TMW #041 | The event tech hangover, Google and Shopify partnership, and the value of connected shopping

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I try to look to where the industry is going and make sense of it all.

👋 Why you should sign up

There are two versions of TMW, the full version for subscribers and a 50% version that's for everyone. You are reading the 50% version. Sign up to get the full version delivered every Sunday for this and every TMW. Learn more here.

👋 Hello and welcome to new subscribers from Singapore, The United States, Australia, The United Kingdom, India, and The Netherlands!

The event technology industry in 2020 produced 400% more companies than 2019. That’s a lot of startups. This week I look at what the event technology industry will look like as the pandemic subsides globally and how innovations in virtual events will continue to persist.

I also dive into the Google and Shopify partnership and what it means for product discoverability and why connected shopping experiences can drive 10 times more revenue than only digital channels.

Also, I take a trip down memory lane to a true internet relic - The 1996 Space Jam promotional website 🏀

🎤 New MSoM podcast up this week. It’s called the optimisation step change, a conversation with the folks at Omniconvert on how the AB testing and optimisation industry is changing. Link

👇 Here’s everything you’ve missed in marketing and tech this week.

✍ Commentary

🎥 The event tech hangover. The closest analogy I could find for the event technology industry right now is waking up in a random apartment after getting blackout drunk at an underground rave - you’re hungover, can’t remember anything, and have lost your wallet. It’s been a wild ride over 2020 as the pandemic forced everyone to do events online, leading to significant growth for online event technology (the rave). But now as people are being vaccinated and can meet “IRL” growth on these platforms is clearly stalling or dropping off altogether (the hangover). First some stats, from 2019 to 2020, in just one year, the amount of event technology companies started increased by 400%. That’s about 832 companies across 11 categories including event management, virtual events, event booking, audio response software, conference apps, and event check-in technologies around the globe. From a small village of tech companies innovating in events, to a crowded marketplace of many similar types of technologies, event platforms have become a significant part of the marketer’s toolkit. But it’s not only the number of tech companies founded last year, it’s also the size of some of these companies. Two of which innovated quickly were at the right place at the right time and benefited from the basic human need to connect. These are Hopin and Clubhouse, the king and queen of pandemic apps. 👑 👑

