TMW #137 | Ads networks are everywhere

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

Ads networks are everywhere

Investor and Adtech analyst Eric Seufert has been saying something repeatedly over the past twelve months. So much so that it’s become a catch phrase – Everything is an ad network.

This phrase could mean a whole bunch of things, but I’m starting to see what Seufert wants to convey with it. Lately, there’s been an announcement almost every single week of some large, multinational company getting into the ad business. Netflix, Disney, Expedia, Amazon, Intuit, Roblox, and Activision are just a small sampling of a larger trend of companies that really don’t have any business getting into the ad business, but here they are.

These are the companies we used to stream video from, seek out for travel accommodation, and let our teenage kids play on the weekends. Now they are all turning into advertising businesses; a land grab to convert online attention into new sources of high-margin revenue. Some of these announcements are obvious – I mean, Amazon’s strategy to grow revenue through ads is brilliant; but some of these announcements are completely bizarre – Intuit, for instance: what is the creator of TurboTax and QuickBooks doing on that list?

Seufert explains the rationale for why companies of all verticals, shapes and sizes are getting into ads. With the broader shift to a more private web, this is opening up space for new players to get involved:

“Each of these companies sees an opportunity to layer ad impressions atop first-party data so as to facilitate proprietary ad targeting. This opportunity is new: while Google and Facebook took 89% of all ad spend growth previously because their enormous reach provided them with the leverage and ability to ingest third-party data from advertising clients, now those advertisers are wrapping their arms around their data and monetizing it.”

This essay is an addendum to last week’s piece: TMW #137 | An Internet of silos. In that essay, I describe the unanticipated problem of the fracturing of the web for consumers and marketers as third-party cookies slowly go away. An internet of silos is one of many second-order effects in the wake of third-party cookie deprecation, but another shift, is companies seizing the opportunity to create scalable, high-margin revenue through ads. From the essay:

“The pressures for breaking down Big Tech are real. Heavy-handed regulation, lawsuits, and fines for the internet’s incumbents, the destruction of third-party cookies as the only open and distributed form of tracking, and even the slowness of enterprise internet companies that seem to kill more product ideas than they keep might be the best things to have happened to the internet in a long time. Only for the fact that in some of these areas, the online playing field is reset and marketers are forced to be creative once again, instead of paying Google or Meta to grow their businesses for them.”

If the internet is indeed siloing, then what do those silos look like? In this essay, I want to explore why seemingly every major consumer and a few B2B brands are getting into ads and what those companies look like. From Intuit to WordPress to Roblox to Walmart and to Disney, there is a huge amount of activity that’s building around companies that have never run ads, but are uniquely positioned to start and scale up ad networks and media operations… And fast.

But the trend of bolting ads onto everything on the web is part of a broader shift to privacy, economic pressure, and also the growing digital capabilities and market maturity to actually pull off some great capabilities. I call it the perfect storm of COVID-19 leading to greater Martech capabilities and an economic crisis. So let’s dive in: first, what’s causing all of this hurry into the ad business?

Covid > capability > crisis

Elysium is my go-to illustration to describe the pressures and shifts as the web becomes more privatized. In the movie, the tension is all in the two different societies. The space society where the 1% live, and the society on earth that live in pollution and poverty. The open programmatic web is the 99%, filled with Made-For-Advertising (MFA) websites, conspiracy platforms, fake news, “churnalism,” and an endless sewer of UGC. This is the open web, where mayhem rules.

The 1% are all of the high-quality websites that have built up their own ecosystem of content, products and services. COVID-19 lockdowns became a trigger for a lot of companies to invest in things like CDPs, data streaming in and out of the data warehouse, and things like personalization and AB testing – the necessary ingredients to build a successful ad platform.

