Essay: Three ways to think about Martech in 2021

2021 has been one of those years where change has been the constant in almost every category. The question I have when looking back is this - what has changed about the Martech industry?

If anything, 2021 has taught us that the concept of “Martech” which is really just two words mushed together (marketing & tech), is constrained in definition. Hardly anyone talking about this category talks about crypto or regulation or AI, and somehow they are all topics relegated to broader tech niches. But if you sit down with a CMO, or ahead of digital, all of them will tell you that these things are on their radar.

There are three ways to sort the noise from what has shaped the industry in 2021:

The convergence: The great Martech consolidation is starting, expanding the footprint and capabilities of the world's largest vendors.

The divergence: Regulation, privacy, and consumer attitudes are the catalyst for diverse thinking about online marketing.

The emergence: Web3, NFTs, Metaverse, and all the shiny new tech from last decade that is driving a fresh wave of marketing experimentation.

The Convergence: Super apps, Big Martech, and the great consolidation.

Convergence is a concept to explain when multiple things come together to form a new whole. This year we’ve seen a significant amount of high-profile acquisitions and mergers in what I dubbed earlier this year “the great consolidation.” Martech is becoming more diverse, but it’s also getting bigger. The industry is valued north of $344.8 billion with 75% of Martech companies outperforming the S&P 500 in 2021. Triggered by the influx of brands needing to invest in digital channels due to consumer behavior change from COVID-19, the industry has only exponentially grown.

But Martech is growing also in the size and scale of companies. Last week I put an idea forward to explain a growing movement, calling it Big Martech. The category is increasingly becoming subjugated by fewer and fewer companies. Surveying the M&A landscape over 2021 definitely points in this direction.

A few examples come to mind when thinking about Big Martech in 2021; Sitecore’s historic $1.2 billion fundraise and acquisition of Boxever, Amazon’s acquisition of Selz, a competitor to Shopify, Intuit’s acquisition of Mailchimp for a record-setting $12 billion, Optimizely (formally Episerver) acquires CDP Zaius and Welcome, a project management tool, Square’s acquisition of Afterpay, Adobe’s acquisition of Frame.io, a video workflow app, Zendesk’s acquisition of Momentive a CX research business, Twitter’s acquisition Revue, a Substack competitor, and CM group merges with Cheetah Digital, to round out their portfolio with an enterprise loyalty platform.

All of these acquisitions form what I’m seeing as a consolidation of technological prowess, and an expanding footprint around some of the world’s largest technology companies.

