TMW #067 | Amazon, HubSpot, and Big Martech, the economics of online creators, and Kickstarter moves to the blockchain.

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

👋 Hello and welcome to new subscribers from the US, Australia, Canada, the Netherlands, and Austria! Know someone who has shiny object syndrome? Send them this link.

Welcome to the very last "normal" TMW newsletter of 2021. Next week I'm going to attempt a reflection on everything that happened in marketing tech this year. TMW will then resume on the 9th of Jan.

Before we move to the week that was, an episode of the podcast went live this morning. It's about communities for marketers, peer learning, and industry participation with Mike Rizzo, founder of Mo Pros. Listen.

Here’s the week:

- Amazon, HubSpot, and Big Martech: HubSpot is more than a CRM and Amazon wants to be more than a retailing advertiser.

- The ways creators are getting paid. It's about income diversity and selling T-shirts.

- Kickstarter moves onto the blockchain. The crowdfunding cornerstone has seen the writing on the wall.

- Everything else: Building websites on your phone, how Shopify uses Google Cloud, the empty promises of Web3, TikTok can read your mind, compressed commerce, the $109 billion in holiday spending, the cloudless cloud, and the art of the one-pager!

✍ Commentary

Amazon, HubSpot and Big Martech™ A couple of years ago a friend of mine had a significant change in their career. They moved from working in solution architecture to sales. When I asked why, they said that your career is better off the closer you are to the revenue. Perhaps Amazon was thinking the same thing when, back in August, the M&A team were talking about acquiring HubSpot for up to $40 billion.

For the record, I don’t think the rumors will eventuate into an acquisition, but the thought experiment of what Amazon would do with a company like HubSpot is interesting, to say the least. Interesting in that Amazon would even consider an acquisition in the first place, and what it can tell us about Big Tech’s increasing involvement in B2B marketing platforms.

On the surface, there’s a mismatch between Amazon’s retail customers (merchants) and HubSpot's core customers (B2B services firms). But when you look at who’s using AWS (aside from everyone) there’s a large proportion of users who are exactly in this category. And as HubSpot is running on AWS anyway, there’s a strong value proposition around a native integration in the pipeline from data warehouse to CRM to marketing execution.