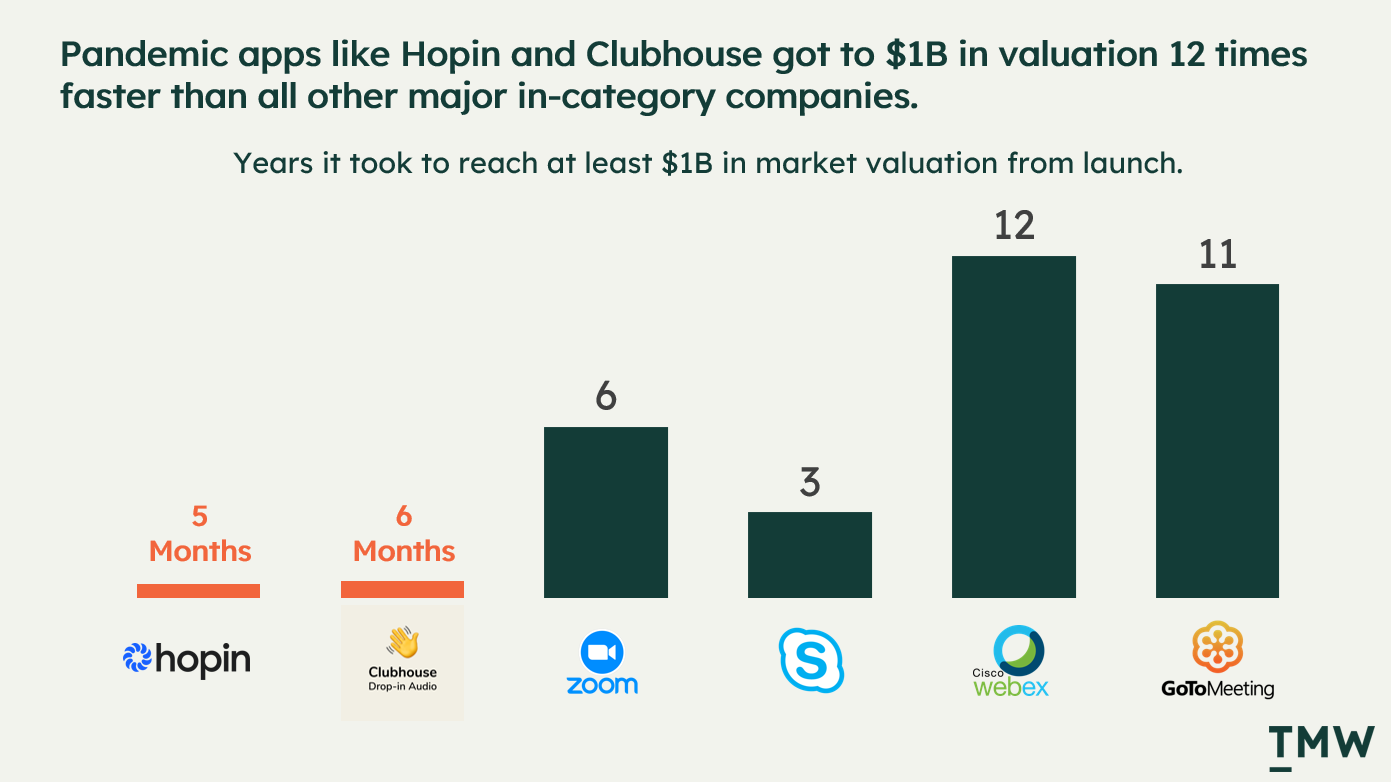

These two companies reached a $1 billion valuation in less than six months after going live, 12 times faster than all other major event and conferencing software. Hopin is an interesting company as they took a same-same-but-different approach to how online conferences should be experienced. The company went from zero users and a team of 6 to more than 400 employees and 80,000 customers in six months. And while they were developing the technology in stealth mode months before the pandemic, they saw the opportunity and ran with it. The technology is interesting as a re-imagination of how online events should work. For starters, the company takes some of the serendipity of in-person events and replicates it within the platform, by having a main stage, breakout spaces, and a homepage with all the content you would need. A Lot of events on Hopin are designed to foster more conversation and connection between guests while housing all the key interactions with customers in one place. From ticketing to reminders and one-click entrances into the events, they’ve somehow been able to disrupt both Eventbrite and Zoom at once by bundling a variety of services into one platform. They also built the platform with an open API from the start, another interesting feature, knowing that most people running events would like to integrate things like a CRM or lead management software into the platform. Hopin took the bundling opportunity to virtual events as there wasn’t a platform for the holistic online event experience, just various point solutions that all did their one or two things really well.

Clubhouse, however, is a very different story, this app I believe benefited especially from US lockdowns addressing a need to connect socially and in groups with an audio-only social media platform. The app has had some truly strange audio rooms, like rooms where people just sit in silence, to people pretending to be goats. Which brought with it some interesting creative expression in audio. But the app really gained user growth by hosting events with celebrities like Mark Zuckerburg and Elon Musk. Audio social media became an event app that tried to mimic the dynamics of group events, but it took too long to scale, didn’t support Android for the first 12 months, and has now seen a significant decline in active users. This is due to what Shan Puri called the “interestingness problem.” The app does take effort and time to find great content, but because it's synchronous content only, you have to be lucky enough to come across something interesting, the more a user doesn't find anything interesting, the less the app is used. I personally cut off notifications and totally forgot it existed. Clubhouse will have the worst hangover of all pandemic apps, as it was an interesting problem to solve during lockdowns, but cannot compete with real parties and events.