The logical chain for why we’re seeing so many random ad networks pop up is that for a lot of companies, they’ve built or are building up their data orchestration capabilities, and they need to point it at something. Advertising products is an obvious choice for a lot of these brands, as I mention in TMW #125 | When Martech and Adtech come together:

“It’s this powerful combination – the ability to harness data, create a valuable exchange for it with consumers, and then monetize that data with ads – that is the most promising aspect of Martech and Adtech coming together. And while I have my reservations about the wisdom of moving to first-party data as the next source for tracking people and targeting them with ads, there are a lot of benefits here too. When Martech and Adtech come together, we might just see brands become more focused on their customers instead of platforms, more cognizant of customers’ consent to give them more control over it, and more able than ever to compete against big tech for ad dollars.”

Jonathan Mendez called this trend “Amazoning” your own brand: the process of mastering data, identity and behavior to build something new and leveraging nominally useless resources - disparate customer data sitting in online stores, e-commerce transactional files, and email marketing platforms.

COVID-19 really accelerated the need for brands to build this kind of capability as consumers shifted their attention and spending online. Because of this, there was a 16% increase in Martech spending 2020, with a 21% increase in 2021, increasing to $18 billion.

But now we’re in an economic crisis. Last year saw the highest level of inflation in more than 20 years in the US, growth capital is drying up for companies building products because it’s become too expensive, and the need to find revenue to substantiate the incredulous forecasts of the digital economy in years to come, has led a lot of companies that have invested millions or billions into new marketing infrastructure still struggling to find the ROI beyond CX uplift and tactical use cases.

What this creates is a lot of pressure. Downward pressure, as the cost of doing business rises, but also opportunity to create new revenue sources using the existing Martech capabilities built during COVID-19. In TMW #104 | The rise of Retail Media – one particularly interesting area of growth in ad networks – this concept is playing out in real time.

Thinning margins due to inflation and rising costs is one the main drivers of why retailers are getting into media – its high margin, scalable revenue. It’s also why Netflix and Disney are also getting into the ad business – steaming margins are too thin, there’s too much competition, and with original content budgets running into the billions, finding customers and keeping them is getting harder on the web.

The capabilities are there, the maturity is there, the economic problems forcing the need to find new revenue are there; why not bolt on advertising to your online store, or your accounting software, or even Zoom calls? Well, there’s a problem with that - everyone is doing it.

Bring your own ad network

Building the plumbing so that companies can quickly scale up their own is becoming an interesting opportunity in Adtech: it’s creating a ripe opportunity for companies to build Adtech networks, and also for vendors to step in and provide the necessary infrastructure.

CB Insights is tracking the global retail media technology category and has found that there are now more than 139 companies working on the technology supply chain for retail media. One of the problems with this tech category is whether or not there’s going to be space to innovate. It remains to be seen how much of the category’s value is in the tech. Social media and search were tech-led advertising shifts, but retail has been around forever and selling ads in physical stores for just as long. Is retail media solving a tech problem or a content problem?

Still, retailers are opting to outsource and buy their way into the ad business. Which, while not directly innovative, is still a lucrative category for tech vendors to play in. One example of this is Macy’s partnership with The Trade Desk, opting to outsource all the critical audience, targeting and features, instead of building it themselves.

Companies like Moloco are literally building a company on this premise. As a retail media network as a service, the technology sits on top of existing e-commerce storefronts in order that retailers can activate their data for advertising use cases. Criteo is another example that saw a 50% increase in new business, with a growing division coming from retail media platform capabilities, one of the faster growing of the business lines.