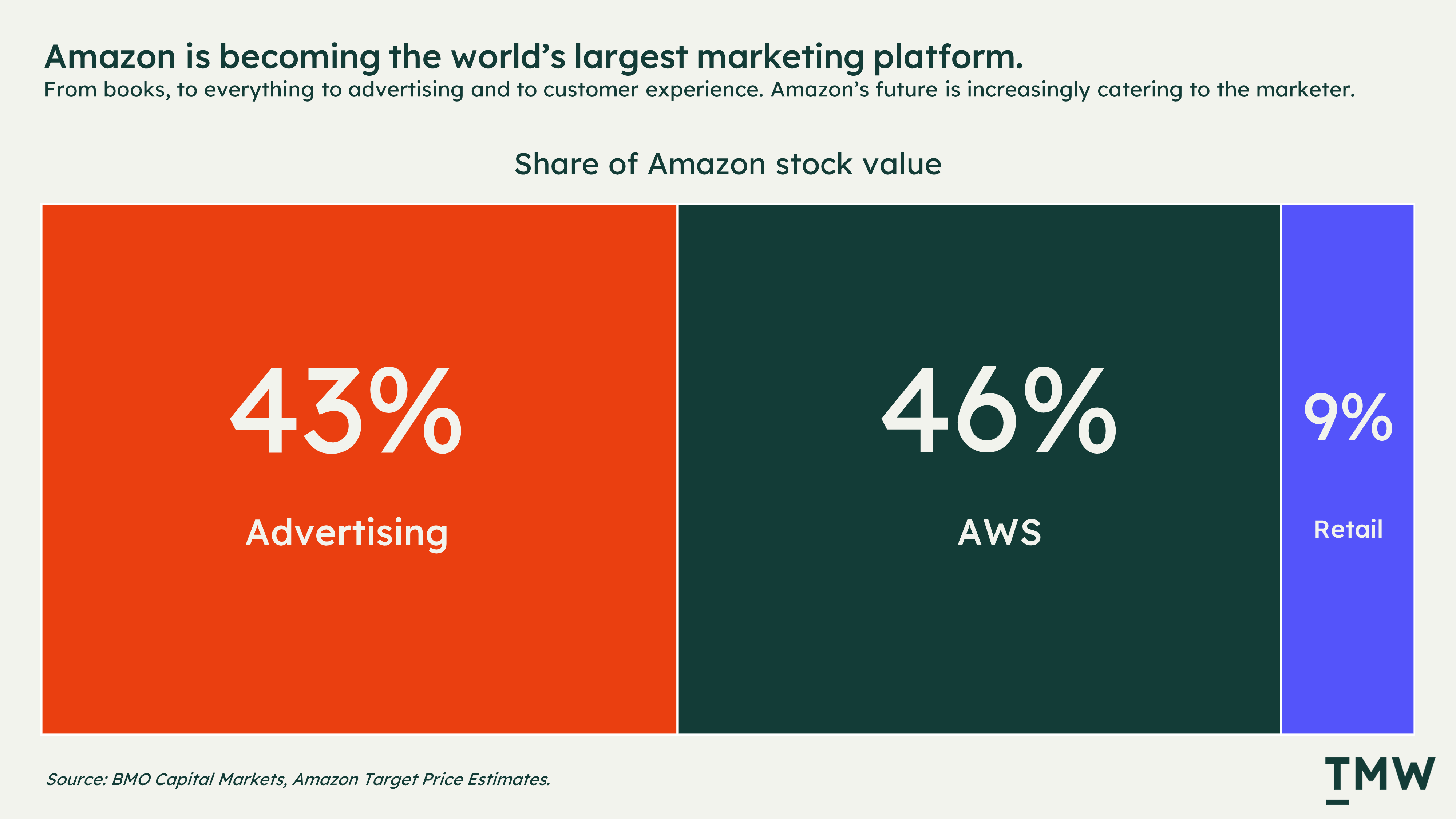

So what would Amazon do with HubSpot? Amazon has been building several tools for marketers as the company increasingly moves into the advertising space. The Amazon Marketing Cloud platform, which is the technology layer to buy ads on Amazon’s network of websites including retail has scaled to a point that 43% of Amazon stock value comes from advertising. This is almost as much as the entire AWS business. Like in the early days of the internet, Amazon transformed from a bookseller into The Everything Store, and before our eyes, the company is transforming again into the world’s largest platform for marketers.

So why is this important? And what does it have to do with HubSpot? Amazon has been building tools on the other side of the advertising fence for years. Products like Predict, and Pinpoint are both extensions of the AWS ecosystem that seek to help brands build experiences for customers. However, the tools haven’t taken off in a major way. AWS is still a cloud infrastructure company, and if you talk to any enterprise Martech buyer, they won’t be having AWS on their marketing cloud vendor list anytime soon.

If Amazon is rapidly scaling the advertising side of their business, the next logical step would be to move into owned channels, like sales, email, SMS, and web experiences. HubSpot offers products for all of these channels and has cemented itself as the champion of small to medium enterprises. In this way the acquisition would make sense, it gives Amazon a way to move into this market and give customers a potential capability to link advertising efforts with customer experience, sales, and marketing.