Event technologies will take a larger role in the way marketers, especially in the B2B sector, will engage with customers. The ability for a company to jump from localized events to global is now even more accessible thanks to products like Hopin that deliver good UX, integrations and are manageable end to end. For this reason, the apps that have clear use cases for reaching global audiences will become the mainstay of the event technology industry. Why host a 60 person event at the pub down the road when you host a 600,000 person event online with a global audience and have it all recorded and transcribed for asynchronous consumption and follow-up? Moreso, the ability to measure interactions (did this lead to going to workshop 1 or 2?) and personalizing some of these experiences is one of the more interesting aspects of event technology and one area that is still very new. I get that hallway conversations at conferences are important, but people just tend to replicate this anyway with sidebar chats and debriefs. And while the technology replicates some of the functionality of in-person events, there is still some magic there as people communicate more meaningfully in person. It will be interesting to see how technology changes the value proposition as events go from bedroom to ballroom. Let's hope that some of the innovation isn’t lost. Links: EventTech supergraphic. Hopin’s growth story. Why Clubhouse will fail.

🤝 Google and Shopify partnership. This is an interesting partnership, one that was expected and a strong indicator of where ecommerce is going. The story is this - 1.7 million merchants that are powered by Shopify stores are going to benefit from increased organic search presence with Google as the company continues to compete with Amazon. The idea here is that Amazon is increasingly ramping up it’s advertising business, which already has a strong position for organic search. About 44% of US shoppers will turn to Amazon first for product searches. Over the last year, Google has slipped from 34% of consumers to 28% indicating that Google has to do something, anything, to continue to defend it’s Adwords business. And so, a Shopify integration makes a lot of sense here.

The partnership, however, goes beyond boosting organic search for Shopify stores; there will be new native tools to plug into Google’s other suite of products like Google maps for local discoverability. The eCommerce industry is continuing down a path of platform aggregation as the largest players take the vast majority of shopping solutions, leaving many smaller platforms out in the cold. The only problem I see with this partnership is the reliance on the individual merchant’s ability to do organic search well. And as we know, a lot of Shopify is made up of side projects, and small local businesses. It’s not like Google is going to optimize the H1 tags for these merchants. And because of this, Google will most likely remain in the #2 spots for product searches in the US but also globally. Amazon has literally a decade-plus of experience in keyword optimization, which allows them to offer a strong value proposition for retailers everywhere - come to us if you want to reach customers. Links: Google and Shopify. Amazon share of search. Ecommerce 3.0.