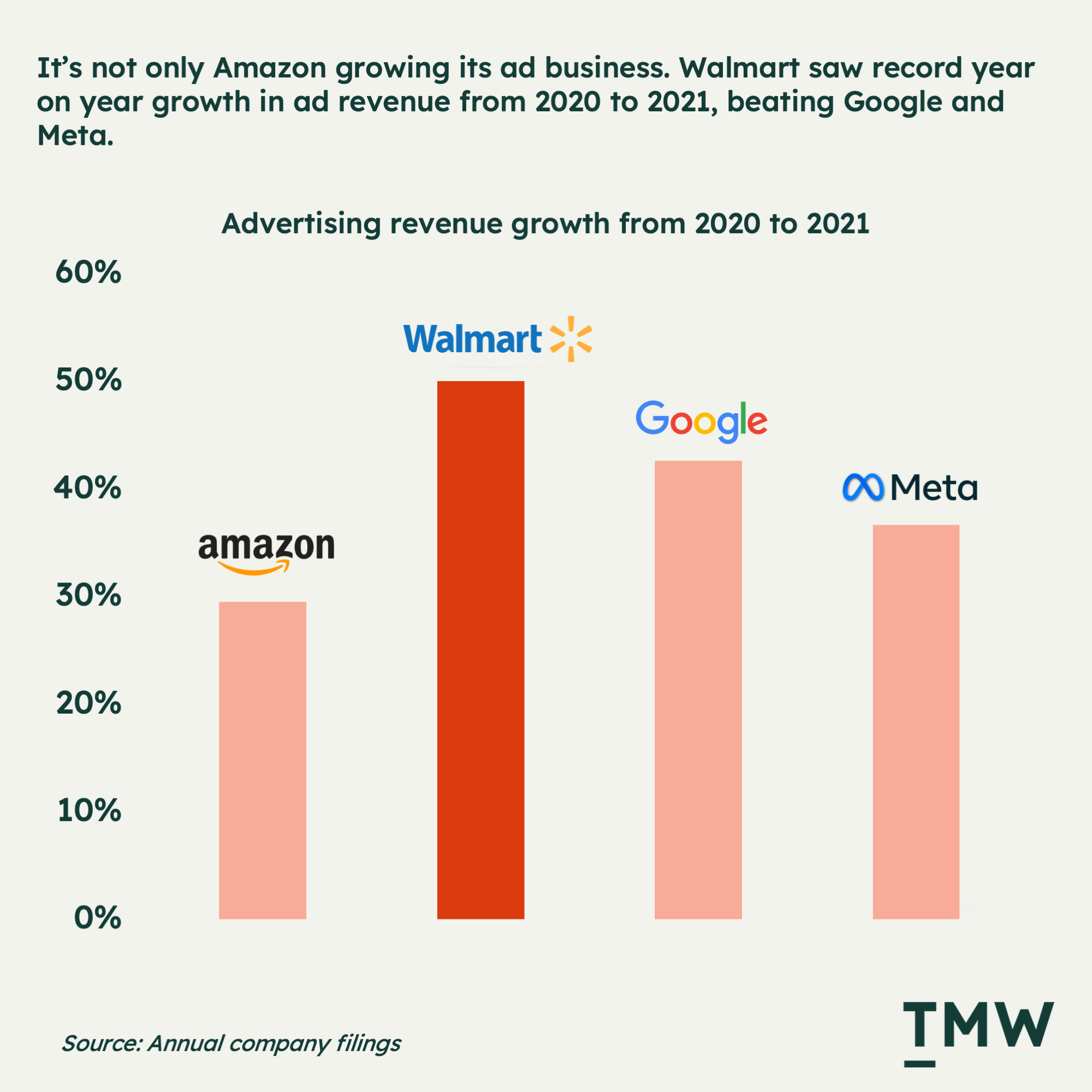

And then we have companies like Walmart:

Walmart has transformed from a retailer that leveraged the invention of the car to bring us big box retail stores you can drive to and do all your shopping at, to becoming a technology company that is seeing incredible growth in ad revenue. Even to the point now where Walmart sells apps in the Salesforce App store.

All of these signals tell me that the ability to orchestrate data in companies to provide personalized experiences is now a mostly solved problem. There’s a tech category that services this, legacy brands are growing in their capabilities, and there’s not a lot of innovation. The next phase is converting the more sophisticated brands into ad networks, which will increase the demand for bring-your-own type technology that will enable more companies to do targeted, programmatic advertising faster and at scale.

Content, Commerce, Code

From streaming to content to retail to software to marketplaces, there are now dozens of new advertising options, with plenty for marketers to tap into. But if you’re a marketer, do you embrace these fledging ad offerings? How do you choose?

Well, there’s one way to think about it, and it’s to spread each new type of media offering into whether it's serving a core media offering around commerce like Amazon and Walmart, content like Roku, WordPress and Netflix, or most interestingly, code, which is monetizing the surface areas of popular consumer and business apps.