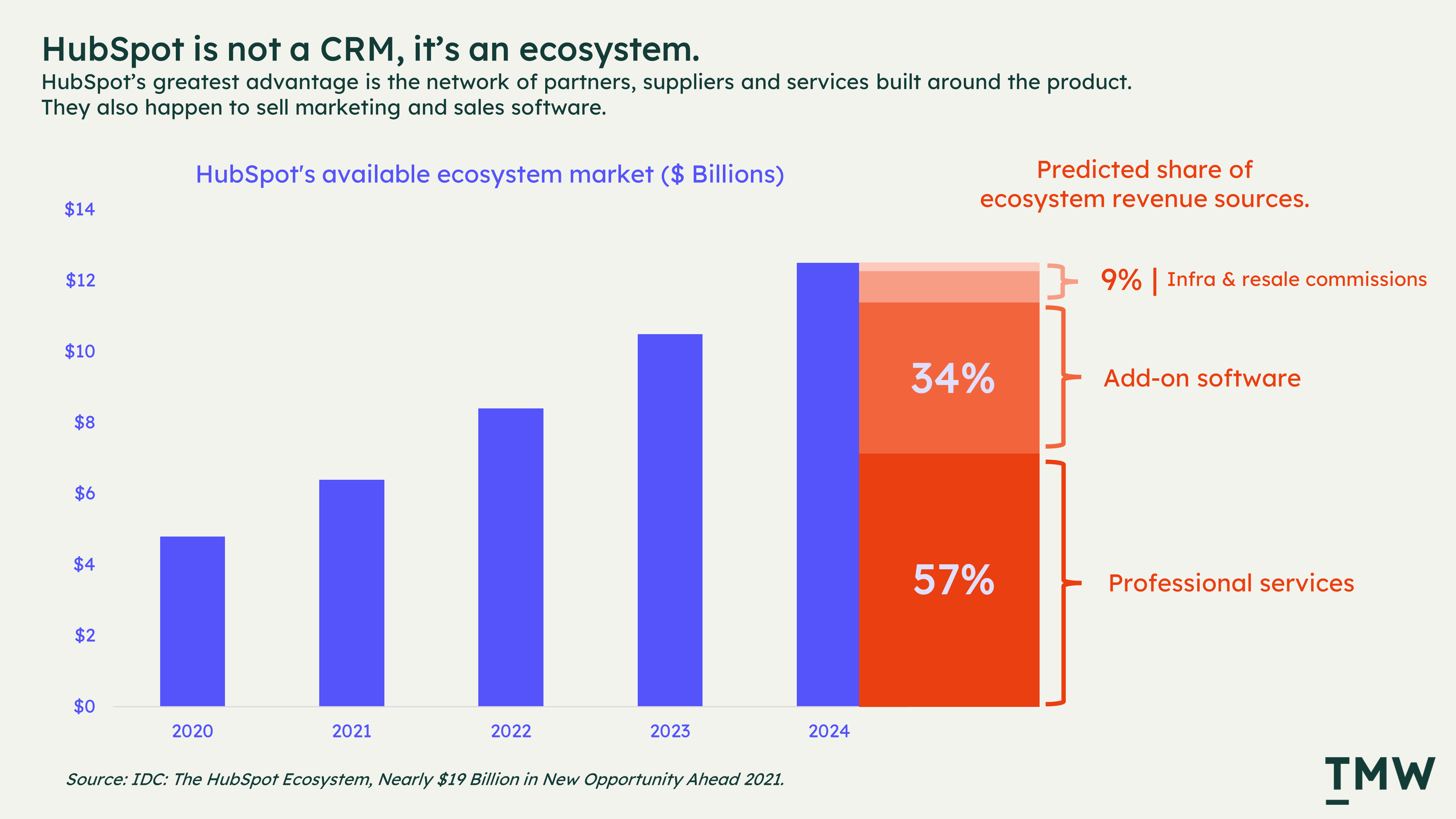

It’s not only the technology that would make HubSpot an attractive acquisition target. The company has a thriving ecosystem of apps, service partners, and sellers, which has the potential to drive more than $12 billion in revenue within the marketplace by 2024. There are many people who rely on the HubSpot platform to remain open and available to marketers to integrate apps and find agencies to service the software.

It’s this web of partners and ecosystem participants that could create an entirely new upside for the AWS business. All of these participants rely on cloud computing, and by owning the substate of technology, you have captive app developers who wouldn't mind being on the same infrastructure as HubSpot.

The real opportunity for Amazon, however, is to maintain a competitive edge in ascendant platform trends. Google, Microsoft, and Facebook are all making moves into the customer experience space, from acquiring customer service tools, to launching CX platforms and building features to activate customer data. For Amazon, entering the customer experience realm with HubSpot would help the company hedge against cloud competitors, squarely because marketing suits are notoriously sticky and hard to replace.