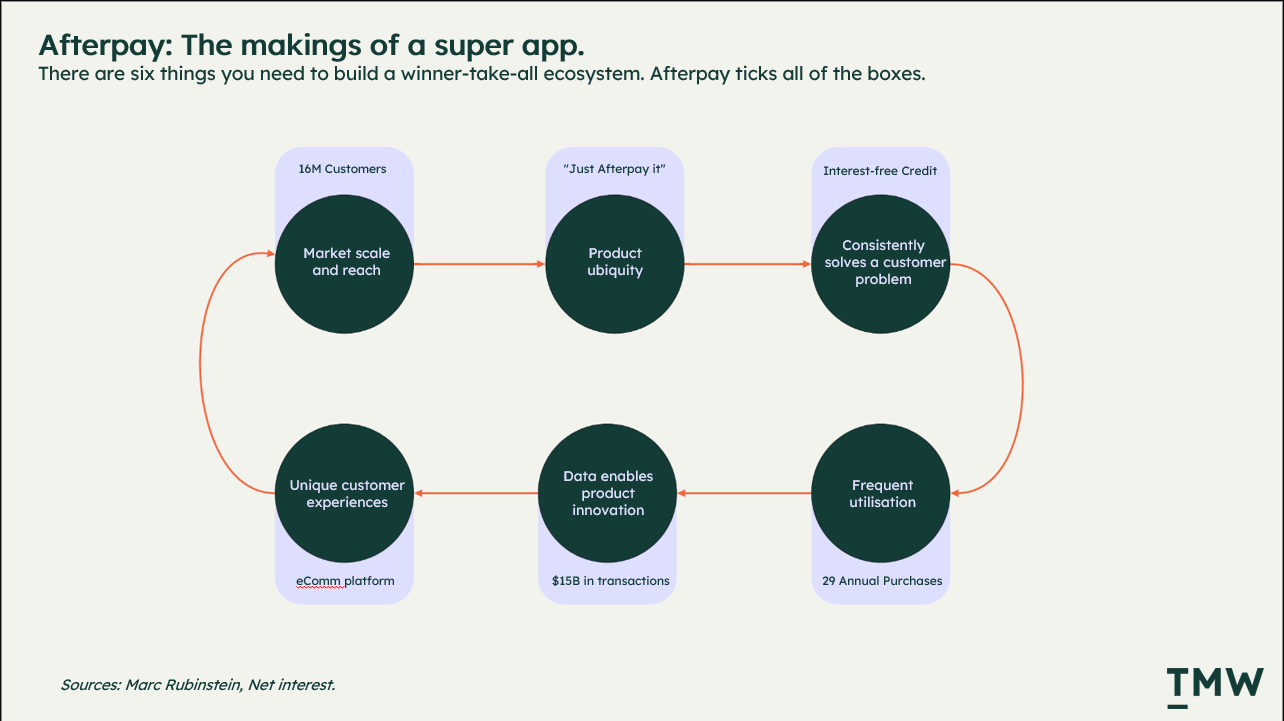

Some call this the Super App era, where companies create a strategy to acquire and build apps that overlap with the core offering and extend the value proposition for new customers. You can see this all over the place; Square’s acquisition of Afterpay turns the payments company into a marketing powerhouse, that connects BNPL, Afterpay's sprawling marketplace, and Square's payments capabilities while integrating with the Cash App consumer product to introduce this combination to millions of more customers.

This is smart. But so is Intuit’s acquisition of Mailchimp, tapping into millions of SMEs and integrating email marketing, e-commerce, and accounting software. Zendesk is combining analytics and customer service, Twitter is leveraging its existing network effects for publishing with Revue and Optimzely and Sitecore extend into the CDP space with their respective acquisitions. This is a leaf from the Super App strategy playbook.

In 2021, consolidation was king and more and more Martech vendors are choosing to join forces to build ecosystems for customers and brands to participate in. There won’t be one SuperApp in the coming years, but many SuperApps that address various aspects of the industry, whether that be eCommerce, payments, CX, or content.

But it doesn't end with mergers or acquisitions, companies are also joining forces to create new capabilities. When Google and Shopify partnered earlier this year to improve site indexing across 1.7 million Shopify stores, or when Salesforce partners with FedEx to power commerce cloud and help brands compete with Amazon, or when Twitter and Spotify cloned Clubhouse to capitalize on changing consumer behavior, or when ByteDance announced its entrance into e-commerce to sell the algorithm that propelled TikTok to 1 billion users in half the time it took Instagram, this tells you something – leaders in these companies are looking at their product strategy not as a way to compete, but rather as a way to consolidate where commercial and behavioral overlaps that can be leveraged.

The convergence in Martech is about how technology companies are building or buying their way to a larger footprint, which means pulling more customers deeper into their various ecosystems. We already have brands that rely on a single vendor to make many things work in their Martech stack, that's not going away anytime soon. It's more likely to accelerate.

This is important because these kinds of shifts invariably reduce choice for both consumers and brands, stifle innovation, and make it harder to escape ecosystems where the capabilities in one area impact all other areas.

An integration between FedEx’s logistics system and Salesforce Commerce Cloud seems like a great way to sidestep a lot of technological challenges until you realize it’s might be more advantageous to work with DHL or Amazon. The same idea applies to Shopify. Increased website traffic from a Google partnership is great, but what if you want to re-platform to Magento?

Consolidated services in Martech are kind of like a maze - easy to enter, harder to leave, and in an environment where Gartner is saying two of the top three areas CMOs are investing into in 2021 are commerce and marketing operations, the maze may be harder to avoid as Martech converges.

The Divergence: Regulation, privacy, and consumer attitudes are the catalyst for diverse thinking about online marketing.

2021 can also be crowned the year of advertising regulation. Let’s look at some stats, of the top 25 digital advertisers, the top 5 control about 46% of the total advertising revenue, about $296 Billion, or the entire GDP of Colombia. You can probably guess who’s in the top five: Google, Facebook, Alibaba, Bytedance (TikTok), and Amazon.

For these companies, regulation is intensifying. The EU has enforced greater penalties against breaches of regulation, Facebook and Google are facing stricter rules after years of actions to stem misinformation, abuse, and privacy violations.

It's not only regulation that was a major theme in 2021. Various platforms are restricting what marketers can do, consumers are wanting a more private web and the effectiveness of online advertising is coming under question.