📈Chart Of The Week

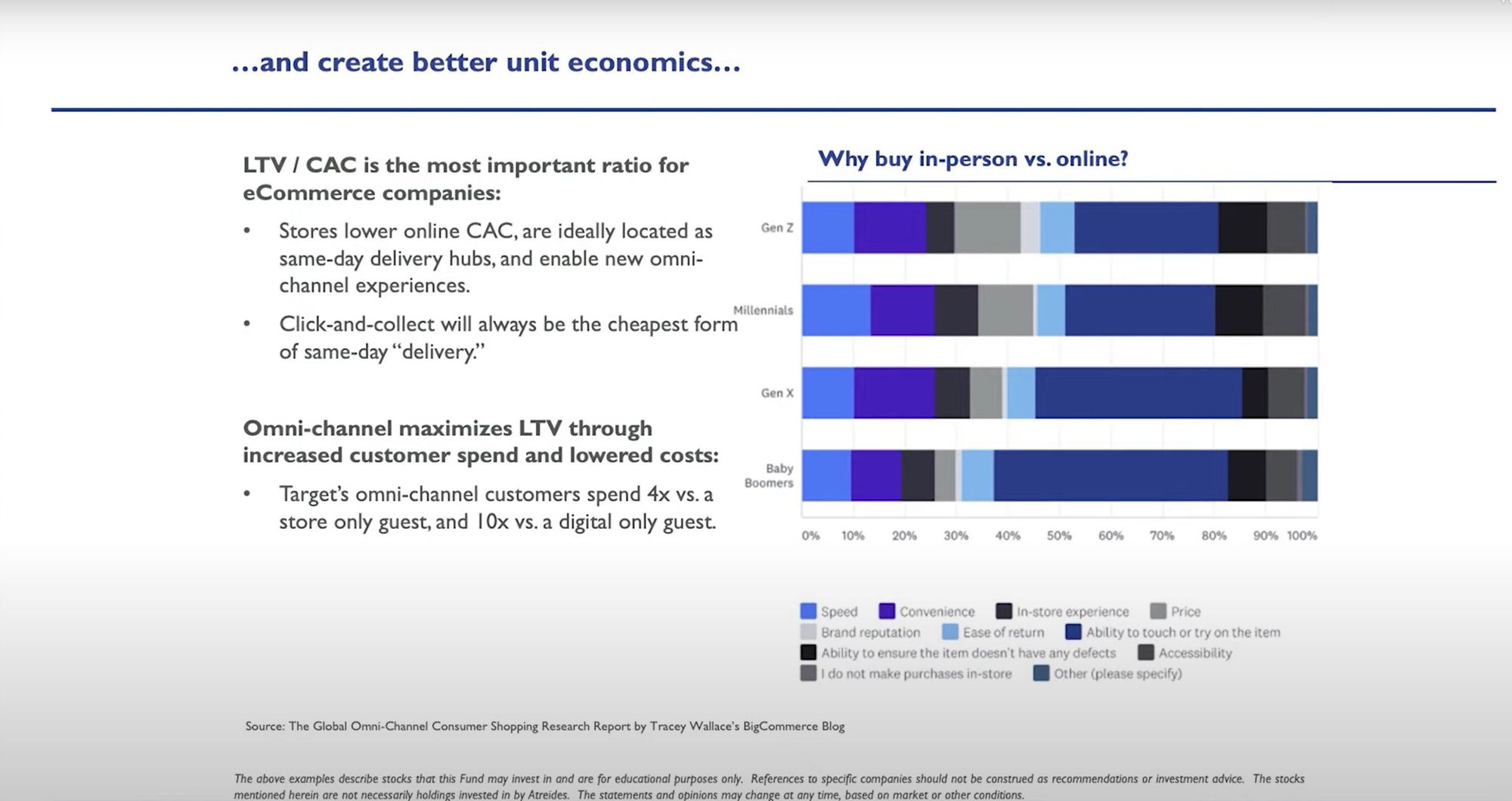

🏬 The value of “connected stores” This report is a good perspective of the value of the underlying concept of omnichannel - enabling a customer to pick whichever combinations of shopping and fulfillment options they want across a purchasing journey. Recent stats from Atreides management looks at the important trends around how online and physical stores can be orchestrated to deliver significant gains in purchasing behavior. One case study is Target which figured out that customers who engaged across both physical and digital channels spend 10 times more than digital-only. Link

📰 Latest Developments

Klavio raises $320 million. The company is now valued at $9.5 billion. Not bad. The company was an early entrant into the eCommerce email marketing software business, competing with the likes of Mailchimp, Drip and to some degree Emarsys. Now they have 70,000 customers and have built a significant foothold through PLG and freemium models for eCommerce business. Yes, they are beneficiaries of COVID-19, but it’s also true that they are winning in the category. Link

Google launches AI service. Vertex has been under development for quite some time, but now the product suite aims to help companies to build and train AI models with 80% fewer lines of code than other platforms, like Amazon SageMaker. The product is targeted to solve the problem of data quality and reliability. Research indicates that about 87% of implementation failures are tied to data issues. How are they going to solve it? Integrate Google Cloud with Vertex under a unified API. Link

Pega releases no-code features. The idea of the citizen developer, allowing non-technical people to ship technology solutions like apps, is the core of Pega’s latest product strategy. The company builds decisioning and analytics products, and so this pivot to no/low code products for app development seems more like an experiment than anything else. If any company can actually afford Pega’s products, they can also afford to hire a few developers. Link

