TMW #152 | Has HubSpot bought a lemon?

Welcome to The Martech Weekly, where every week I review some of the most interesting ideas, research, and latest news. I look to where the industry is going and what you should be paying attention to.

👋 Get TMW every Sunday

TMW is the fastest and easiest way to stay ahead of the Martech industry. Sign up to get the full version delivered every Sunday for this and every TMW, along with an invite to the TMW community. Learn more here.

We made a BIG announcement on Friday, did you see it? We’ve been working hard, learning from readers like you and we are now proud to announce the new TMW PRO with the launch TMW PRO Advantage. Catch the 50% discount as we go live on Wednesday 22nd! Read the announcement.

Has HubSpot bought a lemon?

The concept of a lemon has a long and storied history. Outside of the obvious interpretation of your favorite citrus fruit, it can also mean something that is near worthless – commonly used for cars like this:

It’s been a little while since I’ve written about a major acquisition in the Martech space. The well has been dry for a couple of years now. It hasn’t been since 2021 that we’ve seen a big industry player acquire another major company… until a couple of weeks ago.

And so here we are: HubSpot announced the acquisition of Clearbit for $150 million in cash (in this economy!). I remember playing with the Clearbit Chrome Extension back in 2017 and thinking that the app was some kind of dark data magic; you’re telling me that I can put someone’s name in a box and find where they work, their email, and social contact? I showed a bunch of people around the office, and everyone got excited about how easy it could be to get in contact with potential customers, partners, and employees.

On the face of it, this looks like a great deal for everyone. Marketers and sales folks don’t have to figure out how to integrate Clearbit into their data operations if they are using HubSpot; Clearbit would benefit from HubSpot’s billions of customer records; and clearly, HubSpot has missed the business profile enrichment component in what they call the “customer platform” that ties together CRM, CMS and marketing automation.

But the question I’m asking is that in the face of a generative AI arms race to redefine the marketer’s interface and the increasing scrutiny from regulators and big tech on the data-sharing economy, has HubSpot bought a big old lemon, or has the company made one of the best acquisition in its history? Let’s find out.