This year Google formally announced (and then delayed) cookie deprecation for Chrome, one of the last major web browsers to do so. Along with this Apple's changes to App tracking with the introduction of ATT (App Tracking Transparency) and restricting IDFA (identifier for advertisers) has meant that marketers are more constrained in how they track people online, with a staggering 96% of users who have opted out of Apple App tracking so far. DuckDuckGo the privacy-focused search engine recently surpassed 100 million queries a day this year.

Much of this change underscores that consumers are wanting a more private online experience, and the world’s largest platforms that facilitate so much of what a marketer can do today are making tectonic shifts to meet these expectations.

This is also compounded by research suggesting that upwards of 88% of digital ad clicks are fraudulent, according to Oxford University, a number that’s significant enough to consider when planning your next round of campaigns.

It's these kinds of changes that are triggering new ways for platforms to think about marketing online. I would posit that the three main shifts are occurring in shopping, entertainment, and advertising.

Shift 1: Shopping

More companies are offering ways to integrate shopping within existing platforms. Two important examples include YouTube's integration of shopping within video, and Shopify and Spotify partnering to enable creators to sell merch in-app. What’s important about this is the integration of shopping and media is a method to enable more people to shop where they are already consuming content, and it closes a gap between discovery and purchase.

Shift 2: Entertainment

On the entertainment edge, 2021 saw more companies enter into the world of streaming to take a greater share of eyeballs. Amazon’s 50% acquisition of MGM Studios, Salesforce’s launch of the Salesforce+ streaming network, and the rise of “retailtainment” all suggest a strategic move to move away from pure-play advertising to creating a destination consumers would like to spend some time.

Another example this year is a16z’s launch of Future.com, a media company wholly owned by the VC firm as a way to create a destination for a certain type of audience. It’s harder to regulate media than it is social networks, but the benefits of driving engaged audiences are similar and in some ways more valuable.

