TMW #111 | Unbundling Salesforce

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

San Francisco’s tallest building is the Salesforce Tower. It was completed in 2018 and is an inescapable visual landmark. If you sail out into the open ocean out of the bay, the last thing you see on the horizon is the Salesforce Tower, a symbol of the influence enterprise marketing and sales technology enjoys in Silicon Valley.

Like the tower, Salesforce is a monolith in Martech. Towering over every other enterprise-focused Martech company, Salesforce became and continues to be the market leader in CRM, even owns the $CRM public market ticker and grew into a $290 billion market cap company at its peak in 2021. There is no other company in marketing technology like Salesforce.

The once-eager startup launched out of a one-bedroom apartment is now an enterprise giant that the IDC is forecasting will create 9.3 million jobs, and $1.6 trillion in revenue by 2026. The company has come a long way from its early days of battling against the Software category with browser-based CRM technologies, with a challenger status and fresh message of “No Software” going up against the once-then giants of business technology – Oracle and Seibel.

But with a broader tech downturn and a new generation of technology founders rising in Martech, will Salesforce continue its vaunted place in the Martech industry? Or is time for something new and different? What would it look like if customers start moving away from Salesforce to newer and smaller companies? Let’s find out.

1-800-NO-SOFTWARE

Marc Benioff’s brilliant insight for Salesforce was not that business software was a thing of the past, but that software can move to the browser and be more useful with the internet. By pioneering the movement to SaaS (Software as a Service), Salesforce brought new ideas to the market. It’s not obvious to those of us that weren’t around back in the early 2000s, but the concept of SaaS was entirely novel, full of risks, and a complete departure from purchase-once business models.

Instead of asking customers to install clunky software, they leveraged the only piece of software needed – your browser, and instead of asking customers to pay a once-off fee, Salesforce was one of the first companies to charge subscription fees for their products. The company pioneered the idea that the browser can be powerful enough to carry the enterprise-grade weight of sales and customer service for thousands of customers.

Recurring revenue models and leveraging the browser were the twin insights that changed the direction of every single software company working on marketing technologies. Even their website in 2000 had a hotline you could call, strategically set up as 1-800-NO-SOFTWARE to drive home the point of differentiation.

From the beginning, Salesforce was a master of marketing. But the company caught a wave of innovation with web-based tech and quickening internet connectivity speeds. Internet Explorer and Mosaic were allowing more application-like development on their platform, while internet speeds made it more accessible for heavier workloads.

Evan Armstrong talks about it like this:

“Salesforce argued that a radically different product delivery method, coupled with a novel monetization structure, signified that software was over. But this is… obviously wrong because they are literally selling software. What they actually meant was the previous software paradigm was over. And in that regard, they were right. There are 1000x more software companies now than there were in 2000 (and the size of those businesses are way larger too) but going from licensed/on-prem to subscription/cloud was a significant shift, rapidly changing the power structure of numerous markets.”

That was just over 20 years ago. In 2023 the technology innovation (the browser) and the business model innovation (subscription pricing) have incrementally gotten better over time. But there are shifts in the tectonic plates of data infrastructure and customer experience technology that may bring a whole new paradigm for companies to work towards. In the midst of a tech downturn, Salesforce seems to now be on a precarious shift into a new era of tech, one that might cause disruption not yet seen before.

What is Salesforce?

Now, Salesforce, after spending an exuberant amount of money on new acquisitions, particularly over the COVID-19 pandemic, is facing somewhat of a reckoning. Over the past three years, Salesforce acquired messaging app Slack for $27 billion, Tableau for $2.6 billion, and also took a big bet on the customer data platform category with the acquisition of Evergage. If anything, Salesforce has been on the acquisition warpath, building and diversifying its influence over the technology industry.

The company continues to be a CRM business, but over time with accumulating acquisitions and the build-out of its sprawling cloud services (service, sales, marketing, platform, apps, NFTs, vaccines). This makes Salesforce kind of like an endless maze of products, marketplaces and solutions that address the problems that the company creates for itself.