Just like my friend who changed career paths, acquiring a CRM and marketing platform might help Amazon to get closer to facilitating how brands generate revenue. Right now Amazon controls revenue outcomes for a vast share of online retailers, but not B2B companies that rely on salespeople that sell services, software, or physical goods. These salespeople rely on a CRM to make decisions about their customers, and for Amazon, facilitating those decisions through extending their capability is an important step in a potentially new market.

For this reason, regardless of how a HubSpot acquisition might play out, this is a strong signal that the landscape of Martech will increasingly coalesce around a few larger players. Maybe Big Martech™ might become a thing, but let’s hope not. Links: Acquisition report.Advertising is Amazon’s main business.Amazon and merchants.AWS CX case study proof point. Who’s using AWS?Will Amazon buy HubSpot?IDC HubSpot ecosystem report.HubSpot reaches $1 billion revenue milestone.

📈Chart Of The Week

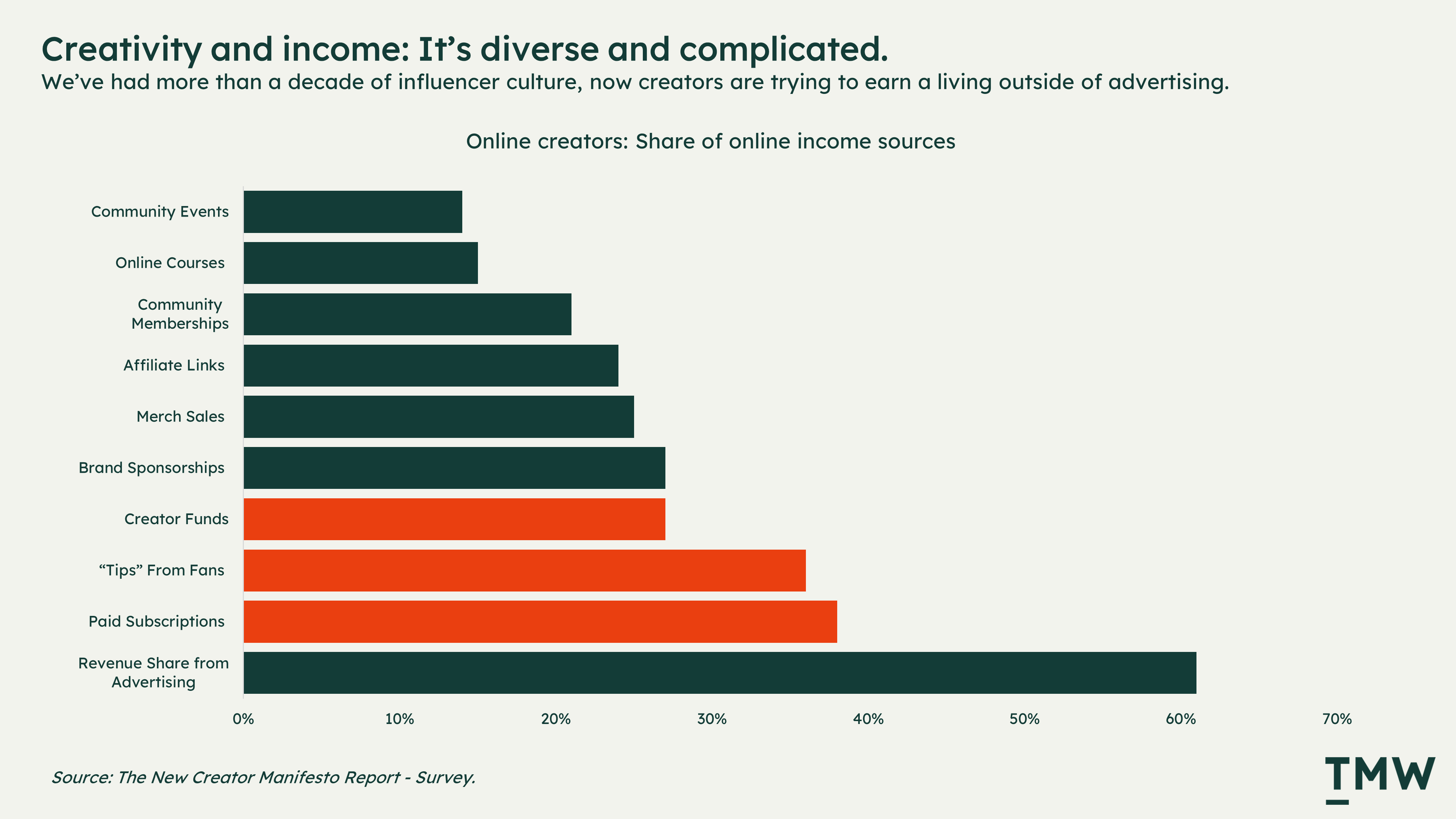

The new creator manifesto. There’s been an interesting trend in the user-generated content space. The early 2010’s gave us social media influencers, and the majority of them burned out from keeping advertisers happy. Then the pandemic happened, and now creative people are building their own brands and generating revenue in diverse ways. Income derived from advertising services still looms large, but patronage, paid subscriptions, and venture funds are all ascending. Link

📰 Latest Developments

Kickstarter is moving onto the blockchain. Crowdfunding is going through significant change and this kind of proves it. The company has announced that they are building their platform through open source, and are making a big bet on cryptocurrency as the future of “internet money.” This could also just be a marketing exercise to appeal to tech audiences who are more crypto-native. Link

Criteo acquires IPONWEB. The depreciation of the third-party cookie is driving the majority of this. The deal is big, more than $380 million, but extends the capabilities of Criteo in significant ways and moves the company into the first-party and contextual spaces. Link

Universe raises $30m. This company is working on a web development tool you can use with your iPhone. There’s been significant traction since launching last year which is a strong indicator that the way we do web development is changing. Link

📚 Reading

How Shopify uses Google Cloud. Over Black Friday, Shopify was processing 30 terabytes a minute on the platform. A good read on the approach to infrastructure, integrating Shop Pay, and setting up for scale. Link