HubSpot’s growth trajectory

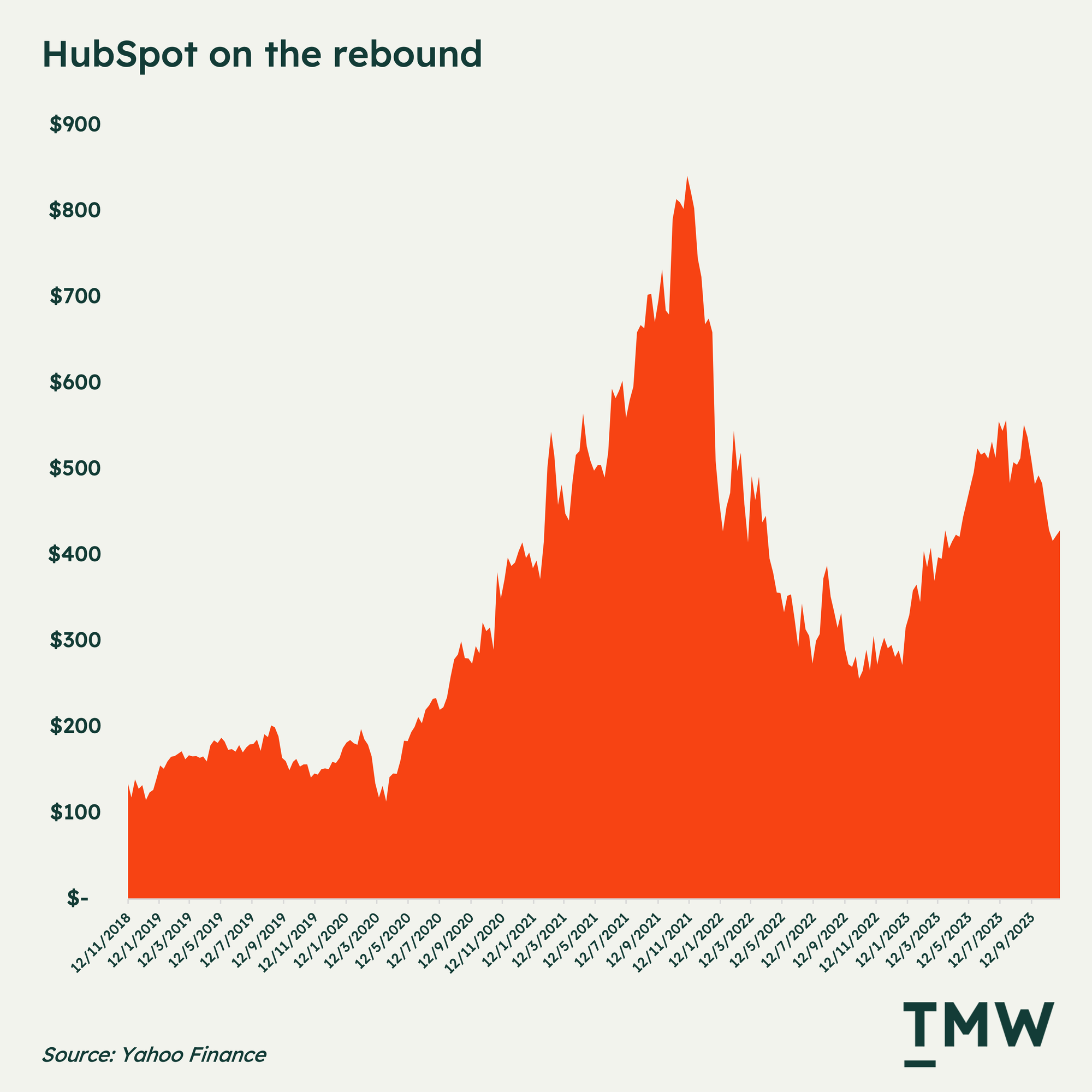

The first area to explore when answering if Clearbit is a good bet on the future of data is to look at HubSpot’s ongoing growth. COVID-19 was rocket fuel for a company primed for an industry that drastically changed when consumers and businesses could no longer do business in person. As you can see, its stock price exploded.

Like the rest of big tech, 2022 saw a major correction; yet of all B2B tech, HubSpot was one of the best companies to rebound from a post-COVID return to the real world. And HubSpot continues to grow. In Q3, HubSpot’s revenue was up to $557.6 million, which increased 26% year-on-year with a huge loss reduction from over $30 million to $5.5 million, while headcount grew by 22% year-on-year. Impressive!

Acquisitions have slowed down significantly as interest rates increased, and the proposition of tech in a post-COVID world landed flat with VCs and investors. But now it’s picking up, and this acquisition is a trigger to the rest of the industry that more acquisitions are indeed going to happen. Clearly this means that HubSpot, like many of the top-of-the-town enterprise tech firms, is moving away from the economic situation of today and planning for the future.

This is how HubSpot explains why paying $150 million for Clearbit is so valuable to the firm’s future:

“Real-time, unified data is at the core of the HubSpot customer platform. HubSpot unifies first-party customer data and connects it with native marketing, sales, and service engagement tools. With Clearbit, HubSpot will be able to bring rich third-party company data into its system of record, making HubSpot the central source of truth for go-to-market professionals. From tracking website visits to monitoring a company’s news announcements, HubSpot will be able to provide front-office teams the most comprehensive context about their customers and prospects–at a time when it is so critical to identify best fit customers and purchase intent.”

The key phrase here is “central source of truth.” Something that rings true for a lot of HubSpot customers - where else can SMEs integrate their CRM, CMS, and MAP in one place with one customer record? Even Salesforce customers in the enterprise often can’t get that right. The second phrase is “context” which is the keyword for profiling businesses and users with very little regard for their consent. But we’ll get to that later.

The main thrust of why HubSpot is going down this path with Clearbit, as they describe it, is to provide additional data on the contacts inside of your everyday marketer’s database to support segmentation and personalization efforts and to speed up the Sales pipeline. And guess what? Clearbit’s market is a close perfect fit to HubSpot’s.

This is how CEO and founder of Clearbit, Matt Sornson explains the value add to HubSpot’s ecosystem, albeit with more colorful language:

“Picture having complete data on over 20 million companies right inside HubSpot. All with over 100 rich data points about the companies and their decision makers. Then imagine being able to easily find high fit prospects natively within your CRM. Finally, imagine that once those companies and contacts are in HubSpot, being alerted when those companies are showing buying intent!”

The point is that HubSpot slept on the data enrichment opportunity ten years ago, and now there are serious players with huge data moats that can’t be replicated without spending a decade in the space collecting and enriching contact data.

For example, a similar and newer company, Apollo, recently raised $100 million on a $1.6 billion valuation (roughly 10x what Clearbit was sold to HubSpot for), and ZoomInfo’s market cap hovers around the $5 billion mark – but has seen a long and hard decline in the value of its stock since 2021.

This is what makes Clearbit the deal of the decade for HubSpot: they got a data enrichment tool with comparable data sets and capabilities at a 10th of the value of the company’s peers. Not bad!