Like most enterprise software companies, an ever-increasing diversity of strategic focus coupled with expensive acquisitions and extravagant marketing can make anyone think, as this gentleman so eloquently put it:

what the fuck is salesforce

— timmygami eyes (@deliclit) January 25, 2023

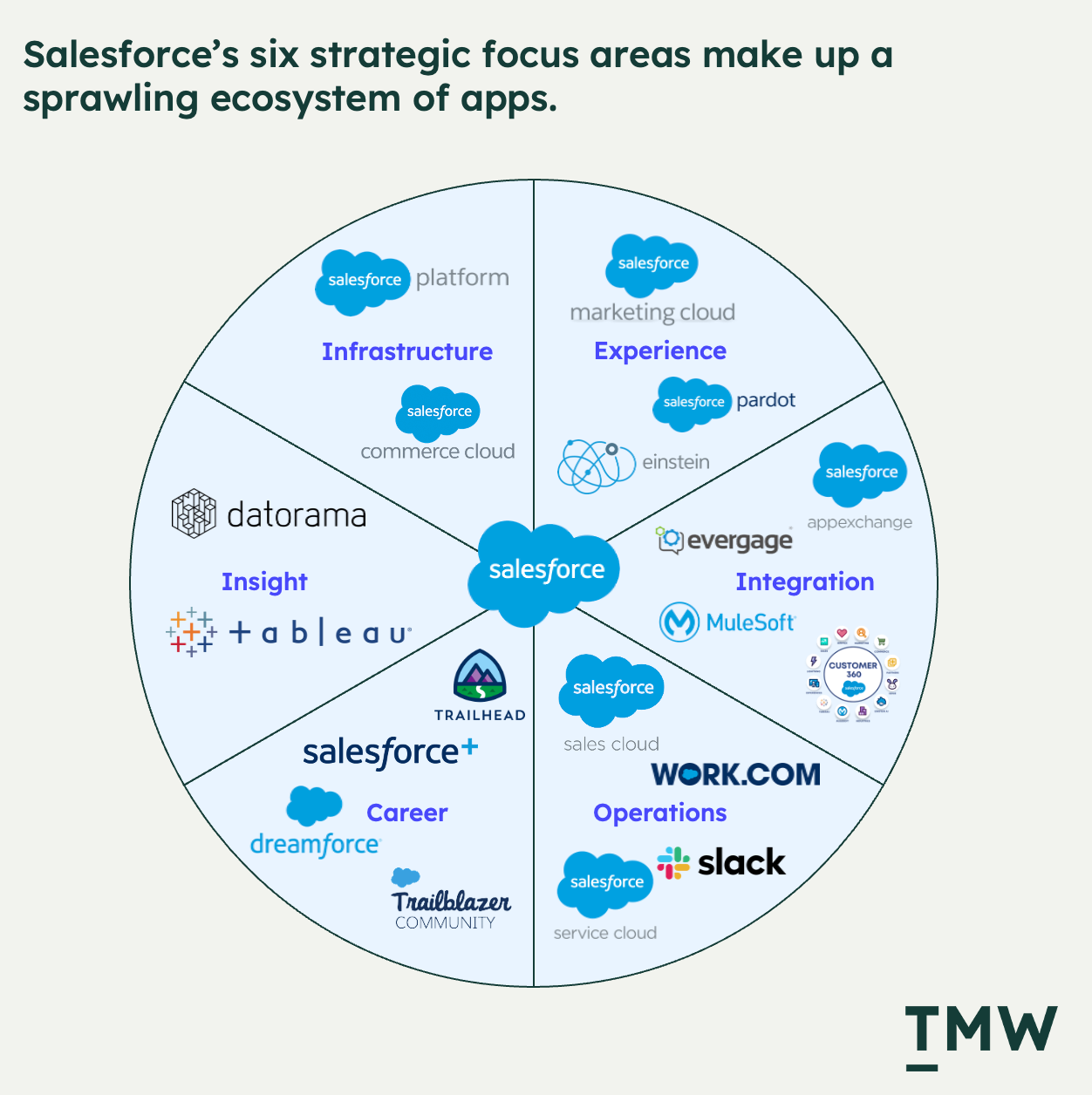

Salesforce organizes its various products into “clouds”, which group around various business functions (sales, service, marketing). But the customer orientation of these various cloud products doesn’t give you the proper insight into the totality of what Salesforce is. I have found it more helpful to think about Salesforce as a company grouped around six strategic focus areas.

From experience (marketing cloud) to operations (CRM, Service and Slack), to insights (Tableau), career (Trailhead and Salesforce+), integrations (MuleSoft, AppExchange) and infrastructure (Commerce Cloud), you can see that Salesforce has created an internal ecosystem of interdependent apps. People will learn on Trailhead to use Marketing Cloud, but will also need to integrate CRM with Marketing Cloud, say with Mulesoft or Customer360. And around and around the merry-go-round spins.

