TMW #092 | The retail resurgence

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

Here’s the week in Martech:

- The retail resurgence: Rethinking the tech downturn

- The current state of media: Visualising the media landscape

- Klavio raises $100m from Shopify. One cannot grow without the other

- Everything else: Everything is a streaming network, integrating agencies, Apple and small businesses, Martech M&As, a good post-cookie use case, and lollipop arbitrage

✍ Commentary

The retail resurgence

We’re now in an innovation cycle that has very little to do with tech. For the past three years, we’ve believed a narrative that we’re now entering a transformative phase of our digital experience.

Some call this Web3 others call it the Metaverse but really most of what we’re talking about is the experimental thinking that happens when most of us can only view the world through the small screen (smartphone), the medium screen (computer) or the large screen (TV) during the pandemic.

This kind of magical thinking about the role of tech in our lives has carried into 2022. But now a change is happening. Tech layoffs are a weekly affair, tech valuation multiples have halved in a year and companies that were supposed to usher us into this new, uncharted time of internet utopia have been nothing more than overhyped technology lacking real-world application and consumer demand.

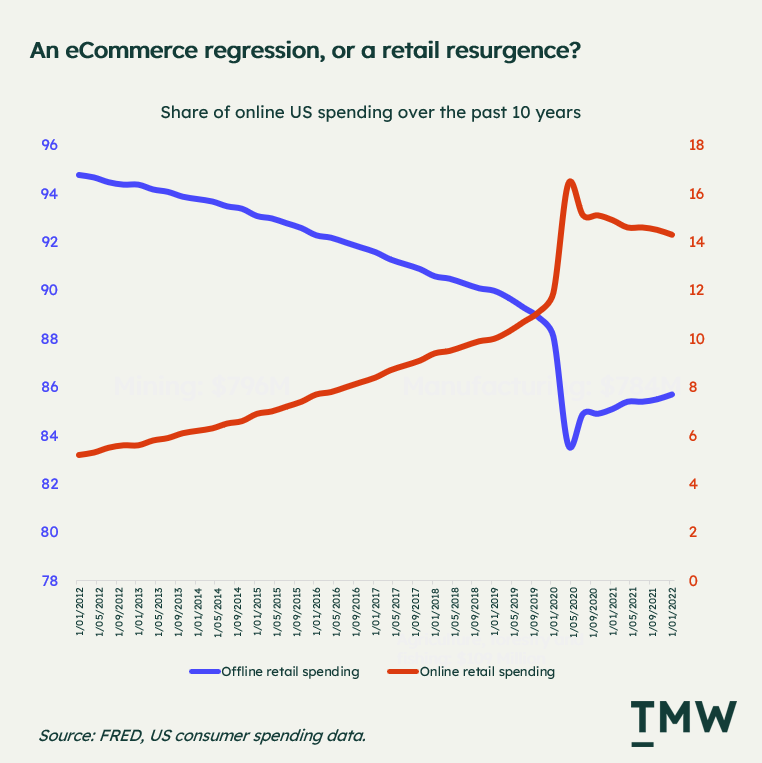

One of the ways to understand what is happening in technology right now is how much people are spending online. US online spending has declined to what Benedict calls “back to the trendline.” And that’s true, the line below represents billions leaving the online economy as eCommerce meets the original trend before the pandemic.

What’s clear as we emerge out of the pandemic is that consumers are wanting to replace bits (digital) with atoms (physical). Most of the online discussion so far is about the decline of digital consumption as borders open, restrictions are lifted and our comfort levels with associating with each other in person are regained. But the most interesting question is what’s happening on the other side of that bright orange line?

If the pandemic forced brands to “digitally transform” then the opposite is the retail resurgence. Since the onset of the pandemic, online spending has declined by 12%, but retail has increased by 2.5% and for the first time in a decade, the trend has now reversed - offline spending is growing, while online spending is shrinking. Now is a good time to think about if brands need to transform how they are moving atoms and how customers are buying them.