Right now, there is a lot of limitations. Many of these networks don’t have a self-serve portal and require an agency; some of the analytics services are rudimentary; and some just need time to build scale, such as Netflix’s low-cost tier, which have attracted more than a million new accounts, but is now on the long crawl to getting anywhere near the kind of scale you see on CTV and other video platforms like YouTube and TikTok.

But there are angles on the different shapes and sizes of these new generation media networks. Starting with the most bizarre: Intuit’s media network. Intuit will be a real case study of running ads within software customers have already purchased, which could be a very exciting opportunity for startups and consumers. If Intuit took 20% off my bill and from time to time I’ll have to watch a video ad or see a banner ad, that’s not a bad deal.

Taking cues from the mobile advertising industry, which delivers software, games and services based on an ad model, bringing this into B2B SaaS could open up a lot of interesting opportunities. The real question here is how this could tie into software ecosystems and partnership models. If your company Is running a marketplace or integration model with other apps, that seems like a good starting point for building media placements and finding advertisers.

After all, we have platforms like Clearbit and ZoomInfo that have solved customer identity enrichment for B2B; there’s a lot already in place to do highly targeted ads in a business context. Demandbase’s DSP solution is one of these platforms that are working in B2B Adtech. There’s a lot already here for ad networks to build up around the more popular apps.

Think Salesforce with an ad-supported tier, or AWS with ads in the database console, or Zapier with a tier that runs suggested products when setting up an integration. The sky really is the limit here; the problem, as with retail media, is to get the customer experience right. But price really matters in B2B and seeing a few ads to save on a contract doesn’t really seem like a far-off possibility. There are certainly enough apps being used by businesses these days to justify media networks in software.

Streaming is another interesting angle. Again, driven by the reticence of users to buy multiple streaming subscriptions, there are similar incentives. But with the rise of all of these different streaming providers, it’s starting to look a lot like cable, but on your laptop.

So far, it’s too early to tell if these attempts to build an ad network around the streaming proposition will be a commercial success. For instance, CTV is a growing category of smart advertising on an old medium, but this time with big data, real-time activation pipelines, and shoppable content like Roku’s Shopify integration. But the market is growing. For example, Disney’s partnership with Hulu has roughly 25 million subscribers on the ad-supported tier.

Commerce is the last of the three main players building ad networks on the open internet, and it’s one of the fastest-growing spaces across the media landscape. Every e-commerce business that’s big enough in the US is building a retail media network of some shape and size, with some forecasts suggesting that Retail Media spending will soon surpass CTV next year.

Commerce, content and code are the three fault lines in which a new generation of advertisers is emerging, which makes all of this so exciting. Marketers are spoiled for choice, but with that choice is a sharp learning curve for everyone – the ad network owner, the marketer, and the middleware in between.

The new commodity: Ad networks

With all of these dozens of new ad networks, the obvious question to answer is if there’s going to be enough demand for all of these small and medium-sized networks. As I argued in last week’s essay, the success of Meta and Google was in standardizing most of the web’s traffic into a portal for targeting users and running ads. It was a single window into a vast population of potential customers. Now that’s going away.