In this way, Salesforce seems more like six different companies solving very different needs for their customers. As a product of the company’s long history, and opportunistic acquisition tendencies, Salesforce is the very definition of sales-led product strategy – if customers are asking for it, we’ll build or buy it.

Change, it’s in the cloud

Salesforce’s sprawling platform and powerful ecosystem is now facing a market downturn along with the rest of the tech industry. After laying off 10% of employees, with a pledge to reduce spending by $3 to $5 billion this year, the company has appointed a new board of directors while activist investor firm Elliot Ventures joins, joins adding additional pressure to the company. The shareholders of the company are circling and wondering out loud about the future of the company.

There’s now a lot of hmming and ahhing about the strategic acquisitions of Tableau and Slack that seemed well valued during the market rally of Covid-19, but now appear to be exorbitantly expensive bets in a popped tech bubble. But in reality, the company has very strong operating metrics. The company has always been cash flow positive, and towards the end of 2022, has generated $6.3 billion in cash on a 21% operating margin, and has a large portion of debt which is low interest and long-term.

I don’t think we’re seeing a crisis for Salesforce, but a much-needed correction to shore up shareholder confidence. Layoffs do that, and so does selling off assets like Slack that are yet to be integrated into the Salesforce ecosystem, along with reducing real estate spending. Yet the thing that might need to change is its sales and marketing expenditure.