The rubber band

Most consumer behavior is informed by history. The physical experiences of marketing and sales enjoyed through in-person conferences and events, shopping in-store, and doing sales over lunch are all that consumers are wanting. This is what has been normal for decades before the internet. But is that the normal something consumers are returning to? When people are forced to do everything online, they have learned behaviors that carry into whatever is next.

One example is the consumer preference to purchase online and the unique opportunities that are present now that most people are now somewhat familiar with it. Groceries is one of the most impacted retail spaces by online shopping. While the majority of consumers are returning to stores, they are also likely to purchase online in far greater numbers than before the pandemic. Over the pandemic, 79% of US consumers learned how to buy groceries online, from only 19% just a few months before the pandemic hit.

DTC (Direct To Consumer) is a counterfactual. The majority of online-only bespoke brands that target a specific niche like Allbirds, Warby Parker, and Stitch Fix are now either consolidating, selling off, or shutting down as billions has been wiped off the industry.

Outside of the logic of lockdowns and the need to avoid other humans, did we really want to buy our shoes, cereal, and bacon from three different websites? (Hint, that’s a no). Clearly, some categories of products and services shouldn’t exist in the real world. DTC is one of them.

Another example of in-person categories facing a resurgence is entertainment. While you can argue that the box office was already on a sharp decline well before the pandemic, people are returning to watch movies together in person and the box office is slowly recovering.

This is important because movie theaters were the most dangerous place for people to congregate when COVID-19 was at its peak. But people are turning up to see Thor and Maverick again because, guess what, going out to see a movie with people is actually a fun experience that can’t be replaced.

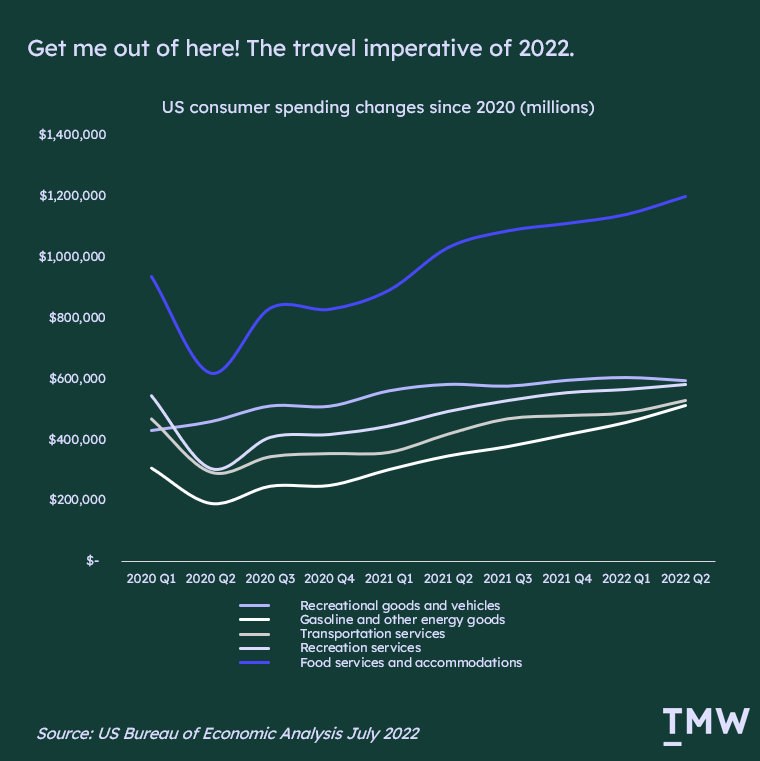

The demand for tourism and holiday travel is also peaking. People are traveling overseas so much that up to May 2022, travel spending has exceeded 2019 levels by 3%. In many ways online demand is only growing across booking aggregators, rental listings like Expedia and Airbnb, and even Uber to provide ground travel (one of the only tech companies to become beneficiaries during the pandemic with Uber Eats and after it).

In a very similar way to how COVID-19 caused a sharp increase in a very new type of behavior, our resurgence to in-person activities is another anomaly altogether. While the shift out of the pandemic is not as sharp as the onset, spending on accommodation, eating out, travel and recreation are all increasing quickly. All that pent-up demand is snapping like a rubber band pulled back for more than two years.

