are best placed to support data connectivity for these various apps.

There are other risks to the future of the CDP though. Infrastructure companies edging into CDP territory, like Google, Azure, and AWS are a growing and unavoidable trend. It does make you think about Microsoft’s product strategy when they announced their very own CX platform a couple of weeks back.

For both interdependent and independent CDP offerings, it’s a harder sell compared to the ability to natively integrate with core cloud systems controlled by the bigger cloud vendors. The difference is like buying an iPhone charger from Apple or from a third party on eBay. You have more confidence that the Apple one will actually work (and won’t blow your phone up). The only difference here is that the vendor that's already managing your data warehouse, will more often than not seem like the sensible, and safer option.

So do CDPs have a future? I would say yes, but there are challenges on the horizon like obsolescence as brands continue to mature in both data capability and strategic thinking about the place of technology in their business. Big tech also can disrupt the category by offering something no other company can - native access to cloud infrastructure and the kind of security capabilities that only companies like AWS can provide.

Without a doubt, CDP technology has created new ways to think about customer data, but the staying power of these platforms lies not in the cool use cases you can create, but in the ways in which you can create market advantages through leveraging the technology holistically. Links: CDPI industry report. Software in the cloud: The great app explosion. CDP category growth analysis. Markets and markets analysis. The 2021 CDP marketplace.

📈Chart Of The Week

B2B SaaS: What happens after the IPO?. When a B2B platform IPOs what does this do their growth trajectory? According to research from Openview, some of the major B2B players like Shopify and Atlassian have exceeded revenue forecasts year over year. A lot of this has to do with these companies having the capital to enter bigger markets and improve the efficiency of their business models. Link

📰 Latest Developments

EU regulation intensifies. European Union lawmakers have voted in the Digital Markets Act which is likely to have a significant impact on key areas in big tech. Targeting minors with ads, interoperability between apps, and fines as much as 20% of company revenue are all elements of the act. This is less of an incremental move and more of a step-change in how governments are reacting to big tech. Link

Why are BNPLs massive losers? This week Klarna has reported a quadrupling of losses from January to September, about $344 million. That is more than a million dollars a day in lost revenue. While Paypal and mainstream payment providers adopt easy-to-replicate BNPL technologies, former category leaders seem to be left holding the bag. Link. Analysis.

Niantic raises $300 million. This company is behind the wildly successful Pokemon Go franchise, one of the first mobile apps to find a mass consumer use case for AR. The company is now valued in the realms of $9 billion. A lot of this comes down to the company’s bet on the role of AR over VR in building the metaverse, which in many ways seems to be the more viable bet for mainstream adoption. Link

📚 Reading

Super Apps are inevitable. Scott Galloway thinks that the concept will produce the world’s first double digital trillion-dollar company. There’s an interesting annex between meeting customer needs by integrating many services into one digital property, and the clear antitrust and monopolistic challenges a Super App represents. Link

Advertising on Web3. Eveyone thinks the days of doing targeted advertising online are numbered. But Facebook has filed patents to run ads in whatever their version of the metaverse is going to look like, and the Adtech industry is thinking hard about how to fit into the jigsaw puzzle of the next evolution of the web. Some of the best commentary I’ve seen so far helps to unpack the issues, and paint of picture of what advertisers are likely to do in the next iteration of the internet. Links: Preserving advertising ($). Digital economies and gaming. Blocking people in the metaverse.

The post-privacy, post-cookies industry report card. Mi3 has done a bit of a round robbin on what the industry is thinking about when it comes to the end of cookies. There are a few of my colleagues in here talking about MMM, and the majority sentiment is there won’t be any one solution to replace cookies anytime soon. Link

🔢 Data & Insights

Adtech and the magic quadrant. Gartner has released the 2021 report for Adtech, reflecting some of the major challenges impacting the assessment for the year. Privacy, cookieless future, and identity alternatives are all up there, shuffling the deck on which platforms are leading in the space. Link

The state of marketing automation. Demandspring has announced its MAP report surveying a large cross-section of marketers on how and when they use these platforms. 96% of marketers have implemented a marketing automation platform, but what’s interesting is 42% of them only started using a MAP in the last four years. Link

The Martech innovation report. CabinetM has released its quarterly report on what’s changing in the industry. According to the research, in the past three months, 49 new products have launched, 52 acquisitions happened, and more than $12 billion in funding went into the industry. Tell me again that the industry is in decline? Link

💡 Ideas

Quitting social media. Social networks are increasingly becoming high effort, low results, and high-risk channels for many companies. Lush, a skincare and makeup brand is in a category that can capitalize fairly well on social media marketing. But they are shutting down their social channels and firing (or reskilling) their social media teams. Link

A $2 million plot of digital land. The flux state of digital “ownership” continues in this example of a land sale in a metaverse space called Decentraland. The way people (particularly wealthy people in tech) define ownership is changing vastly. There’s no reason why owning a plot of land in a video game or somewhere like Roblox or Minecraft should be free. This to me is kind of like an extension of domain names, buy somewhere you hope will be valuable and sell it later down the track. Link

The Black Friday retaliation. I had to include something about Black Friday, the year’s biggest migraine for retail and eCommerce folks. There’s been a growing trend where brands are using it to counter position themselves and call out the ethical, economic, and environmental challenges of the shopping holiday. Here’s a few interesting examples: Mauve Monday. Sack Friday. Planting trees.

✨ Weird and Wonderful

The NFT pirate bay. Link

The world’s first robot lawyer. Link

Fake agile theater! Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.