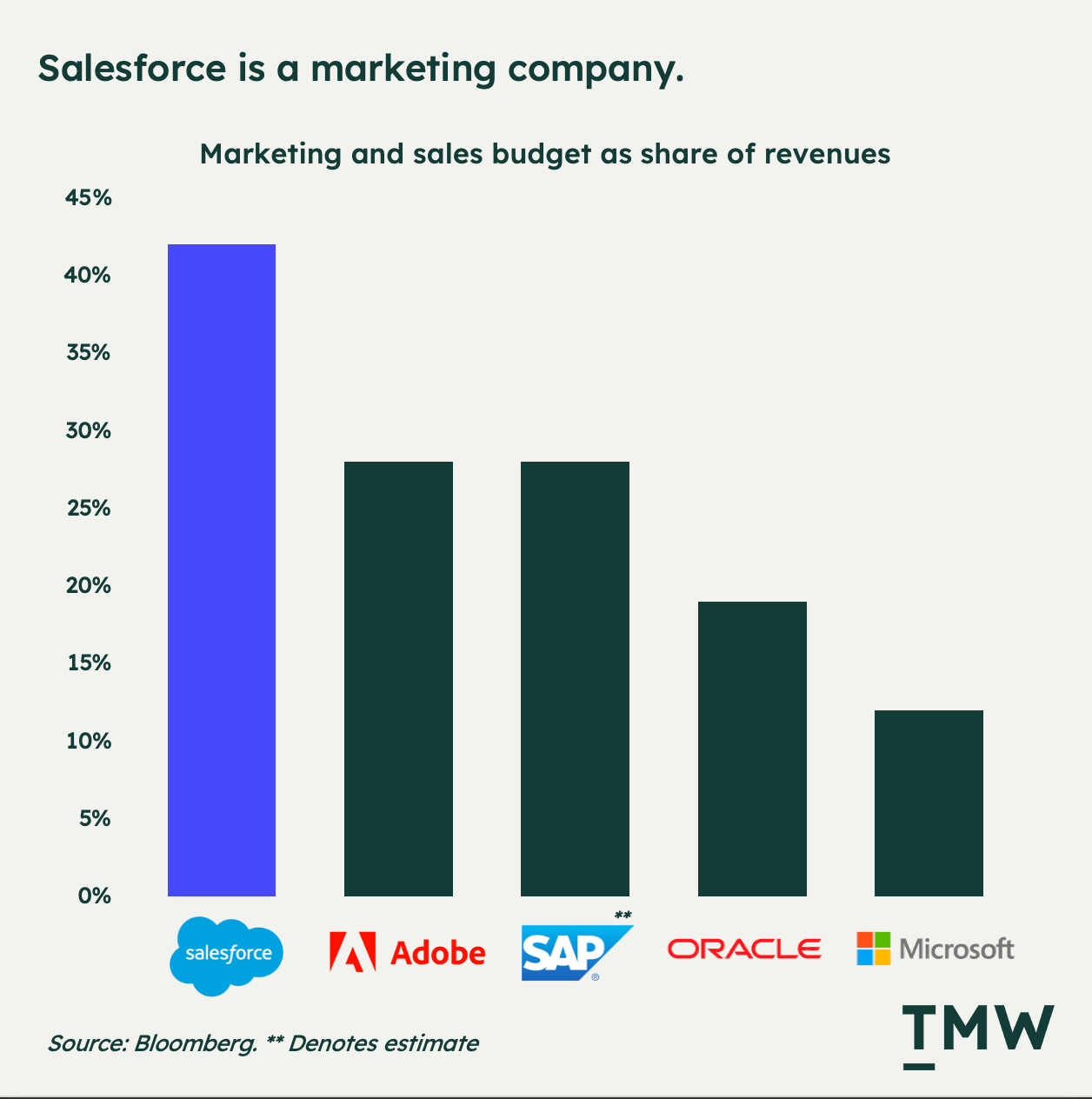

Salesforce in essence is exuberant and unwieldy with how it spends on marketing. Bloomberg suggests that Salesforce's total marketing and sales budget is almost 50% of company revenues. Out of all enterprise software businesses, Salesforce’s marketing and sales budget is almost double that of any other company in its category, and triple that of Microsoft. Change is coming for the big blue cloud.

The Salesforce Career™

There’s a reason why Salesforce spends so much on marketing and sales - Salesforce sells something more powerful than technology. It sells aspiration.

The key to Salesforce’s success is tying the success of the company with the success of people’s individual careers. The company’s focus on education and community over the past twenty years, but particularly since 2015 when Trailhead was introduced, has brought about significant innovation (and spending) into how technology companies train people to use their technology.

To make SaaS work in business, it takes skills-building and proven experience; Trailblazer does that, but then it did something surprising along the way. The company turned a customer success tool (education) and coupled it with community to create a whole new product – career success.

If you spend five minutes reading through Salesforce’s content pages for Trailhead, and the stories of Trailblazers, it’s not even about what you’ll learn – it’s about the career you want to have. Dreamforce by extension is also driving a similar narrative – you go to Dreamforce to learn, connect with others, build skills, and find partnerships.

But you also go to tell everyone else at the office about the Will Smith speech or Alicia Keys concert while you were there. Dreamforce is something in between a vacation and a business trip.

By focusing so intensely on the career of the corporate sales rep, or the systems administrator, or the CRM marketing manager, the company became a key enabler in helping these people climb the corporate ladder and keep them there. Even the golden hoodie, given out every year by Salesforce’s CEO underscores this – they are in the business of transforming people’s career, not merely selling CRM software.

Beyond the software, training is the key staying power the company wields in the market. If you compare how AWS provides its training, it feels more like a grueling bootcamp with a demeaning drill sergeant. But with Salesforce, it kind of feels like a friendly summer camp, but with cocktails and the company of rich and nice people.

If anything, Salesforce turned boring software education into a corporate luxury product. Want to get headhunted for lucrative new roles? Or a seat on the board? Then you better suit up into one of those Trailblazer hoodies and get cracking on those short courses.

Because of this, Trailhead has been an undeniable success story. There are now more than 1.8 million in the learning program, with its Dreamforce attendees reaching 171,000 people at its peak with 16 million viewers.

Generating significant revenue from courses, exhibitors, and attendees for a variety of events, the company shouldn’t be taken as only a technology business; if we must unbundle Salesforce, its education and community products are a major part of how the company operates.

Unbundling the monolith

According to G2, there are now more than 800 CRM companies, 360 marketing automation platforms, 230 analytics products, and 360 customer service solutions. To call Martech saturated is an understatement – we are inundated with a whole host of solutions that squeeze into various industries, niches and buyer types. Like every company facing the constant threat of displacement by new technologies, Salesforce is no stranger.

Like CEO Marc Benioff, talking about Salesforce, once said way back in 2002, “There were the leaders, but Oracle displaced them. The same thing is going to happen again. It’s the beginning of a brand-new technology and business world.” The same is happening again. But how?

In a way, Salesforce has always been unbundled. The only way the various acquisitions and built tech are unified is mostly by their branding. Slack is not really integrated with Sales Cloud yet, and if you compare a similar acquisition Google made of Looker with Salesforce’s Tableau, there’s a stark difference in how the platforms are integrated. The same goes for why it’s hard to get Marketing Cloud to talk to the CRM, or to set up triggers based on Service Cloud customer updates.