Martech, but in the real world

Swapping a laptop for a plane ticket has second and third-order effects on how we do marketing and sales. We often think about marketing technology in the frame of software mediated by the internet. But people have been inventing marketing technologies long before the internet came along.

Someone had to come up with the first printed ad, the first billboard, the first influencer (way before Instagram), and the first TV ad. The most brilliant marketers know that technology only enables an experience and that technology can come in all kinds of interesting formats.

This is why there is a slew of companies that are thinking differently about re-embracing the physical space. Facial and device recognition is one example of bridging the divide between a digital and “in-store” experience.

Companies like Clearview AI, are wanting to store 100 billion photos in a global database to enable facial recognition services across brands, government departments, and police enforcement. While a somewhat innovative way to track purchase and browsing behavior, it’s still highly controversial. Recently, Bunnings and Kmart, Australian hardware mega-retailers are being investigated over their use of its facial recognition technology program citing privacy complaints.

Facial detection is just one angle on in-store customer experience innovation. Amazon has been on an ongoing trajectory to enable cashless and unstaffed stores. The Amazon Go store bridges the divide between your Prime account and what’s on the shelf by housing thousands of cameras and sensors, measuring every move you make in-store, just so you don’t have to interact with another human to pay for something.

It all sounds a little bit silly, but people will pay a lot for convenience, and the integration between membership and household shopping is incredibly valuable for Amazon. And it’s not only happening in the US, Alibaba is similarly rolling out cashless stores called Hema across China.

Innovation in marketing technology doesn’t stop in-store though. As consumers flock to the outdoors, the way marketers are doing outdoor advertising is changing with it. Programmatic Digital Out of Home (pDOOH) is an emerging technology that seeks to bring the programmatic and targeted benefits of the web to outdoor advertising. The rate of growth in pDOOH is at the same levels as when online programmatic advertising first was starting out with 89% of UK marketing executives planning to invest in the technology over the next year.

Better questions

What’s more valuable, bringing the digital into the physical? Or the other way around? Somehow, we’ve all come to think that the digital experience of a consumer is far better and more valuable than the physical. That’s why we install self-serve checkouts at grocery stores and don’t accept cash anymore.

Don’t get me wrong, some of the benefits are clear. Reducing costs by replacing people with efficient machines is one of them, and it’s more convenient for me that I don’t need to take my wallet to the store anymore. But convenience and efficiency are just two sides of a complete picture of value.

How can we make real-world experiences memorable? How do software companies create a presence outside of your typical expos, board meetings, and the occasional billboard? There is a whole world out there to explore new ways to communicate with customers. Encountering a brand in person is powerful.

There are likely whole new ways to market to customers in the physical world. We just need to explore it, understand how people work in it, and build things that make sense in a purely physical environment. It’s perhaps the one and only chance that marketers have in this unique moment to rethink “offline” customer experiences. There is innovation in everything, even in the tried-and-true department store.

The tech economy isn’t shrinking, it’s just returning what it was given during a global pandemic. Instead, it’s more valuable to see this as the resurgence of retail. What if, instead of seeing the tech downturn for what it is, we see it as an opportunity to reinvent what it means to create customer experiences using atoms instead of bits?