📚 Reading

Automation vs effectiveness. When it comes to building out marketing technology strategies, there’s often a balance most companies must choose between when building a path forward. The balance is this, should your technology optimize towards automating communications with customers, reducing human error, and achieving scale, or should you be focusing on how effective your communications are by investing in analytics, and decisioning technology? The dream state is both. But for most, getting to both is a nightmare. Link

Is attribution about to break? A perspective from the likes of Adobe and IAB on the state of advertising attribution for Mi3. The idea is that most publishers have a “once in a lifetime” chance to fix their data strategies to pivot to first-party data, as almost every browser and mobile application are now closing the door on critical tracking capabilities. My only question is this - wasn’t attribution already broken? Link

Apple’s data compromises in China. This is more of a macro view of how Apple is handling data privacy in different countries. The high cost of doing business in China is that Apple has had to build data centers that are managed by the Chinese government, which then controls the data collected on Chinese users of Apple products and services, and enables the censorship of content and the types of apps available to consumers. Apple’s philosophy on privacy is not one size fits all. Link ($).

🔢 Data & Insights

Fan analytics by Spotify. For the first time, Spotify has released statistics on fan behavior on their platform. Some very interesting insights, like how people in Latin America are the most likely to find new music. This is very important for the music industry as Spotify pivots its value proposition to musicians and podcasters - the platform exists primarily not for monetization, anymore, but for distribution and reach. This analysis project is a step in the right direction. Link

Out-of-home (OOH) advertising and online shopping. Very interesting research out of WARC highlights that in the UK, doing OOH lifts online searches, engagement, and purchases by more than 63% compared to non-OOH exposure. Out of home is a collective term that relates to billboard, bus shelter, poster, and physical activation forms of advertising. This is a big violation of the “offline doesn’t work” narrative. Link

For love or money: Loyalty research. Some comprehensive research conducted for the Australian market tracking the changes in the loyalty marketing industry, including consumer attitudes, the impacts of COVID-19, and loyalty program structures. Revealing statistics include a 400% increase in mobile app linking to payment cards since 2017. Link

📫 It's better over email

Sign up to get the full version of every TMW newsletter delivered every Sunday evening.

💡 Ideas

Social commerce in Thailand. A fascinating read on the prevalence of social commerce in the country. Social commerce is the integration between social platforms and online stores as a tightly bound ecosystem for shopping. A shocking 70% of all eCommerce in Thailand comes through social commerce platforms in a country where 80% of the population uses social platforms at least 2 hours a day. Link

Google is building holograms. A very interesting project was announced this week which takes video calls to the next level. Using 3D mapping and specialized hardware, Project Starline enables a hologram-like appearance of someone as if they were physically there. Great for family and friends, probably not so great for sales calls. The project is now live in a number of Google offices. Link

Uber’s subscription service. Announced in Australia, Uber Pass is a monthly subscription service that takes 10% off rides and an Amazon Prime like $0 Uber eats delivery fee, including groceries. This was a no-brainer for Uber as subscription is having a peak moment across many verticals like retail. Reminds me of sunk cost fallacy strategy - Get customers paying $15/ month so they by default have to choose your service. Link

✨ Weird and Wonderful

Apple’s ATT ad offensive. Apple is a master at spinning a situation to its own benefit. The company’s latest ad is a hilarious dig at how advertisers track you on the web. A solid piece of propaganda to promote AppTrackingTransparency as the best solution for privacy in apps. Link Also read Wired UK’s take on how Facebook’s advertising business is collapsing under ATT.

Space Jam: An internet relic. So, there’s this Twitter bot that will check if the 1996 Space Jam website is still online, every day. The movie, starring Michael Jordan and the Looney Tunes cast, was an instant classic when I was a kid. The website is a view into the internet before Google existed, with all the original content unchanged since it went live. Site. Analysis. Bot.

Dark pattern tip line. A website that shames other websites by accepting “tips” on when companies use deceptive UX, design, and messaging practices to manipulate people into doing things online. It’s a huge database tracking every dark pattern you can think of. Link

Stay Curious,

Make sense of marketing technology.

Sign up now to get the full version of TMW delivered to your inbox every Sunday afternoon plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.