TMW #007 | Supermetrics, Facebook's in app tracking, the fifty billion invested in SaaS

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

Here's everything you've missed in marketing and technology this week 👇

👌Top #3

🦸♀️ Supermetrics closes $40M round. This company is in a really interesting space. If you've never used Supermetrics before, the product is a really straightforward data integration tool mostly geared towards startups and small businesses. For example, you can create a connector from your Facebook ads into a Google data studio report with $30 and a couple of clicks. Companies like Supermetrics have been gaining momentum, particularly as more brands are now reliant on big tech platforms for their data and insights needs. What Supermetrics has done is productized the API tool and geared it towards marketers and people with little experience in development. If you've ever exported your Facebook data, you'd know how many millions of rows you have to deal with in an excel sheet, which creates a problem for which Supermetrics offers a solution. The company has been around since 2009 and has been piggybacking on social media, search, web analytics, and data warehouse growth as demand for easy to use integrations increases. A $40m raise doesn't seem like a lot, but it speaks volumes in the traction that no-code API connectors are getting in the space. Other players like Segment and Zapier are also solving this problem and productizing the future of platform data integrations. However, I don't think that integration engineers will be out of a job anytime soon. Link

🔨 Apple puts the hammer to Facebook's in-app network tracking. In a stunning move, and in the shadow of recent anti-trust hearings in the US, Apple's latest iOS 14 update will restrict the use of some identity data usage for Facebook's app. This means that Facebook stands to lose the capability to join together a user's Facebook identity with its off-platform activity. This is a win on a privacy front, yet Facebook stands to lose hundreds of millions of dollars in advertising revenue and advertisers will have a harder time targeting users that fit their segments. The impact is directly tied to the Audience Network arm of Facebook, which represents $3.4 billion of Facebook's $70 billion overall share of digital advertising. This is one of the more significant blows to the beleaguered social media company, and surprising that government regulation has had nothing to do with the limitation of Facebook's capabilities here. This is what happens when a marketplace, platform, and a device bundle are owned by the one and same company - an incredibly powerful influence over the companies that exist within Apple's ecosystem. Apple is now exerting more control over app developers along with Facebook, such as Fortnite, Hey (remember the email app?) and others because Apple does not have nearly as much incentive as the app developers to keep their apps in the store. What does this mean for marketers and advertisers? Well, it will likely mean that the 720 million people using an iOS device will be harder to reach, which means your ad dollars will have to work harder to reach them, this also means the device and operating system targeting in Facebook will have more features. I would not be surprised if Facebook let every single one of their users know about the limitations of not selecting android devices moving forward. Link

🦘 Australia's design thinking shortage. Australia is about 5 years behind the rest of the world when it comes to technological advancement in the technology space. This is especially true when it comes to design thinking talent and accelerated due to demand generated by COVID-10. In 2017 IT spending in Australia was looking to top $85 billion in the year and since then things have grown even further. One of the biggest shifts in recent years has been to incorporate design thinking into product and technology development, which includes UX design, service design, product strategy, user-centered research, interface design, and service design and experimentation strategy. Now in 2020 every company with a digital presence needs these people thinking about the customer experience of technology, but finding and keeping experienced talent in the space is harder than ever. A lot of this has to do with universities being historically behind the eight ball in training for design-centered skills and is compounded by the general unclear nature of the field. "Oh, jenny works in UX, let's assign her this service design project" goes the lines of thinking, not knowing that those roles a very very different. Yes, there's overlap in a lot of design roles, but as Australia's talent pool increases over time people will start differentiating themselves as more opportunities exist for specific skill sets. I foresee the broad-based positioning of a UX designer to become less important as people drill down into specific value streams for design. The accelerating of COVID-19 forced remote working has also meant that Australian companies are tapping into a more global workforce, which also means that getting skilled up in specific disciplines, differentiating your design skills, and pitching yourself as someone who solves very specific design problems will be even more important. Link

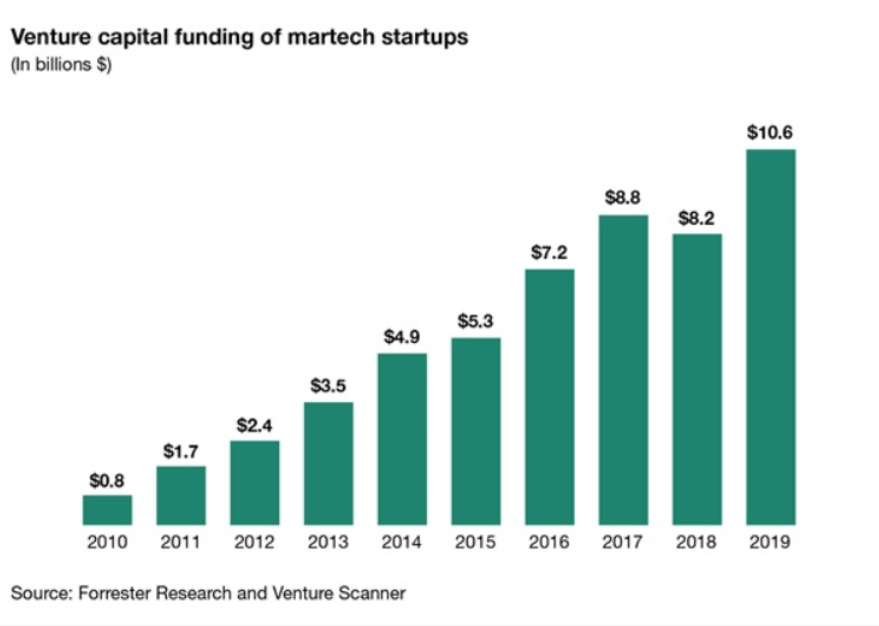

📈Chart Of The Week

In the past decade marketing technology companies have raised more than $50 billion in venture capital. Without a doubt, it's been a good decade for those in the SaaS space as many have literally grown up with their peers during the 2010's wave of digital proliferation, advertising, marketing automation, cloud infrastructure, and social media. Will we see the same level of investment in the coming decade? I would hope so, yet the Martech environment is now seriously crowded which means that historically when there's been vertical fragmentation (many companies trying to do the same thing), along with lackluster customer experiences makes it easier for large players to gain even more opportunity to take up market share. Bigger players will be focusing on making it easier to choose an already trusted brand. This is partly why Salesforce recently acquired Evergage - by targeting a highly fragmented market (CDPs) with an understood solution and integration into the Salesforce cloud, this just reduces choice friction for consumers. It kind of reminds me of social media in 2008, back then we had Friendster, Myspace, and many others. Now we really just have Facebook. We are now living in the Martech equivalent of 2008, and this next decade will be about consolidating market share, not distributing it.

📚 Everything Else

Air Asia leverages "bleeding edge ML tech like gradient boosting machines on top of customer data" as their stage 1 homepage personalisation strategy. Link

A chatbot to help people talk about sexual violence is tech doing good. Link

Afterpay is expanding into Europe. Link

An insider's view of Tiktok's strategy to attract media agencies. Link

Foursquare is building outdoor ads that predict the best times to avoid crowds during COVID-19. Link

KFC dropped their "finger linking good" slogan amid COVID-19. This pandemic is doing weird things to brand marketers. Link

Facebook's CMO is stepping down after spending 2 of the firm's hardest years at the helm. Link

An expose on the very small team running Wikipedia. Link

A great piece of analysis on how consumer spending is changing due to COVID-19. Link

A resource to make workshops less soul destroying. Link

Until next week!

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Friday plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.