📈Chart Of The Week

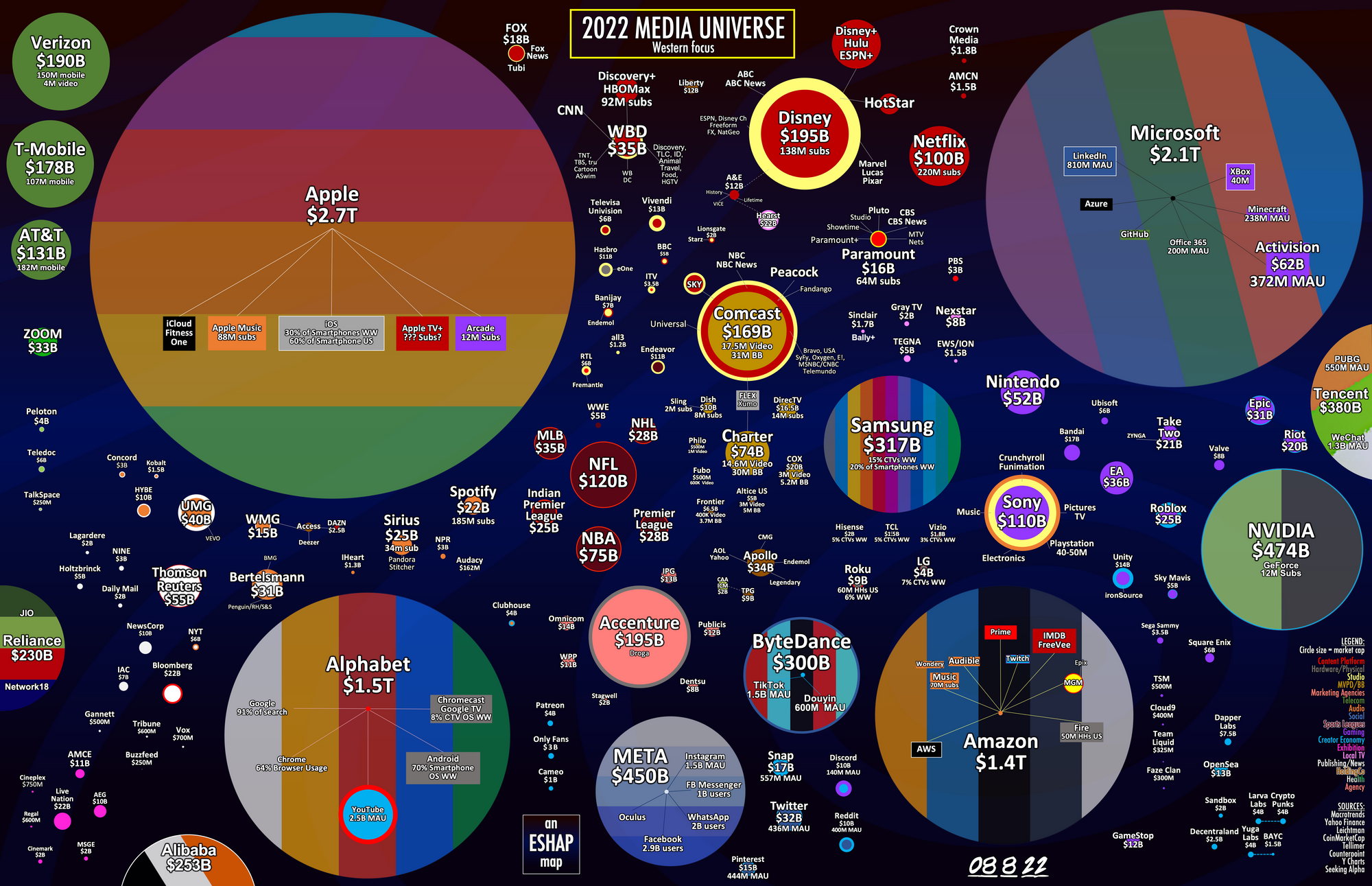

Tracking acquisitions. One of the biggest surprises here is how much Microsoft paid for LinkedIn, and in the five years since, has done very little with it. Link

📰 Latest Developments

Klavio raises $100m from Shopify. These two companies work very well together, and this investment will only double down on Shopify’s commitment to recommend the marketing automation platform across all of Shopify’s platforms. The last valuation for Klavio was around $10 billion, perhaps too big for Shopify to acquire, but $100 million will keep the company in the ecosystem despite a strategic direction at Klavio to go further up the enterprise. The question worth asking here is could Klavio exist without Shopify? Link