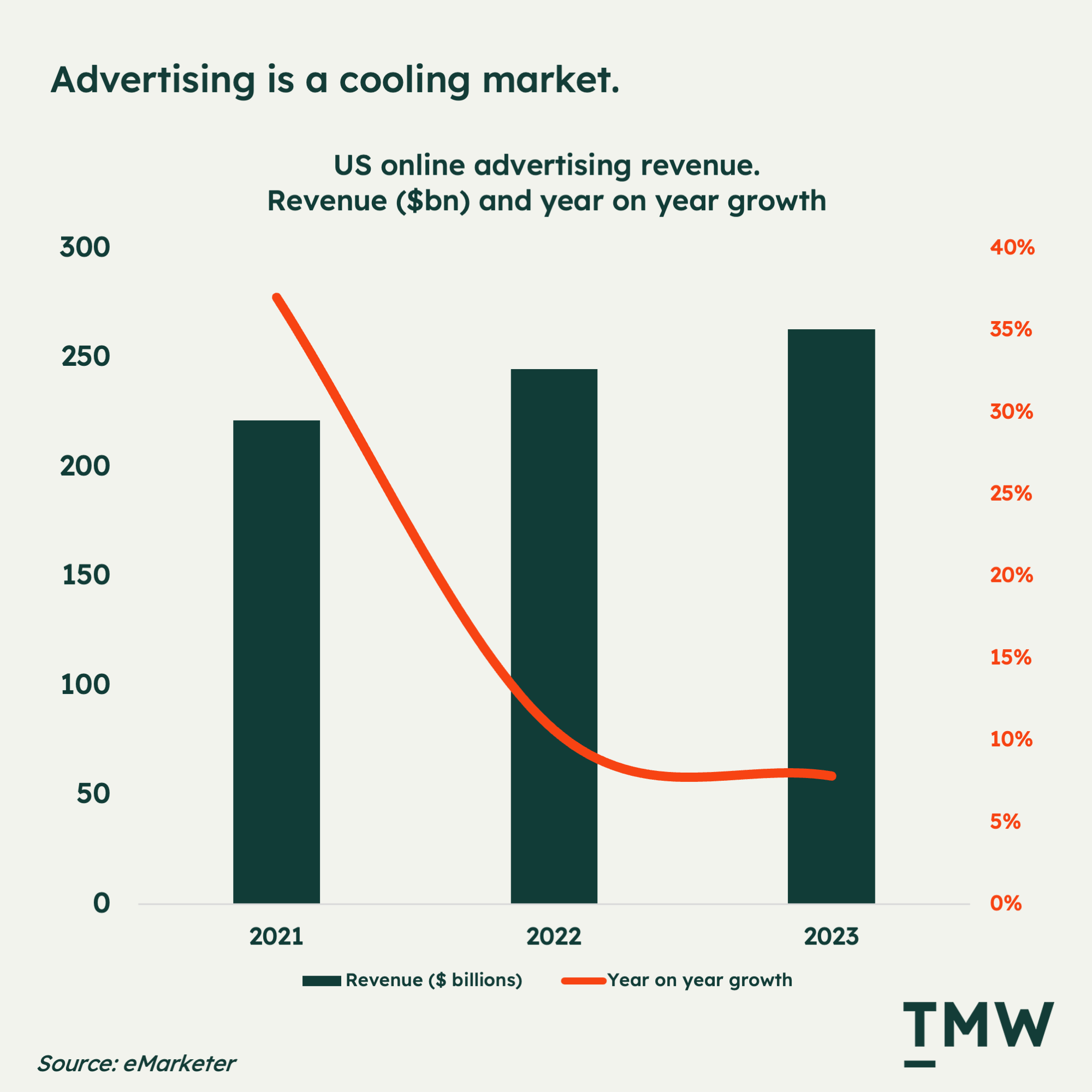

And as legacy advertisers like Meta rebound from a few low-performing quarters in advertising, you have to ask the question: does a Macy’s, or Intuit, or Netflix ad offering make any sense in the face of declining demand for advertising? According to eMarketer, while ad revenue is growing in the United States year on year, the growth rate has flatlined, making it even harder to attract ad dollars in a highly competitive space.