Shift 3: Advertising

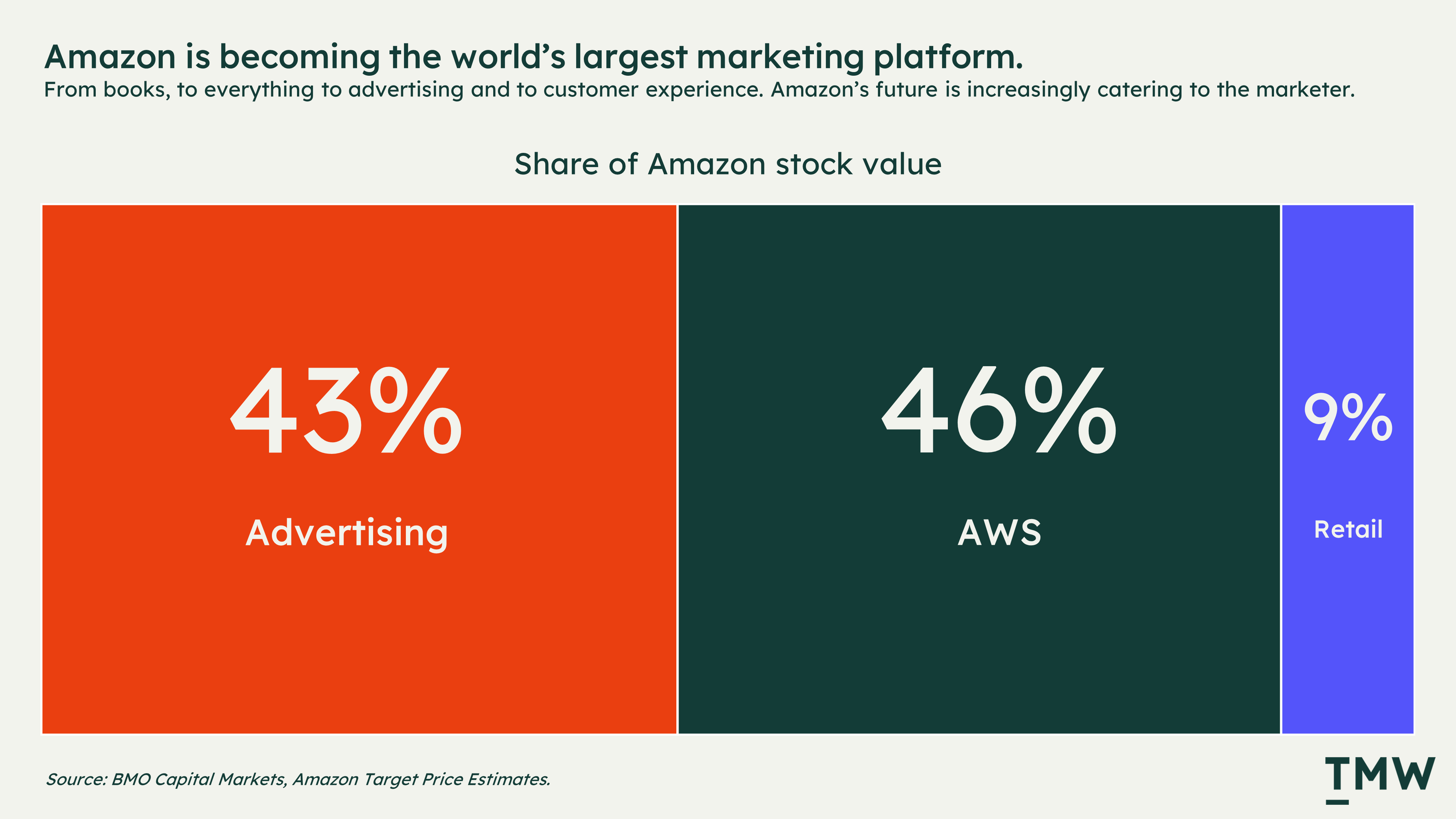

The third reaction to increasing big tech regulation is more retail and eCommerce brands entering the advertising space. Walmart and Tesco, two of the world’s largest grocery chains have announced their programmatic advertising networks this year and Amazon’s Marketing Cloud has quickly moved from a proof of concept to a new revenue stream that accounts for almost half the value of the company.

This is important because the underlying technology to facilitate programmatic advertising is becoming more commoditized so that retail brands with an already large volume of traffic can enter the sector and offer alternatives to Google and Facebook. This is a good step, which offers more choice for advertisers and marketers.

But it’s not just the ways platforms are recalibrating for new use cases that are changing, new ways to do tracking and targeting online have proliferated 2021. UID 2.0, cookieless targeting, and a myriad of contextual advertising opportunities are gaining prominence.

For today’s marketers, one of the most competitive things you can do is to experiment with all the new ways you can reach customers. Turning shopping hubs into entertainment meccas is one way, transforming retail destinations into massive ad businesses is another and also is minimizing the gap between shopping and content consumption.

The Emergence: Web3, the metaverse, NFTs, and all the new ideas from last decade.

This wouldn’t be a 2021 summary without mentioning all the wonderful new words that have entered the mainstream. It’s hard to imagine a world where NFTs is an unknown concept or where brands weren’t planning their metaverse strategy, but here we are, in a period of time that many will tell you is a decided shift from one version of the internet to the newer and fairer one.

Some people call it Web3. Others, like the company formally known as Facebook, will call it the metaverse. The problem is that the majority of these VR, gaming of crypto-led emerging trends are not particularly new.

A lot of what characterized 2021 were new ways to think about how people interact with each other socially and economically online, and a lot of it has nothing to do with the concept of Web3.

Clubhouse, the audio social media company that achieved virality in January was a catalyst for a whole new category. GPT-3 was a major advancement in ML generative content, introducing a galaxy of innovation across visual, written, and video creativity along with automated ways to code and build products. Roblox, one of the closest examples of a metaverse game, now commands the attention of more than 50% of US teenagers, and IPO’d at $5 billion, ten times its valuation from just two years ago. Add to this list Niantic, the AR company that’s behind Pokémon Go achieving a $9 billion valuation and the rise of No-Code, symbolized by Bubble, a no-code app platform that raised $200 million this year and you have a lot of emerging technology disrupting and creating whole new Martech categories.

But it seems like all we wanted to talk about in 2021 is buying and selling pixelated JPEGs.

NFTs have become one of the internet’s true fascinations. There have been ways to understand why they have become so central to how we think about the future of the internet. Some call the phenomenon mostly multi-level marketing or Ponzi schemes – the only value of the tokenized assets is represented by how many people you can get to invest into the network. Others suggest that NFTs distribute wealth to creators in ways massive social networks like Instagram, Twitter, or YouTube cannot. Yet many others indicate that NFTs represent a new way to participate in the internet economy.

I’m inclined to suggest that all three interpretations are true. But all of them are equally visions of the future that’s not realized yet. The argument goes that with all emerging technology, there’s always a user-unfriendly period where adoption is difficult for the everyday person.