Everything is a streaming network. There are two things that almost every major retailer is doing in tech – ads and streaming. Walmart is set to build a streaming service in conjunction with Paramount, Disney, and Comcast as part of their existing loyalty program. This is mostly a competitive move against the Amazon Prime streaming service and another way for the retailer to sell ads. The lines a blurring between what different verticals do with web traffic. We used to sell (eCommerce), entertain (video), and socialize (networks) in different verticals, but increasingly, companies with enough traffic can do all three. Link

Google fined $60 million. In a case announced a year ago, Google was investigated for misleading consumers about the use of their location data on Android. That case has since closed and now the company was fined $60 million or about 0.8% of 2021 revenue in Australia. Is it really a fine or just a very small privacy tax? Link

📚 Reading

The end of social networking. A thought piece talking about the change in priorities from the world’s largest social apps. Meta, Snapchat, and Twitter are all deprioritizing content shared from actual connections in favor of following TikTok’s lead in algorithmic content. All social networks are fundamentally advertising machines, so if a new app can do it better in a different way, why not follow it? Link

Integrating agencies. Forrester analysis on how CMOs are integrating agencies together into partnership models. It appears the larger media firms are also diversifying their portfolio into smaller, more independent business units so that brands can pick and choose the right partners across media, creative, user experience, and tech. Link

The news media bargaining code collapse. A good piece from Mi3 discusses the situation that Meta and Google created with the News Media Bargaining Code (deals that were made directly with legacy publishers so that the Australian government won’t tax them). Meta has decided to pull out of agreed to funding and Google is re-negotiating deals. Where does this leave media companies? Estimates are around 40% less referral traffic. Maybe the whole deal was just a massive waste of time? Link

🔢 Data & Insights

The one thing not slowing down in Martech – M&As. Even though the economy is slowing, the amount of activity over 2022 in the M&A space is on track to meet last year’s outcome of more than $10 billion spent on acquisitions from PE and strategic acquirers. Link

Apple and the small business. A deep dive into how Apple’s privacy initiatives like ATT are limiting the growth potential of smaller companies that are reliant on personalized ads. Most advertisers on Meta’s properties are small companies and the tracking ecosystem up until very recently did a good job at helping these companies access new customers. Link

Two narratives about app download charts. Data from Sensor Tower has TikTok as the #1 app across all major western app store markets. Interestingly a new app is also in the top 10, which is just a video editor for TikTok. If you look at the Asia app store, however, Instagram is at #1. The narrative so far has been that TikTok is an unstoppable force until you figure out that Asia is a very different market with a lot of people too. Link

💡 Ideas

A good post-cookie use case. Media Math used ID5, a third-party cookie alternative to reach 1.4 million B2B customers for IBM in Apple Safari. Third-party cookies were a decentralized technology that enables companies to build AdTech solutions on top. ID5, along with others like UID 2.0 are centralized identity solutions that work only in their own environment. It’s interesting to see more real-world use cases with some of these tracking technologies, but the centralized elephant in the room is still there. Link

Can real companies run on No-Code? Not many people take companies built on No-Code very seriously, but this piece got me thinking about the commodification of SaaS. There was a time when software running in the browser and hosted in the cloud was an innovative thing, but now you can use a drag and drop editor in a No-Code tool and scale it to millions in revenue through marketing, branding, and good customer service. Link

Share of life. An interesting way to describe how Disney+ is overtaking Netflix and many other streaming networks. Instead of thinking about competing on the market (number of users), compete on a greater share of people’s lives involved with the product. Disney+ does this with content that appeals to the entire family. Link

✨ Weird and Wonderful

Lollipop arbitrage. Amazon’s marketplace is a lot like social media networks. A lot of bad actors, shady fraud cases, and hustlers looking for a quick buck. Link

How to build an entire ecosystem by yourself. CoinDesk unmasked a blockchain developer who built multiple DeFi protocols on top of the Solana network by impersonating 11 different anonymous developers. At its peak, the ecosystem of financial products represented more than $7 billion of Solana’s total value of $10.5 billion. I don’t think crypto as a concept will ever be ready for the mass consumer. Link

How cool is Excel? All the things Excel can do that you had no idea about. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.