That’s why the 2020s present a big challenge to Salesforce. With optionality for the customer comes a decrease in pricing power, and Salesforce has a lot of competition. And the greatest of the competitors are not the all-in-one marketing suites of Adobe, Oracle or even Microsoft: they are the companies focusing on decoupling experience from platforms, orchestration from data, and learning from vendors.

Salesforce’s greatest competitive threat is not the sales executive at Adobe working on an RFP response; it’s the skilled-up CRM manager with the know-how to do it better with multiple and (cheaper) applications and a strong API infrastructure.

Salesforce can be unbundled into smaller, more focused products across the platform. And in a way that could lead to better business outcomes. A few examples:

- Experience: Decoupled and headless orchestration and marketing automation platforms like Braze and MessageGears enable companies to bring data in from a variety of sources or fully leverage core customer data

- Integration: Syncari, Hightouch and RudderStack are all building versions of composable and decentralized technology that isn’t reliant on a marketing cloud or a CRM provider

- Operations: Modular and extremely flexible approaches to workflow and CRM from notion to all-in-one sales and service apps like ClickUp and Monday.com, can make it easier to build the kind of workflow you want, without having to wait for a Salesforce developer to send an invoice

- Career: While Trailhead, Salesforce+ and Dreamforce are all focused on a single product category, talented staff are increasingly organizing around the discipline of the work instead of a single vendor with communities like MarketingOps.com, RevGenius and LXA.

- Insight: Analytics tools are often more powerful when not fully reliant on a single platform for operation and data ingestion. Rows, Domo and Snowplow all represent a new generation of flexible analytics and insight tools

- Infrastructure: Salesforce’s strong point is its matured architecture for commerce and development. But companies like Commercetools and Snowflake are offering options to customers that don’t loop them into a single ecosystem for everything they might need

The thing that Salesforce has not countered yet is how data, analytics, orchestration, marketing and digital teams are all maturing within organizations. And with greater skills and experience in data technology, enterprise companies are becoming more sophisticated with how they are using platforms.

It’s been a long slow march for large companies to come to grips with their own data, integration and technology needs, but the times are indeed changing. Marketers are moving away from Marketing Suite training wheels into more strategic positioning about the role of technology in the customer experience, ultimately, the return on investment. And the focus of the 2020s is on flexibility, adaptability and scale.

The data warehouse is quickly becoming the hub for more sophisticated technology companies and has perhaps the greatest opportunity to unbundle Salesforce into numerous, and integrated apps. This month a report from Twilio Segment from their own customers suggests that the data warehouse is now the 2nd most used destination for the Segment CDP.

There’s a reason for that – the cloud data warehouse is becoming an increasingly flexible way to store data for activation and enrichment. And there’s an entire cottage industry supporting this. If it’s dbt that allows you to manage customer identities on top of the cloud data warehouse, or Hightouch that allows you to activate it, or Rows that makes it easy to analyze data on top from any data source with flexible, no-code API infrastructure. The trend is going in the direction of greater mastery over core data sources through modernization, integration and activation.

Commenting on how this shift is working itself out in Martech, Scott Brinker suggests:

“The idea of “composable software” is that smaller software building blocks — API services, functions, data sources, UI elements, etc. — can be assembled together like Lego pieces to craft tailored digital processes, employee experiences, and customer experiences that are unique to your business. They can be easily rearranged as needs shift and opportunities arise.”

That’s why we’re seeing this shift towards greater advancements in composable architecture and the modern data stack. Flexibility and agility are important, and Salesforce is yet to come to grips with this change. Even their own Customer 360 positioning is just a clumping together of existing cloud services. The aim is to make it easier for companies to integrate all customer interactions into a seamless view, but the reality is that no company will ever solely rely on Salesforce for all of their data and services.

In reality, Salesforce is not going anywhere soon. It’s likely to weather the current storm as it did in all previous economic downturns, but the conversation needs to be had – the world of Marketing Technology would look very different if you slapped another logo on that gleaming tower in downtown San Francisco. Or perhaps a few logos.

A shift to a more modular approach to Martech can unlock a significant amount of talent in the industry. But also create new problems. Salesforce created a mental map for how we think about customer relationship management, and it’s still their bread and butter even today.

But in my view, unbundling Salesforce would unleash a whole new wave of enterprise innovation in how brands interact with their customers and build the necessary data and operational infrastructure to support it. In 2000 the future was SaaS, but in 2023, the future is flexible.

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.