The case for Clearbit

Clearbit and their peers turned something individually worthless (your LinkedIn profile) into something extremely valuable in the aggregate (millions of LinkedIn profiles). Truly, this is one of the most fascinating aspects of the unintended consequences of an open web. The business of Clearbit is data in entirety, and guess what – most of it is publicly available. And you’re part of Clearbit and now HubSpot’s value proposition. Yes, you!

Clearbit is one of the most recognizable, consumable products in the B2B data-sharing economy. It was founded in 2015 with an idea: What if we can enable marketers and sales folks with more information about their prospective customers without them having to collect that information. The company now has 100-plus attributes on 20 million companies.

They then moved into onsite identity resolution, profiling where users work and offering a way to contact them, or send them downstream into ad networks without ever asking anything from those users. What a game-changing idea! And since then, it’s been a gravy train. There’s no Clearbit without accessing this depth of consumer data and matching it to a real identity. Talking to the then-CRO of Clearbit, Kevin Tate in a 2022 Making Sense of Martech interview, he unpacked the value proposition of Clearbit as a company that is centered on providing identity resolution outside of a company’s internal Martech stack:

“ID resolution is a really interesting capability. Like many companies, we perform reverse IP lookup. This involves checking the IP address you're coming from. Through a DNS lookup, we can identify the registered company. For example, if the IP address corresponds to MarTech Weekly.

To be honest, this was more helpful a couple of years ago when people were going into an office, and those offices were more reliably linked to their respective companies and IP addresses. However, one of the advantages at Clearbit is that we can also gather data from various other sources.

As you pointed out, probably because the Martech Weekly domain was used for your social account, we know it's associated with this domain name. Much of what we do relies on company domain names. We can recognize a profile picture, a social bio, or other elements associated with that company domain. This goes beyond just pulling in your profile picture; it aids in identity resolution.

So, we've managed to achieve resolution rates that, for the most part, if not entirely, overcome the challenge of more people working from home these days. This is crucial because if you're trying to create content relevant to a company, having some knowledge about that company significantly improves your chances. Even if you don't know the individual, you can identify the company and the industry they're associated with.”

Clearbit as a company has pioneered what they call “business card” data collection and sharing. Along with ZoomInfo and Apollo, these companies collected a vast treasure trove of data by scraping LinkedIn, company websites, their own user contacts, and other murky sources for “professional” contact data that usually would fit on a business card, like their title, company, email and social handles, and often phone numbers.

This is what I mean by dark data magic: it’s scary because it’s so powerful. It feels borderline unethical, like smoking weed somewhere in California. Technically legal, but weird and not quite right. You feel a little dirty.

While HubSpot is excellent at profiling behaviors, Clearbit excels at identity and firmographics. A powerful combination within the same platform if HubSpot can properly integrate the tech. As PLG leader, Leah Tharin explains in her analysis of the acquisition, Clearbit is filling in a big hole for HubSpot:

“They acquired Clearbit to cover this crucial part of the value chain at the beginning. This was never HubSpot’s core business. Their core business today is their PLG acquisition, ease of use, and seamless integration into SMB businesses to handle a sales pipeline. All of it is getting pressured by the current AI craze. Instead of building this access to data themselves, an acquisition makes perfect sense here. There will be more and more customers choosing HubSpot in the future because of its access to this data. It shifts slowly from a nice to have to a core value and ensures its survival in an enterprise business where interfaces matter less and the accuracy of data matters more.”

Thinking bigger than this, what about the deprecation of third-party cookies? In an industry that’s undeniably moving toward using first-party data for advertising, the identity piece will be enormously valuable for downstream Adtech tools. Just look at how Demandbase’s DSP solution has grown, and it’s built for B2B use cases. So there’s a big walled garden opportunity that HubSpot can pursue here that makes the acquisition all the worthwhile.

And if generative AI – something HubSpot is very much interested in pursuing – diminishes the value proposition of packaged software, then data will become even more important to keeping customers on the HubSpot platform. Having to learn a new interface is hard, but migrating your historical customer profiles to somewhere else is a nightmare.

So far so good. Maybe Clearbit isn’t a lemon. And yet, somehow, I can’t but help think about the data-sharing industry, and how much time it has left in an environment where seemingly all kinds of data collection practices are being shut down one by one.

Why hasn’t this B2B data-sharing category faced the same regulatory issues as Google and Meta, and the shutdown of third-party tracking?