The empty promises of Web3. Both of these reads are contrarian perspectives on the hype surrounding the Web3 movement. Is decentralization a positive thing for the internet? Is the tech any good? Is digital ownership reliable? What problems does the Web3 movement solve that existing platforms don’t exactly? All good questions to be asking. Links: I have my DAOts. Say no to Web3.

TikTok can read your mind. The NYTs have access to internal documentation explaining the high-level rule sets of TikTok’s algorithm; how it weighs interactions and the various content pathways the system will take a user on. This company is perhaps one of the most effective in keeping people on devices and in the social network, so there’s plenty to learn here about the decisions and trade-offs to build it. Link

🔢 Data & Insights

Compressed commerce. WPP on changes in consumer behaviors, particularly how buyers transition from the search and discovery phase to purchasing. The gap between discovery and purchase is getting shorter, and people are shifting to finding one good retailer and just buying as much as possible from them. Link

Adobe on holiday spending. Online consumers have spent $109 billion so far. 🤯 Link

The state of digital commerce. Gartner is saying that brands that invest in marketing technologies are more successful when transitioning to D2C or pure-play online commerce business models. Surprisingly B2B brands are more impacted than others. Link

💡 Ideas

The cloudless cloud. The vast majority of enterprise companies are still using on-prem solutions instead of the cloud. And then there are companies that are deploying entire platforms in the cloud, and there are the engineers who will devote their entire lives to understanding Kubernetes. Maybe in the future, the cloud will take the same place as the streets and highways in the physical world – an internet commodity that everyone will need to use. Link

An argument against SEO. The BOM (Bureau of Meteorology) is an Australian government website that doesn’t care about Google at all and literally breaks all of the SEO rules like mobile responsiveness, site load speeds and even having an SSL certificate. This is an interesting case study into how much Google controls how people build websites. Link

The 2022 trends are coming! It’s this time of year where every consultancy and their dog release their version of 2022 marketing and digital trends. Someone created a public Google Drive collecting all of them in one place. Thank me later. Link

✨ Weird and Wonderful

The art of the one-pager. Link

Should dogs own smartphones? Link

Artificial intelligence but with humans who are paid $2 an hour. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.