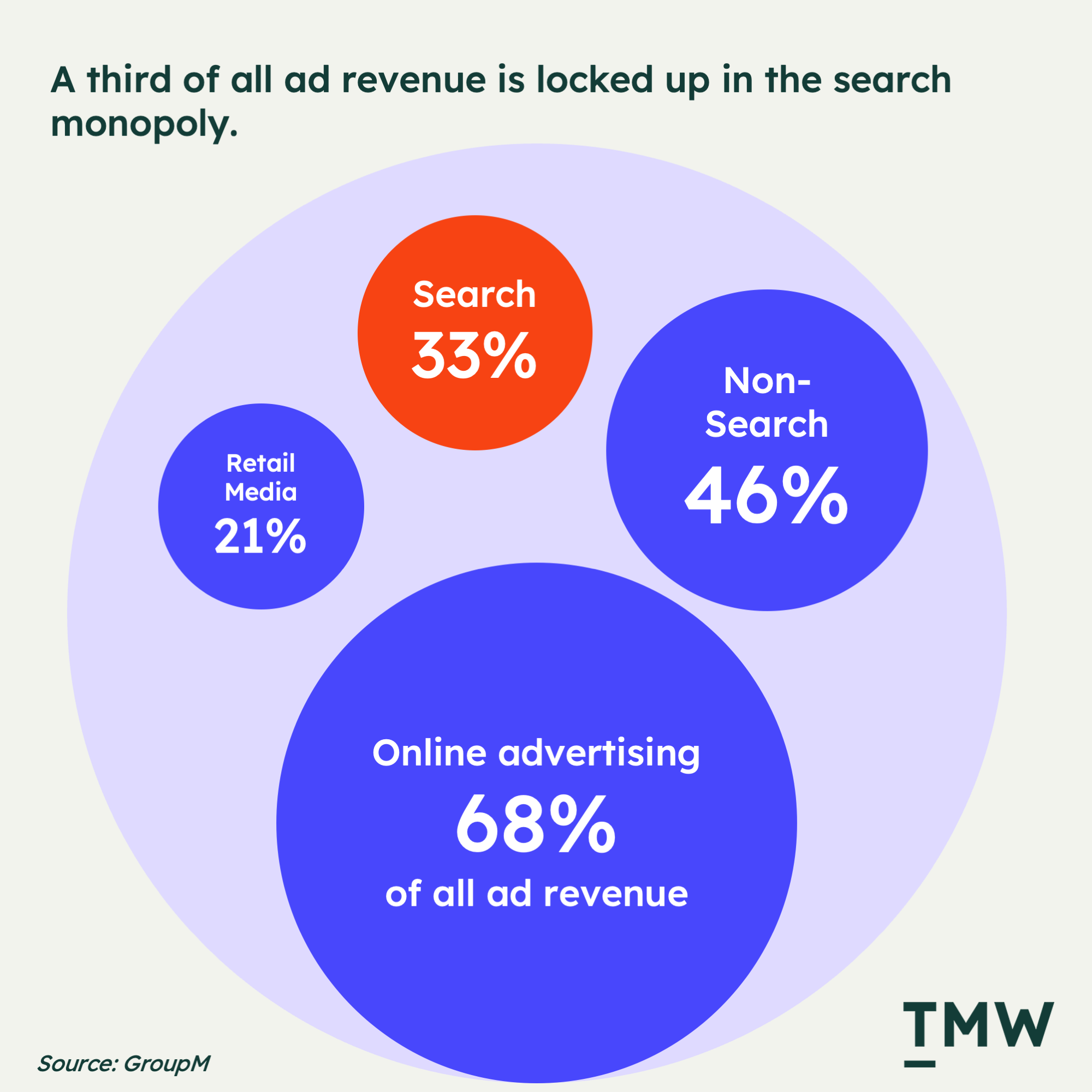

By the way, about 30% of that online ad spending goes directly to search – which is mostly locked up by Google and Microsoft – so you have roughly 60% of ad dollars to compete for. Also, Meta owns a large proportion of “non-search” revenue, according to GroupM, and there’s a chunk of retail media that is already being captured at pace by Amazon. Companies building new media networks have to think long and hard about if the juice is worth the squeeze, because it’s a fool’s errand to think that just because there are a lot of companies that want to grow through ads, that they’ll pick your network.

This, of course, doesn’t apply to marketplaces that already have prebuilt commercial demand from manufacturers and brands. This is how Amazon continues to grow ad revenue year on year at an exponential rate. There’s a lot of value in matching this with ad networks. But software? Or streaming? That’s a big maybe.

The internet is free because advertisers pay for it. But there’s something uniquely exciting about content, commerce, and code-based formats coming out of the woodwork to tap into scaled revenue with low margins. Despite the economic headwinds and a rapidly shrinking opportunity as competitors increase, in the end, ad networks always gravitate towards monopolies, and in each category here, there’s still a lot up for grabs.

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.