One thing that the NFT/Web3/Metaverse movement signals is a desire to move away from supermassive advertising-driven social networking, seen as a way to gatekeep attention and economic opportunity, to something that more people can participate in and own.

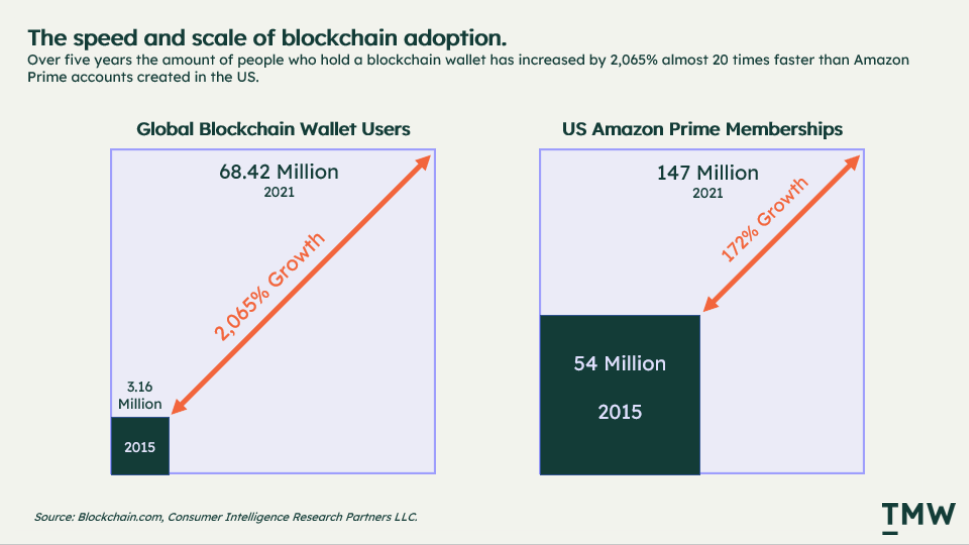

The problem is thinking that the blockchain can be the answer to this kind of future. If the data is anything to go by, blockchain adoption is growing 20 times faster than Amazon Prime subscriptions or more than 2000% in 2021, an indicator not just of the pace of NFT adoption, but also of involvement in decentralized organizations, holding and trading crypto and funding web3 projects of all shapes and sizes. But the blockchain is an inefficient, restrictively expensive, and technologically challenging way to transact online.

Many of what is now deemed "Web2" platforms also reflect these changes too. eBay has announced an NFT offering, and major brands like McDonald's, Adidas, and the NBA have all jumped on the bandwagon. NFT marketplaces like Opensea are exploding with new users, growing to $320 million in transactions recently. PayPal has also made steps to welcome crypto payments, creating opportunities for merchants to attract new kinds of customers.

There is a ceaseless wave of experimentation in this space, just as there is the concept of the Metaverse, most symbolically underscored by Nike’s entrance into the category with the recent “NikeLand” initiative.

But notice that I’m not using the word innovation here, a lot of this is driven by start-up founders wanting to get on the ground floor of something that’s exciting, or marketers wanting to try something new. Most of this is just freewheeling experimentation and working out if there’s any real value that exists under all the hype. I'm not using the word innovation because the technologies that have captured so many imaginations were all invented in the last decade.

Cryptocurrencies are more than a decade old, NFTs were invented back in 2014. The concept of a Metaverse was represented by early prototypes like RuneScape, NeoPets, and Minecraft which were all ancient ideas reformulated and repackaged for an internet economy that’s wanting to move onto something new.

This is not to say that there’s no value in the ideas of these emerging technologies. Experimentation is always a good thing as it pushes brands forward into new ways of thinking and operating, it’s just a bit of a stretch to call it innovation. 2021 has shown us that nothing is new under the sun, but if you pay enough in Etherium and set a Bored Ape as your Twitter profile picture, you can make other people believe there is indeed some new, exciting technology to get excited about.

2021 has become a catalyst for change for many corners of the web. As platforms converge to form super apps and broader ecosystems, marketers need to be prepared for the risks of this growing shift. And while consumer sentiment, regulation, and self-governing tech platforms change how we use consumer data, new and divergent ways to do online marketing are causing the categories of shopping, entertainment, and advertising to blend together. Emerging technologies give us a glimpse into the past disguised as the future, but are also catalyzing innovation at the kind of scale we’ve never seen before. 2021 has been quite the year, and there's no sign of Martech slowing down.

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.