End of days

You might be asking yourself: how does it all work? Where does the data come from for these enrichment tools? Well, there’s a lot of data scraping going on from places like LinkedIn. In all seriousness, Clearbit can’t survive without platforms like this that have created a value proposition for people to share their career information in a semi-open format. Officially Clearbit doesn’t state this in their documentation, only that they collect data from hundreds of sources that are vetted and normalized by their research team.

But here's another view from a Sacra Q&A session with the Founder of Clearbit:

“We did it very differently. We weren’t going to go hire researchers—we wanted to get as much of this as we could programmatically. The way we built that loop is we went out and built a system that could take a domain name, or an email address, and then go hit every single public API or public service we could find to pull data back. So, everything from Google Search results to about.me, to GOIP data. We just found public APIs or APIs that we could pay for, or places we could scrape. We could go in real time and build a profile about that person and company. At one point there were about 215 different data sources, and as the company got bigger, we built our own data assets and data sources that were a little bit more reliable, but also defensible, and used less and less of the smaller public ones.”

Clearly, data scraping is key to the Clearbit value proposition. And you might be asking how Clearbit allows for consent, when usually the platforms that collect the primary data can be so easily scanned and scraped by these tools. I haven’t seen any good answers outside of “you can opt out of Clearbit yourself,” but how is that fair to companies and people when they don’t even know they are being profiled? The GDPR catalyzed active consent as a standard for ethical data collection, but how does GDPR extend to Clearbit, which can’t ask for your consent because you will never know what other website shared that data with Clearbit.

Clearly, this is a grey area; the lack of company and personal awareness of their data collection erodes control and, over time, trust and integrity. A comparable example is looking at how Real Time Bidding has been exposed as one of the world’s largest breaches of consumer data, sharing data with little consent or control from consumers over 178 trillion times every year in the US and Europe.

But why can’t this be regulated like everything else in the online data economy? The argument goes that it’s only business data, and remember the Whitepages? The shock and horror of having millions of company contact details listed in a book delivered to your doorstep! If you’re listing your details on LinkedIn, then it’s fair game, right?

What Clearbit and the company’s peers have really facilitated is the second-order effect of the rise of the cold DM, email or call. LinkedIn messages is what everyone expects, but I’m sure that “contact enrichment” is also facilitating a lot of scams, cybercrime, and billions of unwanted cold emails. How could it not? When you give anyone with some cash to burn access to nearly limitless contact details of people around the web, surely this means an exponential rise in unwanted contact. This is the “dark” bit in the dark data magic.

This is what baffles me in the face of all this data regulation and hysteria. Companies like ZoomInfo, Clearbit and Apollo get a free pass. You can argue that it’s not really sensitive PII; somehow, there’s a big difference between someone’s corporate email and someone’s personal email when it comes to data collection and sharing.

At TMW we’ve used Clearbit for our outreach efforts, and it was extremely helpful. Not only were we able to validate our contacts in our database, but it gave us opportunities to reach out to folks that had an affinity for what we’re selling. So I guess we’re guilty, too. But the value of the technology is extremely powerful; it’s really easy to forget or ignore the costs of making the dark data magic possible when there’s so much to gain.

It’s just a matter of time until regulators come after these data-sharing startups. It just doesn’t sit right with me that free resources like someone’s personally identifiable information can be monetized without these users’ consent. I get that it’s a company “business card” profile, but where are the safeguards?

So is Clearbit a lemon? I don’t think so. It’s a hugely important piece in HubSpot’s data defensibility strategy, and it will create hundreds of millions in efficiency gains and growth potential for SME brands when it’s all hooked up to HubSpot’s CRM and automation plumbing. It really does complete the platform’s profile enrichment capabilities.

But the wheels can easily fall off when data sharing regulations and big tech data shutdowns – even in B2B –finally emerge. Even now, we’re seeing Twitter and Reddit cut off access to its API in a bid to protect the data it has from unwanted collection. I can see LinkedIn, the holy grail of B2B data, doing the same in the near future. After all, Clearbit relies on data that is up-to-date; if it can’t do that, it really will become a lemon.

HubSpot may have temporarily improved its capabilities with this acquisition, but it’s also adopted a huge potential liability when it comes to data regulation and the push to privacy. I just can’t see a future where consent-less data collection and sharing, regardless if it’s a business card profile or not, has much more time in this world. I would argue that the Clearbits of the world have their days numbered. Here today, gone tomorrow.

Stay Curious,

Make sense of marketing technology.

Sign up now to get TMW delivered to your inbox every Sunday evening plus an invite to the slack community.

Want to share something interesting or be featured in The Martech Weekly? Drop me a line at juan@themartechweekly.com.